What do the Taj Mahal, the Burj Al Khalifa, and the project you’re currently working on all have in common?

The requirement of money to be obtained and infused into the project.

Not to be Captain Obvious here, but no project can truly begin without the proper funding.

However, funding requires approval — and that approval can only be gained if you have a project budget proposal that has information about budget items and estimated total costs.

If you’re looking for a straightforward guide to understanding all the what, why, and hows of project budget proposals, you’ve landed on the right page.

In this article, we cover the ins and outs of budget development (and we’ve also got a template to guide you too). So read on!

Why do you need a project budget proposal?

As the saying goes, money doesn’t grow on trees. There’s a limited amount out there, and we all want to save our fair share, and know where the remaining goes.

As such, a budget is needed to show your investors, clients, and stakeholders where you plan to spend their money.

The budget proposal doc allows them to consider the project costs and compare them with the benefit of the project to understand if investing money into the project makes sense.

Aside from just this benefit, a budget also allows you to forecast all possible direct costs (such as travel costs and stipends) and indirect costs (such as administrative costs).

You can also predict profits and losses, and show your clients or stakeholders the direct impact this specific project will create. The benefits don’t stop there.

Project budgets also allow you to instill financial transparency within your firm by showing a detailed summary of all budget items, cost categories, and budget justifications.

Lastly, writing down a detailed budget helps you find loopholes and allows you to optimize your spending for specific projects (for example, two projects may need research in the exact same area, and therefore you may not need to conduct the research twice).

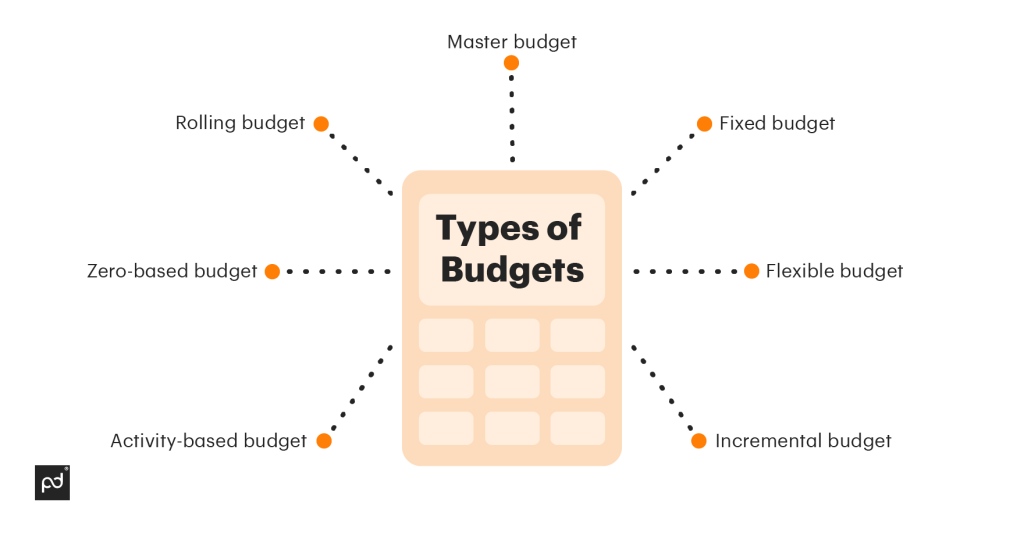

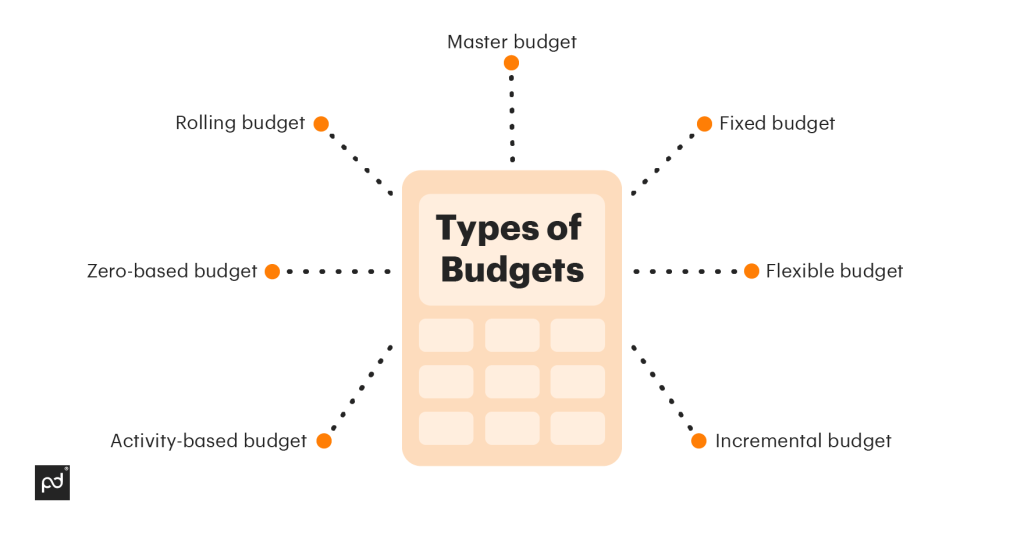

Types of budgets

Although budgets are commonly divided into four distinct categories, we have gone a step further to present you with seven different types of budgets that you can use in any given case or scenario.

1. Fixed budget

As the name would suggest, a fixed budget is static in nature.

With this budget, both income and expenditures are predetermined, and the predetermined amount cannot be changed regardless of the activity levels in an organization.

This budget is easy to determine; however, because it doesn’t consider future fluctuations, it can be difficult to navigate.

2. Flexible budget

Think of something that’s on the opposite side of the spectrum of a fixed budget — that’s where flexible budgets live.

This budget is extremely dynamic, as it is entirely based on fluctuations and activities in a company.

Flexible budgets may often require a lot of guesswork and estimates because the person preparing them needs to assume all future possibilities.

However, regardless of how complex they are to make, these kinds of budgets are generally preferred in any organization because they are more realistic.

3. Incremental budget

Incremental budgets are based on the previous year’s budget. Every year, an organization finalizes the previous year’s income and expenses and then adds or subtracts an amount to or from it.

The benefit of an incremental budget is that it’s easy to make, you can compare changes, and you can implement them without any difficulties.

The obvious disadvantage with this type of budget is that, more often than not, it doesn’t analyze future trends (and it always assumes that the company will have stable operations), and hence it could make the wrong estimates.

4. Zero-based budget

Zero-based budgeting (ZBB) method is preferred by many organizations because it analyzes current trends and expectations to come up with an estimate.

The reason why it’s called zero-based is that every year you’ll need to come up with a new budget that factors in how much you think should be allocated to each department — that’s to say, it starts with a base amount of zero.

The downside of this budgeting method is because it is so complex to make, it can also be very time-consuming to complete.

5. Activity-based budget

An activity-based budget, also known as ABB, delivers estimates of costs based on the activities in an organization.

For example, an activity-based budget identifies multiple costs in an organization, such as the costs of labor, wages, machinery, raw materials, etc., to come up with an estimated cost.

This is different than a traditional budget, which takes the past year’s budget amount and adds to / deducts from that amount.

These kinds of budgets are often preferred by large organizations whose main costs go toward acquiring labor, machinery, raw materials, etc., to understand how and where they can save their costs.

6. Rolling budget

As the name would suggest, a rolling budget, or a continuous budget, is one that constantly keeps changing — for example, it may be created and/or altered once every month, quarterly, every six months, or annually.

A rolling budget assumes every three to six months to be a new budgeting cycle and will only account for costs and expenses during that period of time.

Because they are made so often, they also are reflective of the current market’s expectations.

7. Master budget

Also termed a comprehensive budget, a master budget is where every budget director’s attention needs to be.

It’s a culmination of every budget in an organization in a fiscal year — all your sales budget, marketing budget, operations budget, production budget, etc. — are all included, making up all the pieces of the pie.

Almost every organization needs a master budget, as it allows them to identify all expenses as well as opportunities to earn in a year.

It also allows them to address how they would like to move forward with their long-term and short-term goals.

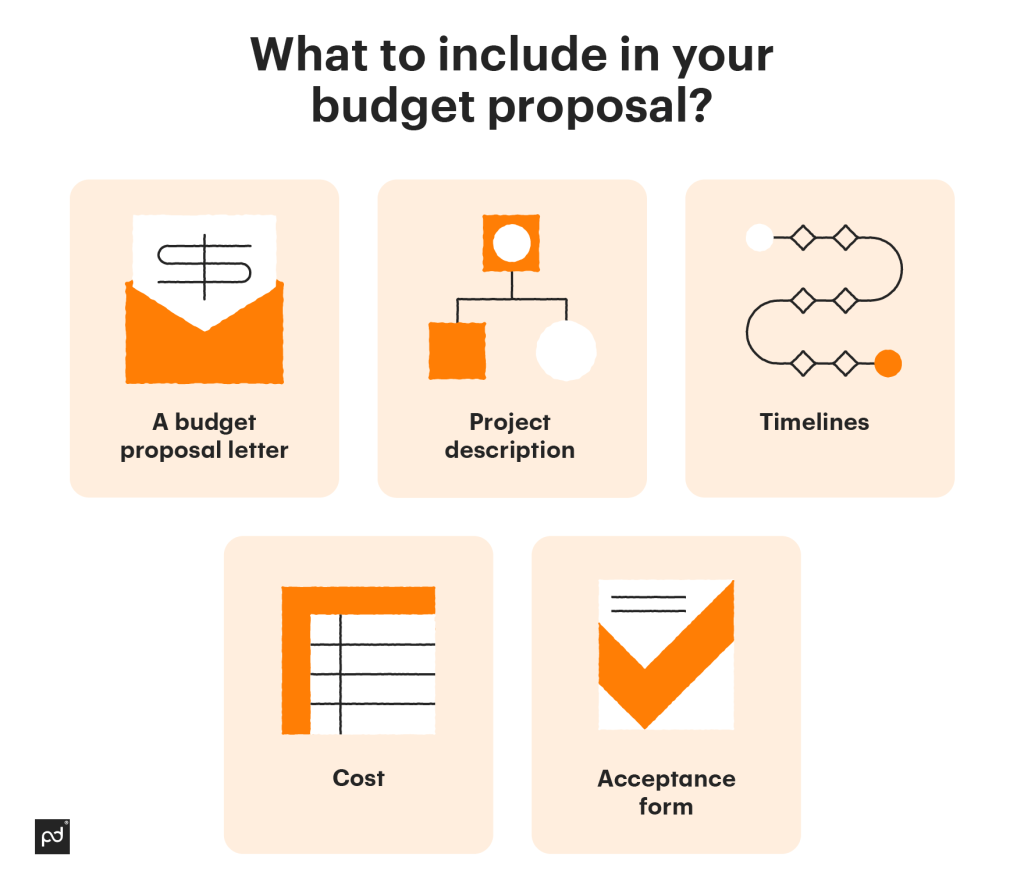

What to include in your budget proposal

Budget proposals should be extremely comprehensive in nature.

However, even if you want to create a basic proposal with only the need-to-know details, you’ll still have to include these five important points:

1. A budget proposal letter

A budget proposal letter is like a cover letter of sorts. By that, we mean it does exactly what a cover letter does: inform the reader that you’re interested in being a part of the project.

You can also go a step further and write why the project is important to you and why you should be the one to undertake it (as opposed to other candidates).

2. Project description

A project description is required to understand the requirements of a specific project.

In this section, you’ll need to add information such as the name of the project, why you are undertaking it, what impact it can have, why you want to focus on it now, etc.

In essence, a description is like your elevator pitch for a project.

3. Timelines

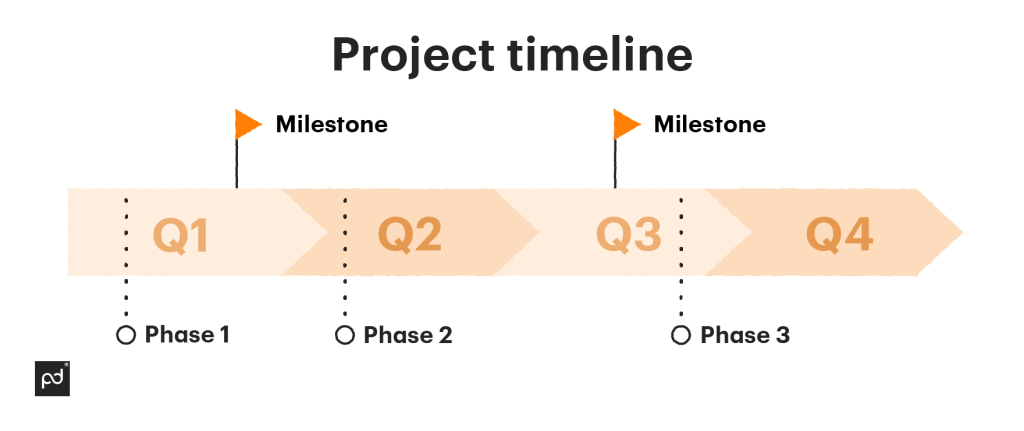

You need to give the reader a thorough understanding of all project timelines and milestones. For example, when do you expect the project to get completed, and when do you plan to begin?

Other questions. like what phases you expect it to have, when you expect to reach certain milestones, etc., are all important points to consider.

4. Cost

Ah, perhaps the most important part of a project budget proposal.

The name is a huge giveaway — your reader wants to know about the anticipated expenditures (both direct costs and indirect costs), the total amount necessary for undertaking the specific project, cost categories, budget items, and all important things related to $$$.

5. Acceptance form

Say your clients/stakeholders scroll through the entire project proposal. They’re happy, satisfied, and want to move on to the next step. And what’s that, you say?

The acceptance form. The acceptance form is a small section that has the signatures of both parties, which shows that everyone has agreed to the budget mentioned in the proposal.

Free Budget Proposal Template

How to write a project proposal budget

1. Write a clear project description

As previously discussed, your project proposal should begin with a budget proposal letter and a detailed project description.

In this section, you should aim to introduce the reader to your project, instead of directly jumping toward talking about money (although, yes, the budget proposal is specifically created to discuss money).

Here, try to include the following details:

- Why you’re taking on the project.

- The impact it will create.

- The benefit for the company of undertaking this project.

- Name of the project.

- Expected outcomes from the project.

- Names of team members undertaking this project.

Although a detailed project description is important, know that the reader is specifically reading your budget proposal to know about the allocation of funds, so cut short any detail from this section that’s not required.

2. Create a projection of timelines

Timelines and costs form the crux of a budget proposal. Begin by dividing these two topics into different categories.

For timelines, you need to consider project phases (such as the starting phase, completion phase, etc.), and time requirements from the project (for example, each project and phase can require the team members’ attention for days, weeks, hours, etc.).

Some companies prefer to see project timelines based on how they fit within the fiscal year — for example, they prefer certain projects to start at the beginning of the fiscal year, so budgets are allocated accordingly.

Hence, that’s another consideration you’ll need to factor in.

3. Emphasize cost elements

As far as expenditures are considered, a budget proposal should ideally have all cost elements crystal clear.

Preferably, it should also account for future profits and the impact the company can make from this project.

In this section, try to include direct costs, indirect costs, and total costs.

Provide a breakdown of each of these costs — for example, for direct costs, if you hire laborers, you’ll need to show how many laborers you plan to hire, justifications for hiring them, what are their hourly rates, would laborers be bringing in equipment or not, would the pricing be based on per project or yearly basis, the names of the laborers, etc.

You can also add a note about who created the budget items and budget costs for this specific project.

Another thing to consider is how these cost elements can change based on the industry you’re in.

For example, some industries have a massive requirement for labor, whereas others may have a massive requirement for machinery.

Begin describing your cost elements with your highest costs and then go on to add in smaller costs, so there’s a clear hierarchy when viewing the entire budget.

4. Submit for approval

Once you’ve nailed all the nitty gritty, it’s now time to add the acceptance form and a cover page. Be sure that your proposal is formatted perfectly and that it reads well.

As soon as you check all the above boxes, your budget proposal is ready to be reviewed!

Why do you need a project budget proposal?

Budget proposals are created to showcase the cost of a project for three important parties:

- Clients (if you’re a service provider pitching a service)

- Stakeholders (if you’re proposing a budget to internal team members)

- Investors (if you plan to undertake a project through the funding of an external investor)

Budget proposals are a “need to have” for any project, not only for the above-mentioned clients/stakeholders/investors but also for the vendors.

The reason why many potential clients ask for a proposal before undertaking a project is so that they understand the financial burden they’re bringing on themselves, and if the expected project value is proportional to that amount.

Investors and stakeholders have a similar reason to ask for a proposal — budget proposals also allow potential clients to choose between multiple vendors solely based on pricing.

For service providers, these budgets are essential because they show a client how much money they would require before undertaking any responsibilities to complete the project.

Aside from this important reason, budget proposals also bring a sense of credibility, and they also establish expectations and timelines from the get-go.

Although the reasons for creating a budget proposal are many, preparing a budget proposal that reflects your deliverables and expectations, and clearly justifies costs, is just as important.

So ensure you create a proposal that leaves no room for assumptions. One solid way to do that? Templates!

Use a template to your advantage

If a budget proposal has you scratching your head, then fret not, for you can use a template to your advantage.

In fact, there’s a high possibility that many of your peers have been using templates too.

The PandaDoc budget proposal template covers all the important details (such as the budget proposal letter, project description, project costs, timelines, acceptance form, etc.).

You can also explore our other templates to ensure that you always present your best foot forward in front of your stakeholders.

Looking For Document Management System?

Call Pursho @ 0731-6725516

Check PURSHO WRYTES Automatic Content Generator

https://wrytes.purshology.com/home

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads