In the corporate world, there are a couple of things you cannot do without.

Contracts, licenses, financial documents, business tax forms, reports, business agreements, and invoices.

Chances are, you’ve heard about an invoice before, and you vaguely know of its importance and usage.

But, if you’re setting up a business (or have already crossed that bridge and are currently a business owner), you need to know exactly what an invoice is, what it does, its importance, usage, and legality.

In this article, we’re covering all the need-to-know about invoices.

So, let’s get on with it!

What is an invoice, and what does it include?

An invoice is a document that is usually created by the vendor for a client to share the total amount payable for the work done.

For example, if you have a small business and you’ve taken on work for an agency, you’ll need to create an invoice to collect payment.

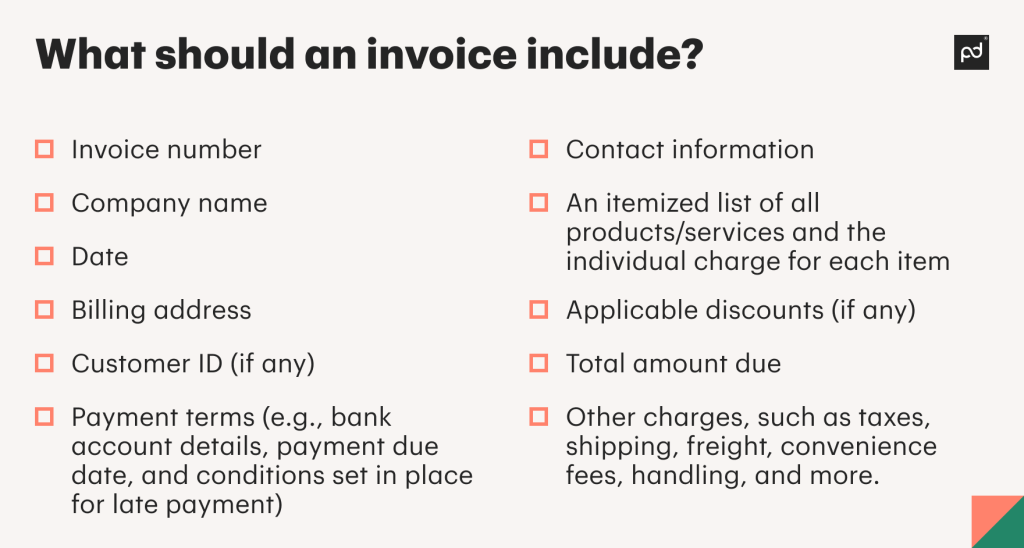

Each invoice should ideally have:

Aside from just requesting payment, invoices are also created as a method of keeping records, streamlining business operations, and monitoring cash flow.

In most cases, companies usually send an invoice at the end of the month to indicate all the work undertaken for that month (but this can change depending on the agreement you have with the client and the kind of projects you undertake).

Here’s an invoice template you can refer to:

PandaDoc has a library of invoice templates that you can use based on your specific requirements.

You can even sign your invoices electronically and get relevant insights (such as how many times the invoice was viewed) with this platform. Learn more about what you can do with PandaDoc here.

What are the different types of invoices?

The use of an invoice differs on a case-to-case basis.

For all the same reasons, you also use different types of invoices depending on their use case.

Here are a few different types of professional invoices commonly used by businesses.

1. Pro forma invoice

A pro forma invoice is quite similar to a standard invoice, except that it’s meant to be created before a standard invoice.

This is because it provides an estimate of the final price rather than the final price itself (certain industries go through price fluctuations based on the season and the conditions the product is produced in, so the pro forma invoice essentially acts as a bill of sale that shows there’s an agreement between the buyer and the seller).

Check the Pro forma invoice here.

2. Commercial invoice

A commercial invoice is primarily used for international payments (however, this is not a stipulation).

With these invoices, businesses request payment for a product that has already been delivered or a service that has already been completed.

A commercial invoice is also treated as a custom report and has additional details (that a standard invoice might not), such as mode of shipment, currency preference, package marks, certifications, etc.

3. Retainer invoice

A retainer invoice is usually made for advance payments.

For example, if you operate an advertising agency and you agree to deliver 15 projects for your client, you might need an advance payment to get started on the projects — in such cases, a retainer invoice would be used.

Of course, the advance amount is deducted from the final amount.

4. Recurring invoice

Like the name suggests, recurring invoices are, well…recurring in nature.

For example, if you offer a subscription service or you deliver pre-decided-upon projects for a client monthly, that’s when you’ll send them a recurring invoice.

5. Credit invoice

A credit invoice, also known as a credit note or a credit memo, accounts for damages, discounts, and errors.

Suppose the previous batch of products you sent to a client had damages worth $200, you’ll deduct the amount (-$200) from this month’s invoice for that client.

6. Timesheet invoice

Timesheet invoices are made based on hourly rates.

Lawyers, contractors, writers, editors, consultants, etc., usually send timesheet invoices to their clients based on the number of hours they worked on a project and their standard per-hour rate.

For example, if a writer worked for five hours at $50/hour, the invoice amount would come up to $250.

7. Other types of invoices

Here are a few other types of professional invoices that are not-so-commonly used in the corporate world (but are still necessary to know about!):

- Mixed invoices: Has a combination of debit and credit charges.

- Debit invoices: Also known as a debit memo or a debit note; in this invoice, additional hours worked on the project that were not previously accounted for are added.

- Expense reports: These invoices (or rather, reports) contain items that a business owner or an employee needs to be reimbursed for.

- Interim invoice: When taking on a large project that spans multiple months, contractors are paid in intervals based on milestones achieved (or other similar factors).

- Past due invoice: These invoices are sent when a client forgets to send a payment by the mentioned due date. It also consists of late fees and interest charges, if any are applicable.

Which invoice do I need?

We previously discussed that the use cases of invoices differ based on the kind of business operations you conduct.

Now, let’s dive in further to explore which team might need what kind of invoices.

1. Legal

Legal teams may benefit by sticking with timesheet invoices as they help itemize all billable and non-billable hours worked on a project, alongside other expenses, such as travel, accommodations, etc.

2. Human Resources

Human Resource teams are often sent a multitude of payment requests, and hence may need to accustom themselves with expense reports, as well as interim, past-due, debit, credit, recurring, and retainer invoices.

However, if you’re an HR consultancy firm, you can charge per-hour or per-project (and might benefit from developing timesheets or standard invoices).

3. IT & Operations

Since IT companies mainly deal with maintenance projects, they would, more often than not, need to create recurring invoices.

4. Finance

Finance consultancy firms usually charge based on the size of the client firm and the scope of the project.

As such, they’ll need to create a standard invoice. Finance firms may also create a pro forma invoice to present their clients with an estimate.

5. Marketing

Marketing firms, before undertaking the production of any deliverables, usually ask for an upfront amount (it’s an industry standard).

As such, they’ll need to create a credit invoice, and then follow it up with a standard or timesheet invoice.

What is the difference between an invoice and a bill?

While many use the terms “invoice” and “bill” interchangeably, these documents have two completely different meanings and different use cases.

Aside from the way both are constructed, the payment terms between an invoice and a bill greatly differ, too.

A bill is generally due to be paid as soon as the product/service has been sold. An invoice, on the other hand, can be paid after a few days (Net-30 days is the most commonly used payment term).

Many large and small businesses also use invoices when they intend to continue a project for a long time period (such as when they create a custom order or if they take a huge assignment), whereas bills are used for one-off transactions (such as payment for groceries).

Are invoices legal documents?

Alright, here’s an important question to consider: are invoices legal documents?

The short answer: no, they are not. However, they can be binding. Allow us to elaborate.

When used alone, invoices cannot be legally binding.

That’s because if they were, anyone could send an invoice to anyone and expect payment. Sounds a little shoddy, doesn’t it?

To ensure that the invoices are paid to the right party for the product/service they agreed to purchase, we need another document of sorts to show the agreement of the offer.

And that “document of sorts” is a contract.

So, invoices, when accompanied by a contract, can be binding.

If you create a contract before you begin working on a project for a client, you’ll need to consider certain factors so that the contract can be considered legally valid. Such factors include:

- The offer

- Consideration

- The capacity of both parties

- Fairness of the contract

- Acceptance of the offer and agreement from both parties

Once the contract is considered legally valid in the eyes of the law and you’ve done the work, you can then send an invoice to show that you’ve completed the assignment and are now requesting payment for it — the invoice has become binding and will need to be paid.

Worst case scenario, even if the client doesn’t pay you and you take them to court, you can show the invoices as proof of the payment request (and can even refer to the invoice date for the payment of late fees).

Payment terms to keep note of

Now that we’ve covered the basics, let’s get to the nitty-gritty details — invoice payment terms.

Ever heard of jargon like Net-X payment, EOM, CIA, PIA, upon receipt, purchase order, accounts receivable, etc., when it came to invoicing? If any of them sound a little unclear, you’re not alone — we’ve all been there!

But you don’t need to struggle to figure out these terms of payment or invoices anymore. We’ve uncovered it all for you.

Net-X payment

The “X” in Net-X payment stands for the due date of payment.

For example, if you agree to Net-30 payment terms, you’re expecting to see payment within a 30-day timeframe.

Popular payment terms are Net-0 (which basically means payment on the same day), Net-7, Net-30, and Net-90 days.

EOM

Also known as “end of month,” EOM means that you agree for something to be paid by the end of the month.

This jargon is used across many industries to streamline payment schedules or points of discussion.

CIA

Short for “cash in advance,” CIA means you’re asking clients to pay you the final amount of the project in full cash before you start working on the project.

PIA

Standing for “payment in advance,” PIA means you’re asking clients to pay you the entire amount of the project before you begin working.

Upon receipt

Upon receipt refers to when your clients receive your invoice.

For example, if you ask your clients to pay you upon receipt, you’re expecting immediate payment as soon as they receive the invoice.

Purchase order

A purchase order is a legal document that usually precedes an invoice, which indicates the quantities and prices of a product and the client’s agreement to buy the product.

Accounts receivable

If you sell your products/services on credit (as you usually do when it comes to invoice-related payments), accounts receivable refers to the amount you’re entitled to receive from your clients. Accounts payable means the opposite.

MFI

Short for “month following invoice,” MFI means you have to pay the amount the following month.

For example, if you write 15 MFI, you’re asking to receive payment by the 15th of the following month from when you send the invoice.

5/15 Net 30

The numbers in front of Net 30 indicate the discount and date.

In this case, the client can send the payment within 30 days, but if they send the payment within 15 days, they qualify for a 5% discount.

These numbers can be changed to anything the billing party wants to change them to.

Creating an invoice in PandaDoc

If you don’t have the hang of it, invoice creation can easily become a tricky business because you’re not entirely aware of the invoicing processes of other businesses, or you don’t completely know what should go there, what shouldn’t, and when you should expect payment.

So, here’s a quick walkthrough on how to create an invoice in PandaDoc.

To begin with, you can create a free eSign account on PandaDoc.

From there, go on Resources > Templates > Invoices (you can find the option of invoices in the left bar or simply search for invoices by typing it in the search bar).

Once here, you’ll find a library of invoices.

Feel free to select whichever template that suits your needs best (e.g., you can use the commercial invoice for international payments).

And once you click on it, you can edit the invoices to add in whatever details necessary (all fields, such as text, media, signature fields, etc., will be available on the right side of the panel).

Alternatively, if you wish to create invoices from scratch, you can do so by using the PandaDoc editor (you can also refer to the blank invoice template we have to serve as a guiding point).

The best part of all?

After creating these invoices, you can track them, too.

For example, if you wish to know how many times your clients revisited the invoice or how long they spent reviewing it, you can easily do so through PandaDoc.

Oh, and PandaDoc customers have seen a 50% decrease in the time spent creating documents, a 87% increase in completed documents, and a 36% increase in close rates after using our service.

If you wish to know what other capabilities our solution has, you can arrange a free call with a PandaDoc representative and we’ll be happy to guide you as to how PandaDoc can become a supportive part of your organization!

Disclaimer

PandDoc is not a law firm, or a substitute for an attorney or law firm. This page is not intended to and does not provide legal advice. Should you have legal questions on the validity of e-signatures or digital signatures and the enforceability thereof, please consult with an attorney or law firm. Use of PandaDocs services are governed by our Terms of Use and Privacy Policy.

Looking For Document Management System?

Call Pursho @ 0731-6725516

Check PURSHO WRYTES Automatic Content Generator

https://wrytes.purshology.com/home

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads