Forex markets are trading trillions of dollars a day. Traders all over the world are always looking for the best brokers to trade forex, CFD, binary options, stocks, cryptocurrencies, and more.

With the advent of new forex brokers regularly appearing, determining the legitimacy of a broker can be a real challenge.

As a consumer, it is vital to investigate the company before investing in trading.

Most Trusted Forex Brokers Comparison

Here is a comparison of the most reliable forex brokers.

| Feature | IG | Swissquote | CMC Markets | Saxo Bank |

| Trust Score | 99 | 99 | 99 | 98 |

| Year Founded | 1974 | 1996 | 1989 | 1992 |

| Publicly Traded (Listed) | Yes | Yes | Yes | No |

| Bank | Yes | Yes | No | Yes |

| Tier-1 Licenses | 6 | 4 | 4 | 6 |

| Tier-2 Licenses | 3 | 1 | 2 | 1 |

| Tier-3 Licenses | 1 | 0 | 0 | 0 |

| Authorized in the European Union | Yes | Yes | Yes | Yes |

Questions You Should Ask To Avoid A Trading Scam

- Is the broker’s activity regulated?

- If regulated, how reliable is the regulator?

- Does the broker offer profit or remuneration for opening an account?

- Does the broker offer a bonus for opening an account?

- Does the broker offer automatic trades or signals to guarantee a profit?

- Does the company’s website include reliable information such as company history, financial statements, head office address, etc.?

- If awards are listed, can I verify their authenticity?

- If a significant corporate sponsorship is being promoted (e.g., athlete sponsorship), am I doing my best to ensure that the company can be trusted?

Is The Broker Regulated?

Unregulated brokers are not required to report to a governing body. It means that if they trick you in any way, be it “glitches” or “malfunctions” that cause severe slippage in their system, or you go to withdraw money from your account, and they do not process it (steal your money), then you are out of luck.

Aside from posting a bad review on the internet, there is little you can do, because these brokers have no legal authority to respond to it.

How do I check if the broker is regulated? One way to check the registration of a broker is to find it at the bottom of the site. The figure below shows the bottom of 12Trader, a broker we recommend to avoid.

You will notice that nowhere in this picture is a regulatory body mentioned. The “about us” page has a hint for logging into your account. On the site, there is no mention of the regulator or company history. All these warning signs should lead you to be careful.

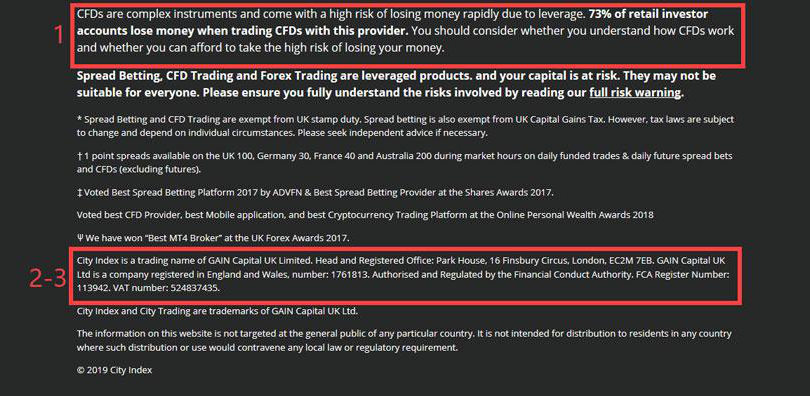

Now let’s look at the bottom of the home page of City Index, a trusted and regulated broker.

You will notice that:

- The company warns explicitly you of the risks associated with trading CFDs,

- The company is registered in Wales and England and has posted an address,

- It is regulated and authorized by the Financial Conduct Authority and has published a registration number.

Note: The regulated broker is required to place appropriate risk disclaimers and regulatory information at the bottom of all pages of its website.

If Regulated, How Trustworthy Is The Regulatory Body?

Some fraudulent brokers claim that their activities are regulated and registered by a regulatory body that does not control or regulate forex companies.

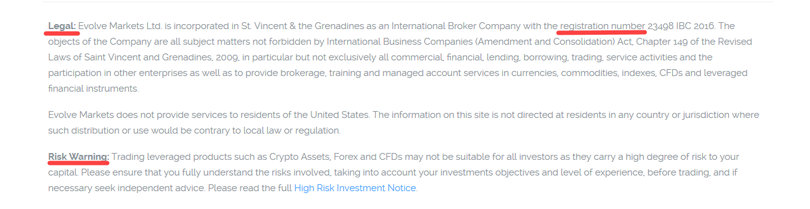

For example, let’s take a look at Evolve Markets.

The information disclosure at the bottom of the home page gives an idea of the regulated broker. There is a warning about the risks of trading CFDs, as well as a legal section.

After further reading the legal section, you will notice that although the firm is registered as an international broker in St Vincent and the Grenadines, it is not a regulated broker.

How Do I Know What Regulatory Bodies Are Legitimate?

Forex brokers, which are regulated in a large center, are always more reliable. Brokers in emerging centers can also be reputable, but care should be taken.

Based on an annual Regulatory Reliability Study, here is a list of the regulators and the reliability of each of them:

- FCA Regulated – United Kingdom – (Great)

- CySEC Regulated – Cyprus (OK)

- ASIC Regulated – Australia (Good)

- SFC Authorized – Securities Futures Commission – Hong Kong (Good)

- MAS Authorized – Singapore (Good)

- FSA Authorized – Japan (Good)

- IIROC Authorized – Canada (Good)

- FINMA Authorized – Switzerland (Good)

- FMA Authorized – New Zealand (OK)

Note: Verify the authority of the governing body that regulates the broker you are looking at. You can visit the governing body’s website to find the registration number and verify its legitimacy.

Is The Broker Offering Profits Or Rewards For Opening An Account?

Scam brokers often make statements such as “earning $50 per day on $250 investments” or “earning 80% profit on profit signals” or “96% success rate”.

These claims are fraudulent, regardless of whether they are made for Forex, CFDs, or binary options. Forex brokers should not promise profits at all, small or large. If a broker promises to earn you money, it is usually fraudulent.

Other common fraud practices include advertising pictures of expensive cars that are given to lucky investors.

Many binary options of “brokers” have been set up as fraudulent transactions. In these cases, there is no real broker. The client is betting against a broker who acts as a bucket shop. Manipulating price data to make clients lose is commonplace.

Withdrawal is regularly delayed or rejected by such transactions; if the client has a good reason to expect a payment, the operator stops answering his phone calls.

Although binary options are sometimes traded on a regulated exchange, they are generally unregulated, traded online, and subject to fraud.

Note: If a binary option or Forex broker promises you more profits on your money, this is a clear sign of fraud. You will not earn $100,000 in a mega-trade; you will not make 96% of your profit in less than a minute, and you will not win a $40,000 car by depositing $2,000. Instead, save your money.

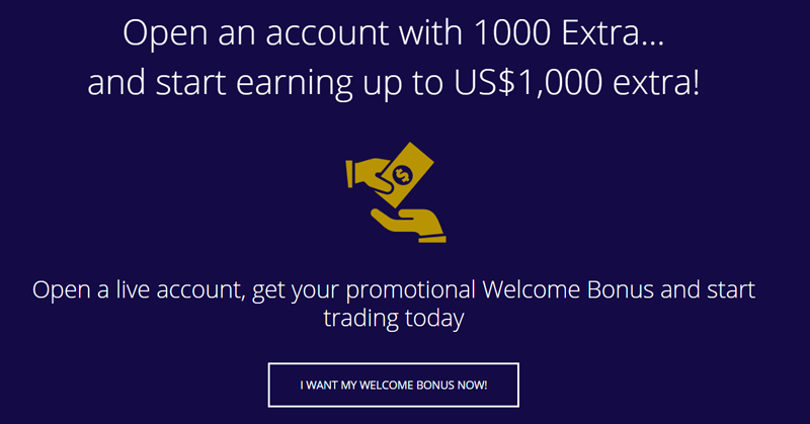

Is The Broker Offering A Cash Bonus If You Open An Account?

If a broker offers an abnormally high cash bonus, is not regulated, and does not show the details of the bonus offer, then you are most likely dealing with a fraud broker.

For example, 1000Extra hints at a $1000 bonus with their vague promotional offer. If you click around to collect more information, you will be redirected to sign up for an account.

1000Extra is unregulated, has minimal information about the company, and also has internet fraud reports.

Note: In most regulated regions of the world, advertising bonuses for opening a new account are not allowed. The two exceptions are the US, which is for US citizens only, and Asia.

Is The Broker Offering Automatic Trades Or Signals To Guarantee Profits?

Many fraudulent brokers offer automatic trading performed by a robot or algorithm that claims to be making money.

These brokers claim that their robots send signals to compromise to make money for you. Often, these brokers focus on cryptocurrency or binary options.

No company has found a way to generate huge profits through automatic or signal trading continually, and if it had, it would never have offered them to everyone for free. You should use your common sense: if it sounds too good to be true.

Are Any Of The Company’s Credentials Included On Its Website?

If there is no information about the company’s management, where the company is located, or what telephone support it offers, it is most likely fraud.

Fraudsters do not need any names, locations, or contact details associated with them when they inevitably get into trouble.

If you cannot find real reviews on brokers you are interested in, do not sign up for the accounts.

For example, take a look at this text from a review site that advertises fraudulent brokers.

The review text promoted by the Crypto Robot 365 promises the same as the con broker’s website. This “review” has no depth of content and is not credible.

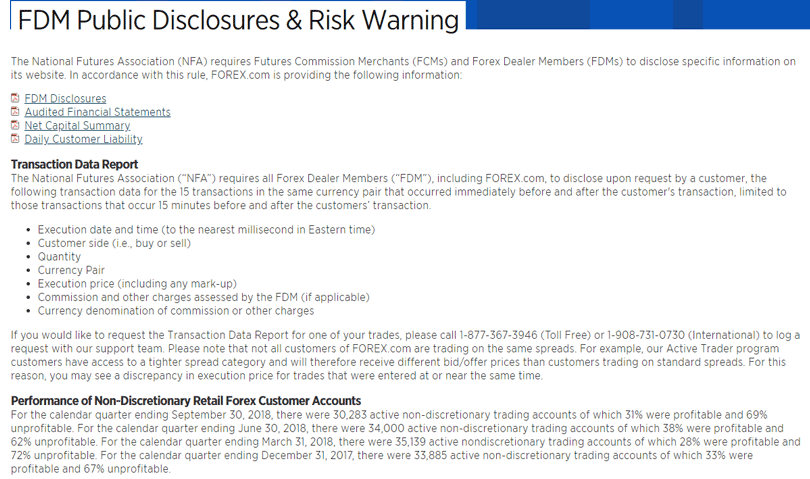

It is also essential to check for disclosure documents that contain important information about the company.

For example, take a look at the Forex.com disclosures page, where you can see the forex client history, audited financial statements, and disclosures.

Companies that do not disclose information are likely to be unregulated and should always be treated with caution.

Finally, take your time reading the numerous reviews. Search “Check Broker By Name” and then go to it.

Note: If you cannot find accurate information and feedback about the company, including its management, location of the business, corporate history, or any financial information, STAY AWAY.

If Awards Are Cited, Can I Verify Their Authenticity?

A lot of scammers say they have great awards. Most of the time, the award will be called “Best Broker of the Year 2015”, and the news edition will not be viewed, or it is not a reliable edition.

Scam brokers will intentionally publish fake awards a few years ago because they are harder to verify than the 2019 award.

At other times, scam brokers will have awards from reliable media, but the awards will be fake. It is a piece of “12 traders” with fake awards from Bloomberg and the New York Times. If these awards were real, you could click on a link and view them or find them using Google search. The New York Times doesn’t give out “best signal provider” awards.

Note: Recheck all reported awards to verify their legality.

If A Big Corporate Sponsorship is promoted (e.g., Athlete Sponsorship), Does This Mean I Have Done My Due Diligence And Can Trust The Company?

The last trick to avoid is to assume that the broker can be trusted because he sponsors a football club or a professional athlete.

Just because a firm is a significant sponsor paying to have its name on a T-shirt does not mean that they should be trusted.

IronFX, a well-established fraud broker, used to sponsor FC Barcelona, paying the club €3 million for the season.

Note: Never automatically trust forex brokers just because they sponsor a football club or professional athlete.

Final Thoughts

With the advent of new forex brokers regularly appearing, determining the legitimacy of a broker can be a real challenge. As a consumer, it is vital to investigate the company before investing in trading.

In his article, we have addressed eight simple questions that you should ask yourself when considering a broker to trade forex, binary options, or CFD.

Above all, make sure that you do your research and due diligence before you start trading.