Have you ever gone to the grocery store without a grocery list, then tried to make your meals for the week with a random assortment of products? The meals were inevitably less nutritious and less delicious. There were probably plenty of items you needed but didn’t get, and other items you didn’t need that went to waste.

Grocery shopping is a tactic. Meal planning—including that crucial grocery list—is the strategy. It’s what bridges the gap between a random mishmash of produce and the actual ingredients you need for a satisfying meal.

If it’s that crucial for your weekly grocery run, you can imagine how important the distinction between strategy and tactics is for a business.

What is the difference between strategy and tactics?

Your strategy is the why and how you do something, whereas your tactics are what you actually do. Strategy guides the actions you take by ensuring they lead to the outcome you want.

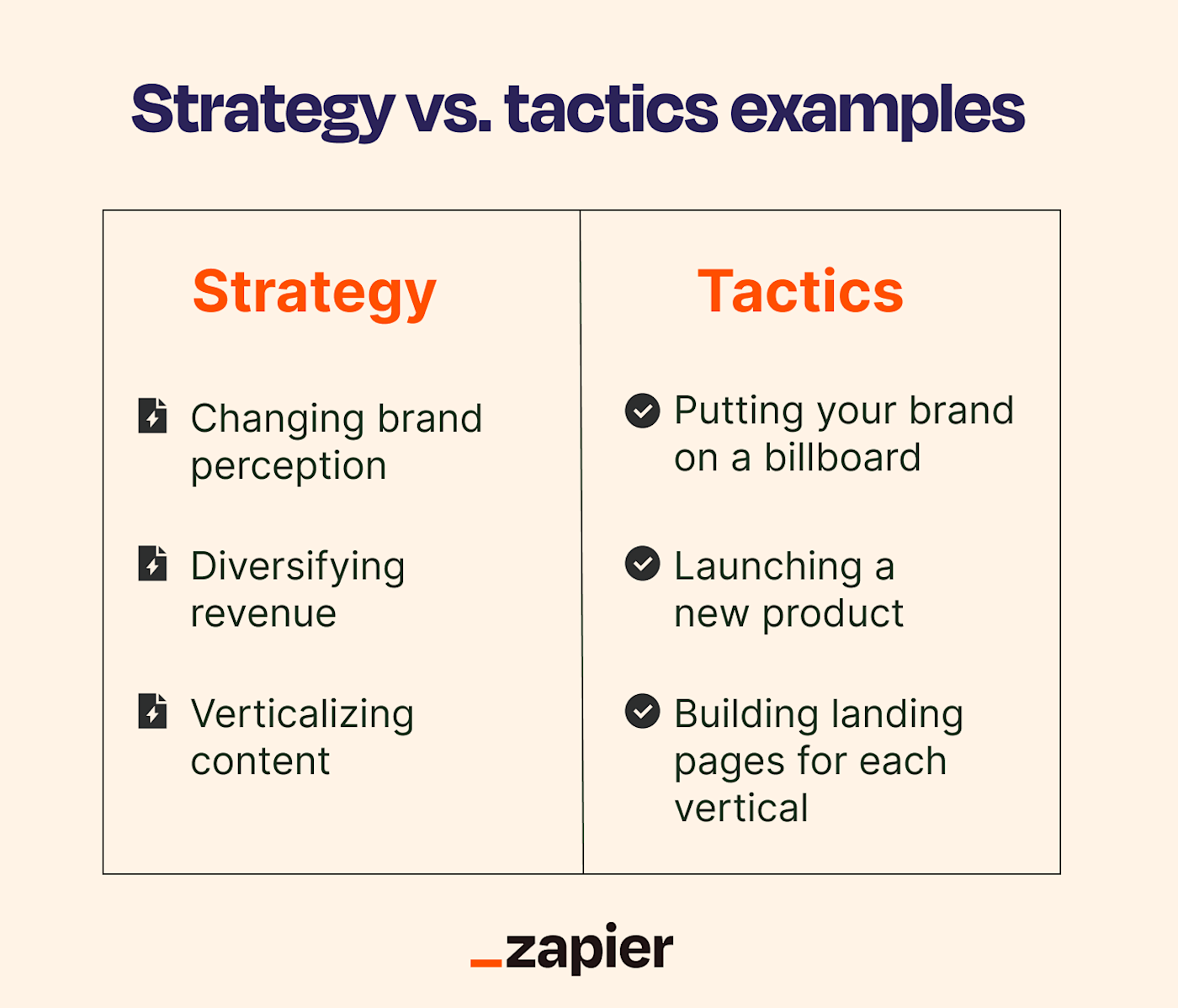

Strategy vs. tactics examples

In business, your strategy will always tie your tactics to your bottom line. For example:

-

Changing your brand perception is a strategy; putting your brand on a billboard is a tactic.

-

Diversifying revenue is a strategy; launching a new product is a tactic.

-

Verticalizing your content is a strategy; creating landing pages for each vertical is a tactic.

Why tactics without strategy ends in disaster (and why so many businesses do it anyway)

Tactics are more visible because they’re driven by action and lead to a tangible result. That’s what makes it so tempting to dive right into tactical execution—it’s the fastest way to get something to show for your work.

But doing things that way can be detrimental to your resources. While strategizing may feel a little fuzzy and adds time to the process, having a solid strategy is the only way to make your tactics worthwhile. Tactics without strategy result in a lot of effort that might not help you meet your goals and a lot of data that doesn’t actually tell you anything.

It’s a hard urge to fight, though, which is why strategy-barren tactics can be found everywhere. They can appear as a new product or feature that doesn’t address a customer pain point (Colgate once attempted to market and sell a frozen lasagna), or leveraging a new tool just because it’s exciting (when Facebook first offered a video view objective in their ads platform, I ran a hefty video campaign and ended up with a lot of video views—and nothing else).

When it comes to tactics vs. strategy, it’s all about thinking before you act.

It’s not strategies vs. tactics; it’s strategies and tactics

You need both strategies and tactics to achieve your business goals, but there’s an order of operations.

1. Start with strategy

Remember, your strategy is what you’re trying to accomplish, not what you’re going to do. To create your strategy, you need to first nail down the following:

-

Business goal. Why are you doing this in the first place, and how will it contribute to your business’s bottom line?

-

Key performance indicators (KPIs). What metrics will you track, and how will you quantify success?

-

Target audience. Who do you want to reach with this initiative?

When I became the Head of Communications at Capital on Tap, one of my first tasks was taking ownership of content. Rather than creating and sharing assets ad hoc, I first sat down to create a content strategy. To build my strategy, I started with these three components.

|

Business goal |

Small businesses know Capital on Tap is the best small business credit card custom-built for them |

|

KPIs |

Reach, website traffic, DA (domain authority), new customers |

|

Target audience |

Small business owners (primary), FinTech influencers and leaders (secondary) |

You’ll notice how my business goal is slightly different from Capital on Tap’s bottom line. Our bottom line, like most businesses, comes down to revenue. But to keep my strategy focused so it could best guide my tactics, I articulated a goal that was more closely tied to my current initiative—while still directly impacting the business’s bottom line (the more small businesses who know about and view Capital on Tap favorably, the more customers we would get).

2. Determine your tactics

Your strategy can now guide the creation of your tactics: the things you actually do to execute your strategy and reach your goal. When creating your tactics, think about:

-

Distribution. Where will you execute?

-

Assets. What and how many are you creating?

-

Timing. When will you execute?

Think of this step as the bridge between your strategy and your execution. Even though you now have enough information to start thinking about tactics, you’re still in the planning phase, which allows you to make these tactical decisions strategically.

It’s important to note that these three components will look slightly different depending on the nature of your initiative. Really, it just breaks down to the where, what, and when (which you can now answer now that you’ve established the why, how, and who in your strategy).

For the Capital on Tap content strategy, this broke down into execution channels, creative assets, and frequency. Each piece of our execution was carefully guided by the groundwork we laid by establishing our strategy.

|

Execution channels The platforms we use to publish our content |

Social media (Facebook, Twitter, LinkedIn, Instagram), Capital on Tap blog |

|

Creative assets The content we create for the execution channels |

Creative assets to achieve one of the following: – Empathize and entertain (40%) – Inform (40%) – Showcase our product (10%) – Showcase our company culture (10%) |

|

Timing and frequency When and how often we publish on each channel |

Publish 2x weekly on each social channel, publish 1 article per week on the blog |

For example, we chose Instagram as our focus social media channel because we found the largest percentage of our target audience was on Instagram compared to other social channels, coupled with the fact that we had a greater capacity to reach them organically compared to Facebook and Twitter (which aligned with one of our reach KPIs).

We selected the blog and determined the posting frequency to increase our domain authority and drive more website visitors, and designated the creative asset breakdown, which also served as our messaging strategy, to influence brand perception. This aligned with our business goal of small businesses recognizing Capital on Tap as the best small business credit card custom-built for their unique needs.

3. Benchmark your current status and make a plan for measurement

To ensure your execution aligns with your strategy and is actually driving business value, make sure you have both the tools and methodology to track your KPIs before your project kicks off.

You’ll want to put some forethought into both how (which tools and who owns it) and when measurement happens, as well as the results you need to see to consider your initiative a success. Most importantly, you’ll want to benchmark where you currently stand, so you can effectively attribute your success to the hard work you’ve put in.

4. Execute and track results

This is the part you’ve been waiting for—the doing. Your reward for putting in the work to create a strategy and plan is that you know the work you do to execute will be meaningful. Track your progress based on your plans from the previous stage—and don’t forget to celebrate.

We’d benchmarked our KPIs at Capital on Tap before we launched the content strategy, and within six months, we:

-

Improved our domain authority by 10 points

-

Grew our blog readership by 71%

-

Grew our reach by 800%

-

Drove our first 40 customers through organic content

Common mistakes brands make when executing on a strategy

When doing the strategy vs. tactic dance, there are a few common pitfalls that can keep you from reaching your goals once you’re in the execution stage. I learned some of these the hard way, so keep your eye out for them.

Shiny object syndrome

Shiny object syndrome takes hold when a new and exciting tactic is available—but offers no real business value. My Facebook video ad campaign is the perfect example of this. People (me) get excited by the cool factor and fail to see that the fun new tactic doesn’t align with their strategy. The good news: if you’re consistently using your strategy as your guidepost, you can avoid this.

Getting too caught up in the details

While it’s important to make a plan, it’s just as important to assume things won’t go as planned. In my 15 years in marketing, I’ve never once seen a project go off without a hitch. That’s ok—it keeps things fresh. What you want to avoid is losing the forest for the trees and letting one area of your work eat up disproportionate time and resources. This is easily avoidable by revisiting your strategy often and reprioritizing as needed.

Refusing to pivot when something’s not working

You have to be willing to let go. If something isn’t providing a justifiable return on investment, you need to be ready and willing to change tactics—or even scrap part or all of your project. The sunk cost fallacy is tough here. Just remember everything you do for your business provides new learnings that will get you closer the next time.

Ensure your tactics are driven by your strategy from start to finish

Starting with a strategy prevents you from allocating time and resources to initiatives that don’t drive business objectives, allowing for more efficient work and a stronger ROI. Once you set your strategy and your plan for action, be sure to revisit it often in the execution stage. Tactics without strategy will get you nowhere, fast.

Now go make a grocery list.

This was a guest post from Kiera Wiatrak, the Head of Communications at Capital on Tap. Globally, Capital on Tap provides an all-in-one small business credit card and spend management platform. Access funding for your business, manage cards for your employees, and earn cashback, travel, and gift card rewards—all built with small business owners in mind. Join the 200,000 small businesses on the platform today. The Capital on Tap Business Credit Card is issued by WebBank. Want to see your work on the Zapier blog? Read our guidelines, and get in touch.

[adsanity_group align=’alignnone’ num_ads=1 num_columns=1 group_ids=’15192′]

Need Any Technology Assistance? Call Pursho @ 0731-6725516