Heightened customer expectations for anytime, anywhere services, growing competition, and shifting workplace trends are putting new pressures on the financial services industry—and RingCentral’s latest Customer Success Metrics Survey shows that deploying a cloud communications and collaboration platform can be a powerful differentiator for meeting these new challenges.

Get the stats

Delivering significant internal and customer-facing benefits

According to the results of our recent survey, which included the opinions of executives and decision makers at financial services organizations in the U.S., the U.K., and Canada, RingCentral delivers significant internal and customer-facing benefits that position their organizations for success in this rapidly changing climate.

In recent years, as new online products and services have emerged from financial services organizations, a growing number of customers have come to expect flexible, personalized mobile offerings. The global healthcare crisis only exacerbated these growing pressures. For example, banks saw an all-time high for mobile logins and check deposits along with spikes in call center interactions.

Having recognized the convenience of digital services, these customer shifts are likely to be long-lasting. But at the same time, major shake-ups to workplace models mean the industry must overcome inherent challenges of remote and hybrid work in order to maintain productivity and customer satisfaction.

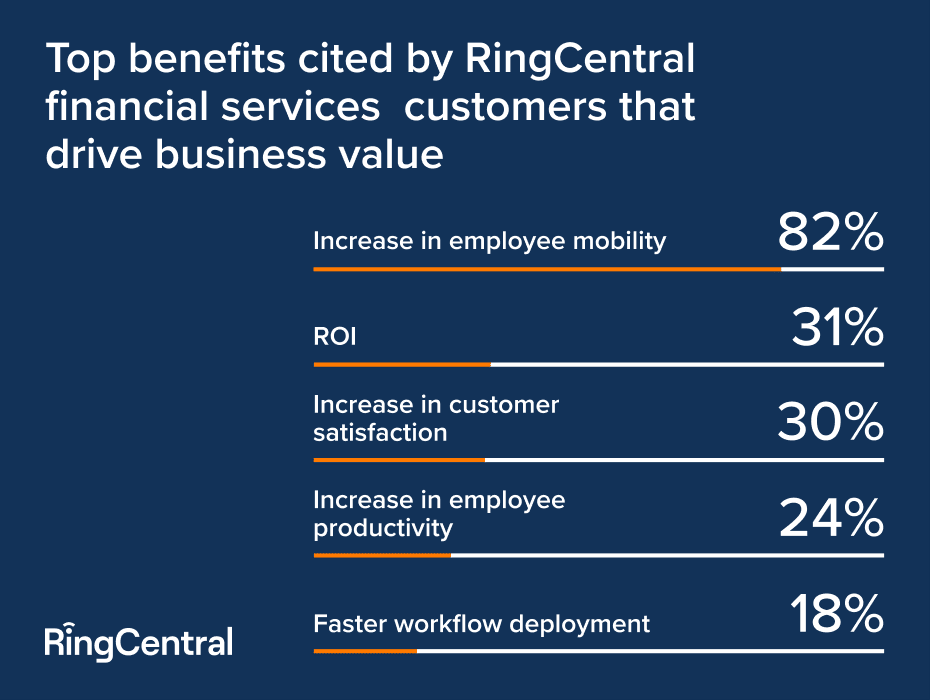

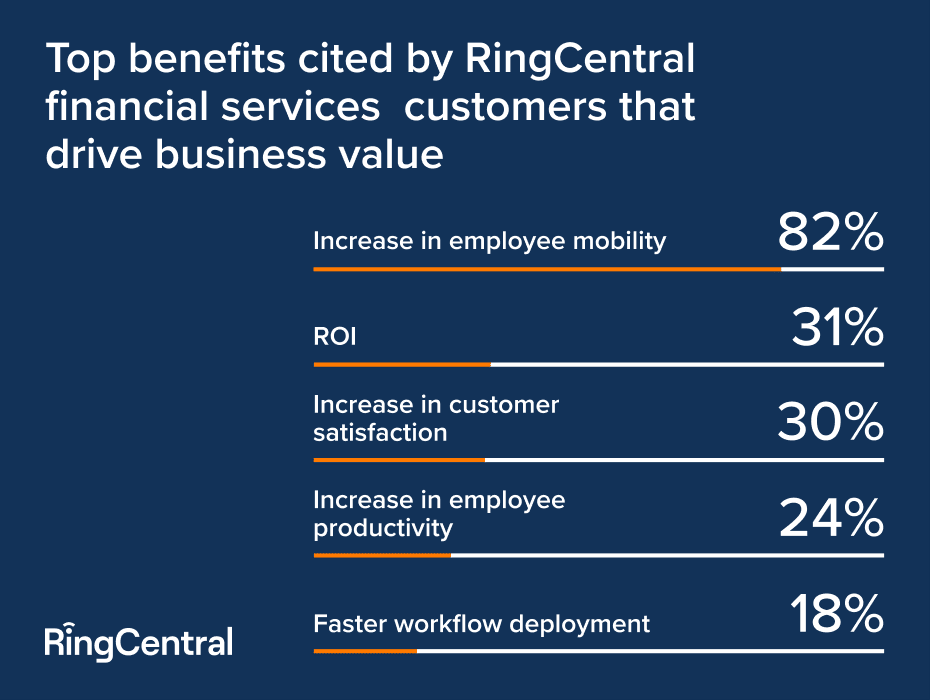

Real-life gains cited by RingCentral financial services customers

Our survey asked RingCentral financial services customers about the real-life gains they’re experiencing from deploying our all-in-one messaging, video, and phone solution and revealed key benefits that address these pressures.

82% increase in employee mobility

From underwriters and analysts to customer support representatives working in a call center, remote employees need full access to all of the tools, customer information, and other resources that they would have on site. RingCentral enables employees—in any type of role—to do their jobs from anywhere, with an 82% increase in employee mobility.

31% overall ROI

Replacing legacy infrastructure and providing the tools financial services organizations need to serve customers and employees can be costly—but not necessarily so. Shifting to the cloud can provide significant cost savings, including easier, faster configuration, deployment, and management, and reduced hardware spend, all while enabling more productive work. Together these savings and gains add up to an average 31% return on investment.

30% increase in customer satisfaction

Customers expect seamless, personalized, and fast service across all channels, and customer service has become a key differentiator in the fight to win and retain business. There’s a direct line between the capabilities RingCentral can provide to financial services organizations and their ability to meet these growing demands, resulting in a 30% boost in customer satisfaction among financial services organizations that use our solution.

24% increase in employee productivity

If not carefully considered, remote and hybrid work can result in unintentional barriers to productivity, including departmental silos and the need for multiple apps to collaborate and share information. RingCentral eliminates many of these pain points and promotes more effective work, delivering an average 24% increase to employee productivity.

18% decrease in time to deploy workflows

Workflow automation offers huge potential within the financial services industry, with the ability to increase employee capacity, improve accuracy due to a reduction in input errors, and better serve customers due to improved access to their data. But deploying automation can be complicated and costly, slowing the potential returns. With out-of-the-box and easily customizable integrations, RingCentral helps organizations realize the benefits of automation more quickly, shrinking the time to workflow deployment.

Supporting financial services organizations in the digital era

To demonstrate the power of RingCentral in supporting financial services organizations in the digital era, there’s no better example than First Bank, a multibillion-dollar institution that began as a single branch in 1906. In order to serve its more than 100 branch locations, as well as 1000+ employees and more than a dozen call centers, the bank needed to migrate its legacy communications systems from on-premises PBX to the cloud.

Just midway through a two-phase rollout, First Bank was already seeing significant gains. “We’ve been able to replace our PBX and the six or seven servers we were maintaining to run our previous call center infrastructure with a lightweight, cloud-based system. Even factoring in the cost of RingCentral’s desktop VoIP phones that we’ve set up, the RingCentral rollout is already saving us 30% on our overall phone system costs,” said Bala Nibhanupudi, First Bank’s Chief Information Officer.

“Also, as soon as we replaced our employees’ legacy phones with RingCentral, we began to see value immediately. Our team was able to do a lot more with RingCentral’s softphone capability than they’d ever been able to do with our legacy phones,” Nibhanupudi added.

Get the stats

A closer look at the RingCentral advantage

Throughout our #CustomerSuccess blog series, we take a closer look at the RingCentral advantage as indicated by overall survey results and explore some of the specific improvements seen across key business segments and within industry vertical markets.

To learn more about the value RingCentral delivers for financial services organizations across 16 key metrics, download our Customer Success Metrics Survey datasheet now.

Looking For Startup Consultants ?

Call Pursho @ 0731-6725516

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads