Point-of-sale financing services such as Klarna and Affirm make it easy for online shoppers to buy now and pay later. These financial tech companies have the ability to reduce checkout friction and please customers, but they may affect ecommerce in other, perhaps unexpected, ways.

For many online sellers, point-of-sale financing services can be a boon. Integration is typically easy. Merchants get paid immediately. Rates and fees are not extraordinary, and, as with most payment solutions, there are few or no upfront costs.

What’s more, adding Klarna, Affirm, or similar to a checkout page is likely to improve conversions. And both Klarna and Affirm will expose a store’s products and brand to millions of potential customers.

Thus adding a point-of-sale financing solution to ecommerce sites is seemingly a no-brainer. Yet there are a few long-term implications.

Financing as Marketing

At the time of writing, Klarna received about 85 million social media impressions a month. The company had about 7.5 million monthly active users. Klarna’s “Smooth shopping” app was the ninth most popular retail app in the iPhone App Store behind Amazon, Walmart, and Target.

Klarna’s app ranked higher than Wish, Etsy, Macy’s, Sam’s Club, Kohl’s, Best Buy, and Walgreens, to mention a few.

Klarna is among the most popular retail shopping apps. It may attract shoppers not because of what they can buy through the app, but how they can pay.

So what does that imply?

Imagine you’re a shopper. Christmas is around the corner. You’re nervous about spending cash or even running up credit card debt during the pandemic. The prospect of dividing your holiday gift purchases over four installments has much appeal.

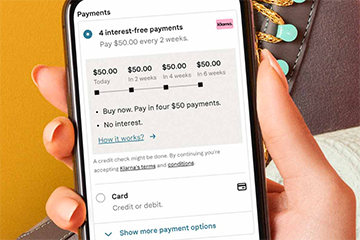

Well, you can. You simply download the Klarna app, shop away, and voila, you can “pay in four at any store,” making four interest-free payments over six weeks.

While this is very helpful for many shoppers, the marketing department at some retailers might be worried. The time and money that it has invested in attracting and converting customers just went out the window.

Many Klarna and Affirm app users are likely shopping at a store not because of marketing but because of extended payment options. Thus offering one or more point-of-sale financing services might be a marketing necessity.

Trouble Differentiating

When financing services and their associated mobile apps become a form of marketing and customer acquisition, differentiating retailers becomes challenging.

Think about the Amazon marketplace. Selling national brands such as Tide, Kleenex, or Nike is not the norm for smaller businesses — competing head-to-head against huge companies.

Many successful Amazon sellers are direct-to-consumer brands. They produce a product that is different in some way.

This same idea could apply to the Klarna and Affirm apps. These point-of-sale financing services might be creating marketplaces with their own form of search optimization and product promotion and their own ways of differentiating stores and products.

Customer Relationships

Is a shopper who pays for an order with Klarna or Affirm a customer of the merchant or those financing services?

When she visits an ecommerce store and pays with a Visa card, a shopper is, arguably, a customer of both Visa and the merchant. She is acquiring a service from Visa and a product from the store.

This could also be true of a point-of-sale financing service. When he pays with Affirm, a shopper is a customer of both Affirm and the merchant. Like the Visa example, he is acquiring a service from Affirm and a product from the store.

Visa and other payment card providers have generally played nice with customer relationships. For example, Visa has an app that helps consumers find deals and discounts while shopping, but Visa has refrained from sending marketing emails to customers every time they purchase, encouraging them to shop via a Visa-specific marketplace.

Klarna and Affirm are not quite doing this either, but they have been promoting their apps.

Payment Complexity

As the popularity of buy-now, pay-later ecommerce increases, integration with ecommerce shopping carts, mobile wallets, and even physical point-of-sale systems will be vital if payment complexity is kept to a minimum.

Imagine, for example, if it became normal for merchants to offer point-of-sale financing from Klarna, Affirm, PayPal, Afterpay, Sezzle, Quadpay, and similar. The shopper could face a checkout with more logos than a European soccer team.