You’re reading Entrepreneur United States, an international franchise of Entrepreneur Media.

The now billionaire Kim Kardashian is being targeted by the British government for her work as an influencer. Authority Financial Conduct (FCA) in the U.K. said the businesswoman’s promotion of speculative cryptocurrency Ethereum Max (EMAX), a token that raised its value more than 1,370% in just two weeks, could be fraudulent.

Depositphotos.com

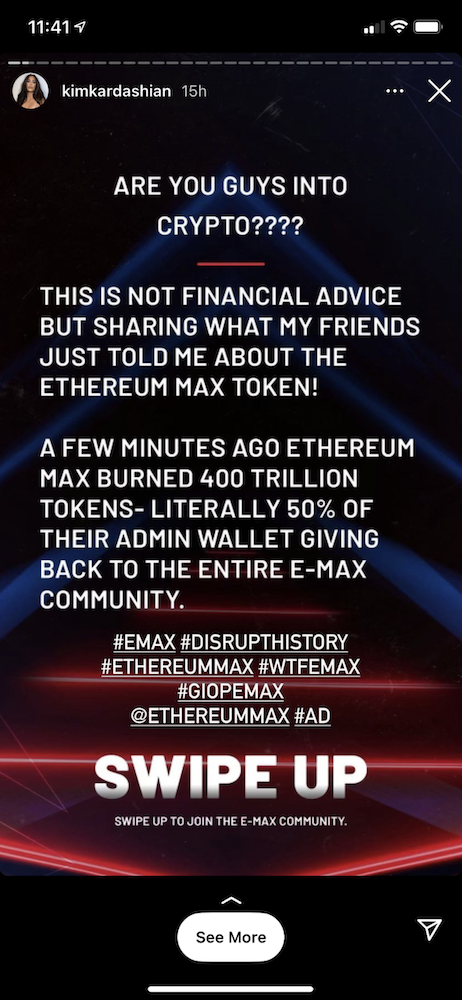

Charles Randall, director of the FCA, revealed that the founder of KKW Beauty published an Instagram story last June recommending the mysterious digital currency, which is not linked in any way to the Ethereum network.

Related: Two Children Place an Ethereum Mining Pperation in Their Garage and Earn $32,000 a Month

Since Kim Kardashian has more than 251 million followers on Instagram alone, Randall said it was perhaps “the financial promotion with the largest audience reach in history,” in a speech posted on the FCA website.

Image: Kim Kardashian via Instagram .

“Are you guys into crypto???? This is not financial advice, but sharing what my friends just told me about the Ethereum Max token! A few minutes ago Ethereum Max burned 400 trillion tokens – literally 50% of their admin wallet giving back to the entire E-Max community,” read the celebrity’s Instagram Story.

In addition to Kim Kardashian, celebrities like boxer Floyd Mayweather and former basketball player Paul Pierce have made announcements about Ethereum Max.

In fact, according to a press release, Ethereum Max was “cryptocurrency Exclusive (sic) accepted for purchase online ticket” for the recent pay-per-view bout Mayweather vs. Logan Paul.

Related: Cardano, the Cryptocurrency That Could Become the Most Valuable in the Cyber World

Did Kim Kardashian commit any infraction while promoting Ethereum Max?

In the publication, Randall acknowledges that the most famous Kardashian did comply with the rules of Instagram, indicating that they were paid ads. Furthermore, he said, Kim had no obligation to explain or make transparent what Ethereum Max is.

“Of course, I can’t tell if this particular token is a scam. But scammers routinely pay social media influencers to help them push and dispose of new tokens based on pure speculation. Some influencers promote currencies that simply do not exist at all,” detailed the director of the FCA.

“There are many stories of people losing all their savings when they are drawn into the cryptocurrency bubble under the illusion of getting rich quick,” added Randall. “And sometimes this happens thanks to influencers who are willing to betray their fans in exchange for money .”

At the time, the CoinDesk portal speculated that Kim Kardashian would have made between $300,000 and $500,000 (or more) by promoting EMAX.

Related: As of Today, Bitcoin Is Legal Tender in El Salvador; They Can Buy It Through Bitso

What is Ethereum Max or EMAX?

“Ethereum Max, not to be confused with Ethereum, was a speculative digital token created a month before (from Kim Kardashian’s post) by unknown developers, one of hundreds of such tokens that fill crypto exchanges,” explained Randall.

Little is known about this cryptocurrency. It just launched just last May 14 with a transaction volume of $16.11 million and a price of $0.00000005875, according to data from CoinMarketCap. It is primarily traded against Ether, the native currency of the Ethereum network on Uniswap, a decentralized exchange that allows anyone to list a token.

By May 30, EMAX already had a transaction volume of almost $118 million, up 632% in just two weeks. The day before, it reached its maximum price of $ 0.000000863, which represents a rise of 1.370% more than its initial price of $0.00000005875.

However, the streak did not last long, and Ethereum Max began to deflate. On July 15, it hit its all-time low: $ 0.000000017 per unit, a 98% drop from which it has not been able to recover. On August 1, its transaction volume plummeted to $157,423, which is less than a hundredth of its initial capital.

According to the British authority, this digital currency is not covered or regulated by the body, which represents a risk for investors.

“At the FCA we have repeatedly warned about the risks of holding speculative tokens. To be clear: these tokens are not regulated by the FCA. They are not covered by the Financial Services Compensation Plan. If you buy them, you must be prepared to lose all your money,” emphasized the director of the FCA.