A move by Equifax to enable buy now, pay later (BNPL) vendors to report their customers’ “pay-in-four” loans to the credit rating agency could dampen consumer enthusiasm for the popular payment method.

“Any added friction during checkout will impact the popularity of a payment option among consumers, and this is a pretty big one,” observed Donny Ouyang, CEO of Blackcart, a try-before-you-buy solutions provider in Toronto.

“Even if the credit angle is pitched as a benefit, it’s going to be tough to get over,” he told the E-Commerce Times. “Retailers selling products, especially moderately price products, will see a drop in conversion rates and sales.”

Rob Enderle, president and principal analyst at the Enderle Group, an advisory services firm in Bend, Ore. agreed that retailers could be hurt by Equifax’s decision. “It may make buy now, pay later less attractive because its inclusion will degrade credit ratings,” he told the E-Commerce Times. “So there may be an adverse impact on sales.

However, the impact of the Equifax move was downplayed by Rajiv Bhatia, an equity research analyst at Morningstar Research Services in Chicago.

For BNPL providers, it will be business as usual. “The reporting of this by the credit bureaus doesn’t change whether BNPL providers decide to do a soft or hard credit inquiry,” he told the E-Commerce Times, “and for consumers, the reporting of this could help their credit scores, if they make on-time payments.”

Stepping Stone to Better Credit

Equifax also maintained that reporting buy now, pay later loans could benefit consumers.

As the first consumer reporting agency to formalize a process for including BNPL on traditional credit reports, Equifax sees this as an important step in expanding access to credit, it said in a posting on its website.

An Equifax study of anonymized consumer data from a BNPL provider shows that individuals who pay their BNPL loans on time could potentially increase their credit score, helping consumers to both build and rebuild credit, it added.

“Consumers should get credit for paying bills on time and should be able to use their responsible BNPL behaviors as a stepping stone to other types of credit, like auto loans or mortgages,” Equifax U.S. Information Solutions Chief Product Officer Mark Luber said in a statement.

“Typically,” he continued, “consumers can leverage BNPL products early on in their credit lifecycle, even if they may not qualify for other traditional types of credit. For consumers with young credit files — or those looking to rebuild their credit — using BNPL products from companies reporting presents an opportunity to demonstrate responsible behavior and build or rebuild credit.”

Ouyang pointed out, though, that one of BNPL’s chief selling points during this period of rapid growth has been its place outside the credit reporting system. “If having buy now, pay later being considered in credit ratings were a benefit to merchants, they wouldn’t have spent the last five or six years pitching consumers that it would not impact their credit scores as one of the main value propositions of the product,” he argued.

Retail Success Story

Buy now, pay later has been a success story for retailers. According to Forrester Research, buy now, pay later surged from 2020 to 2021, with online merchants offering the service growing from 26 percent in 2020 to 52 percent in 2021.

The expansion of e-commerce is one reason for that growth, Bhatia noted, while another is younger consumers shying away from credit cards.

In its survey, Forrester found that among the respondents under 35 years old, 29 percent made a BNPL purchase because they didn’t want to use a credit card, 20 percent didn’t want to pay credit card interest on the purchase and 18 percent didn’t have a credit card.

A very basic instinct may also be contributing to buy now, pay later’s growth. “Instant gratification is part of our nature and buy now, pay later appeals to those who want that,” Enderle said, “and to those that are bad with strategic decisions and have a tendency to run up excessive debt.”

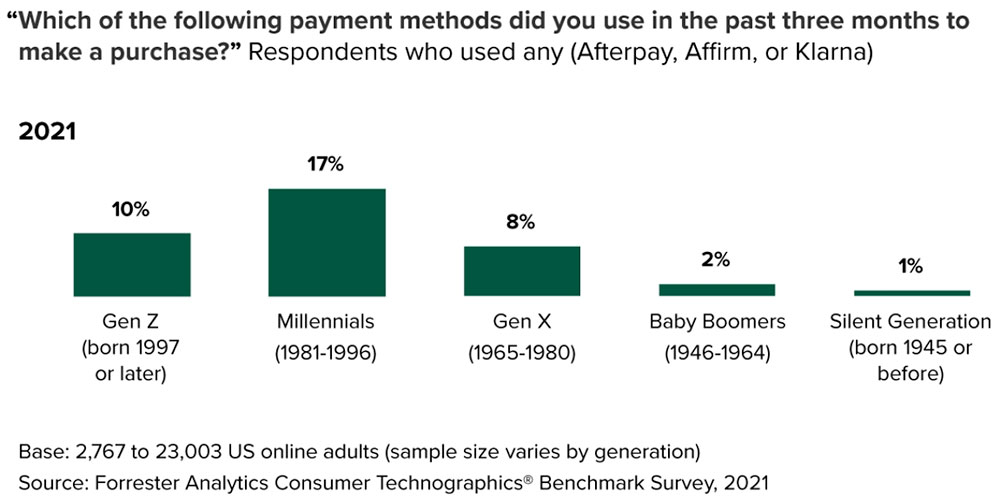

Forrester also found that the number of consumers using buy now, pay later services, such as Affirm, Afterpay and Klarma more than doubled during the period, from four percent in 2020 to nine percent in 2021. The biggest users of the payment method were millennials (17 percent), followed by Gen Z (10 percent) and Gen X (eight percent).

Chart Credit: Forrester Research, Inc. | Reproduced with permission.

“Buy now, pay later tends to be popular with low-income groups, which include kids,” Enderle explained. “That could damage a kid’s credit ratings initially. On the other hand, if the kid pays off the debt in a timely manner, it could also be a way to create a more positive record sooner, so it does depend on the behavior of the borrower.”

However, Ouyang maintained, “If millennials have their credit score impacted when placing an order with buy now, pay later, its value proposition becomes significantly less attractive.”

Try Before You Buy

Ouyang believes that reporting buy now, pay later loans will drive consumers toward his business, which is “try before you buy.”

“Our research shows that when shopping for low- to medium-priced products the reason for choosing buy now, pay later shifts away from affordability towards product uncertainty,” he explained.

“Try before you buy solves the uncertainty around product quality, fit and sizing,” he said.

After a rocky beginning, he maintained he has a good working model. “When we started, it was very painful,” he admitted. “At this point, though, we’ve gotten pretty sophisticated with our AI. Losses are less than one percent.”

Blackcart determines a consumer’s willingness to pay before sending them goods. “When you go through checkouts, we’ll take the phone number that’s input and cross-reference it with telco and government data sets to see if the billing and shipping addresses you entered matches,” he explained. “We look at several hundreds of those signals to determine if you’re eligible for try before you buy.”

“All that happens so fast that a person doesn’t notice it,” he continued.

“Now that there’s less concern about the pandemic, e-commerce has slowed down,” he said. “That’s because the main benefit of offline shopping hasn’t been addressed by ecommerce — being able to try things on and then making a purchase decision.”

“Trying before buying has always been part of the core formula for success for retail in everything from Apple stores to Nike stores,” he said.