If you’ve been in business for long, you realize that it’s not only about serving your customers. There’s a lot of work about the work too. A host of documentation, information going back and forth, quotes to approve, invoices that need to be paid—and at the end of the year, the government wants to see if you’ve done your homework.

Save time and reduce errors with accounting automation

That’s why having a powerful accounting app is so important. It can help you handle all the financial stuff, see how your business is performing, and even help you sleep at night during tax season.

I tested dozens of accounting apps to find the best ones for your business—so here’s the list of the best accounting software. Let this year be the year when the word “accounting” doesn’t make you sigh in dismay.

The best accounting software

What makes the best accounting software?

How we evaluate and test apps

All of our best apps roundups are written by humans who’ve spent much of their careers using, testing, and writing about software. We spend dozens of hours researching and testing apps, using each app as it’s intended to be used and evaluating it against the criteria we set for the category. We’re never paid for placement in our articles from any app or for links to any site—we value the trust readers put in us to offer authentic evaluations of the categories and apps we review. For more details on our process, read the full rundown of how we select apps to feature on the Zapier blog.

Accounting software has been around for a long time, so it’s no surprise there are lots of viable options. Once you weed out the duds, the major differences you’ll find are in user experience and in the collection of special features or add-ons that each app offers.

At minimum, online accounting software will handle your bookkeeping, provide a useful dashboard to give you an idea of your income and expenses, have basic sales tax features, and offer a collection of reports so you can look at your business from different angles. More advanced software can also help with inventory tracking, in-depth reporting, automated payroll, bank integration, budgeting, and eCommerce.

As I was testing every small business accounting software I could get my hands on, here’s what I was looking for:

-

Small business emphasis. I was looking for all-in-one tools that could be used by a small business owner or an accounting team at a small or medium business. I didn’t consider anything that was purpose-built for freelancers or was just for invoicing. If you’re looking for that kind of solution, here are Zapier’s picks for the best accounting and bookkeeping apps for freelancers and the best invoicing software.

-

Usability. Is the app easy to use? Is the interface intuitive? Is it fast? Is your data secure?

-

Bookkeeping features. The best small business accounting software should have everything from basic invoices and expenses to projects, time tracking, and inventory tracking.

-

Budgets and reports. I looked at the quality of the dashboard, the variety of reports available, and whether you can create budgets to control your business spending.

-

Tax preparation. Tax filing apps belong in a different category, but some of these accounting tools can help you get ready for the tax season by keeping track of things like 1099s, configuring sales tax, and allowing you to invite your accountant into the app.

-

Extra (useful) features: I kept my eye out for relevant bells and whistles: bank integration, payment portals, automatic reconciliation, CRMs, capturing receipts via mobile app, and more.

I considered and tested dozens of accounting apps, using all the features as if I were running a small business: adding contacts, creating invoices, logging expenses, and so on. (I have thousands and thousands of fictional dollars coming my way sometime soon.) I tested the integrations with payment portals, added data to populate reports, and set some tight budgets to top it off.

Best all-around accounting software for small business

QuickBooks Online (Web, Windows, Mac, iOS, Android)

When QuickBooks first launched, I wasn’t even born yet. That’s how long Intuit has been in business, and the company has used that time to build and refine one of the strongest and most complete accounting apps on the market. And let me open with, in my opinion, its greatest strength: it supports you all the way from step one of the onboarding sequence through to running your own payroll automation.

You’d think that to achieve this level of hand-holding, QuickBooks would have to spend a lot of time with lengthy videos, or divert you on an endless rabbit-hole journey through the knowledge base. But the onboarding is quick and direct, offering you ways to import your data whether you’re coming from the competition or from Excel spreadsheets.

The first setup is organized in a step-by-step process. Work gets done as you customize. While you’re creating your first invoice, there’s a step to edit the template, another to enter all the information appearing on all future invoices, and a final one to configure a payment portal to let your customers pay online.

There’s plenty of help on each of these pages—nothing wordy or complex, and there’s always the right amount of information and support. This is great news, especially when the rest of the app is strong on all counts. It has everything from basic bookkeeping features to bank reconciliation and eCommerce integration.

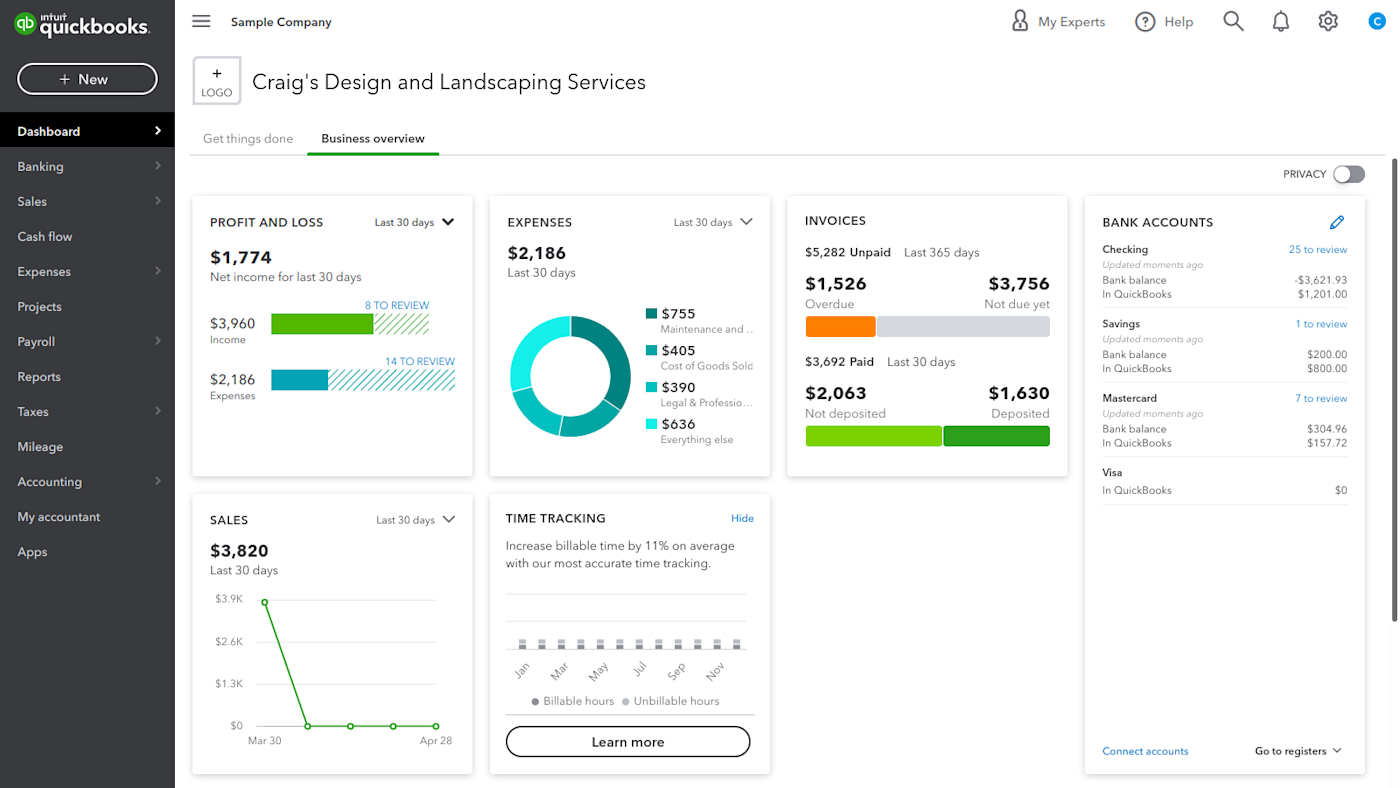

The dashboard has all the information you need, with a set of beautiful graphs, showing that professionalism and aesthetics aren’t as divorced as we think. The whole platform strikes a great balance between these two qualities, with some nice animations that shake up the rhythm without weighing on the app’s speed.

QuickBooks handles your sales tax (and even payroll tax, if you subscribe to the payroll feature), but it just doesn’t file taxes for you (if you want to take that extra step, you can use Intuit’s TurboTax). Some extra features include a cash flow planner, where you can play with the numbers without it affecting the real data. That’s alternate reality support right there.

If you have some extra budget, you can also explore QuickBooks add-ons, such as Payroll, which I already mentioned, or Workforce, which allows your employees to input and update their details for payslips and tax compliance (HR will thank you).

If you value a strong tool with a proven track record, QuickBooks is a great choice. I suspect many app testers yet to be born will still be writing about it in decades to come. While we wait for them, you can connect QuickBooks to Zapier to integrate it with other apps you use.

QuickBooks Online pricing: Plans start at $25/month and increase based on number of users and extra features.

Best free accounting software

Wave (Web, iOS, Android)

Writing about Wave breaks my heart. I used to be a happy Wave user in 2020. It had all the features I wanted, with the kind of user experience that I like—and then Wave stopped operating outside the U.S. and Canada.

I still remember how the bookkeeping features were so simple and powerful. The interface strikes a great balance between cute and functional. It has multicurrency support, allowing you to enter conversion rates manually, so everything syncs to the cent.

The downsides here are that you can’t create projects in Wave, and time tracking can only be added at the invoice level, not via the classic timer. Another feature that works on its own wavelength is the products and services section, which doesn’t have full-on support for inventory tracking; however, if you’re experienced using the accounting journal, it’s possible to do it with a couple of tweaks.

The collection of reports isn’t as deep as other options, but it’s enough to keep track of what’s happening in your business. When tax season comes, you can invite your accountant in, and they’ll be pleased to see that Wave handles details like 1099s.

But then, there’s the top feature that makes Wave attractive, which is tied to its business model. It’s a completely free app, with all the core features that you need from an accounting solution. The way Wave makes money is by taking a percentage off of all online invoice payments. This cuts both ways: if you receive loads of payments online, the percentage may start eating into your finances; but if you also collect payments via other means (such as bank transfer), then Wave can be the solution that’s easy on your wallet and on your eyes, brain, and nerves as well.

Wave makes the list as the best free accounting software for small business due to its great user experience, strong features, and generous plan. If you’re on the right side of the ocean, give it a try. And connect Wave to Zapier, so it can talk to all the other apps you use. Here are some examples:

Wave pricing: Free; online payments charged at a percentage plus a fixed rate.

If you like Wave’s feature set but want to try another take on it, you have a couple of options for Wave alternatives: the first is FreshBooks, which might fit you if you’re running a smaller operation; the other is ZipBooks, with robust inventory tracking features, appealing interface, and a nifty “invoice score” to help you fill in all invoice information to make the late payers reach for their wallets faster.

Best accounting software for project tracking

Xero (Web, Windows, Mac, iOS, Android)

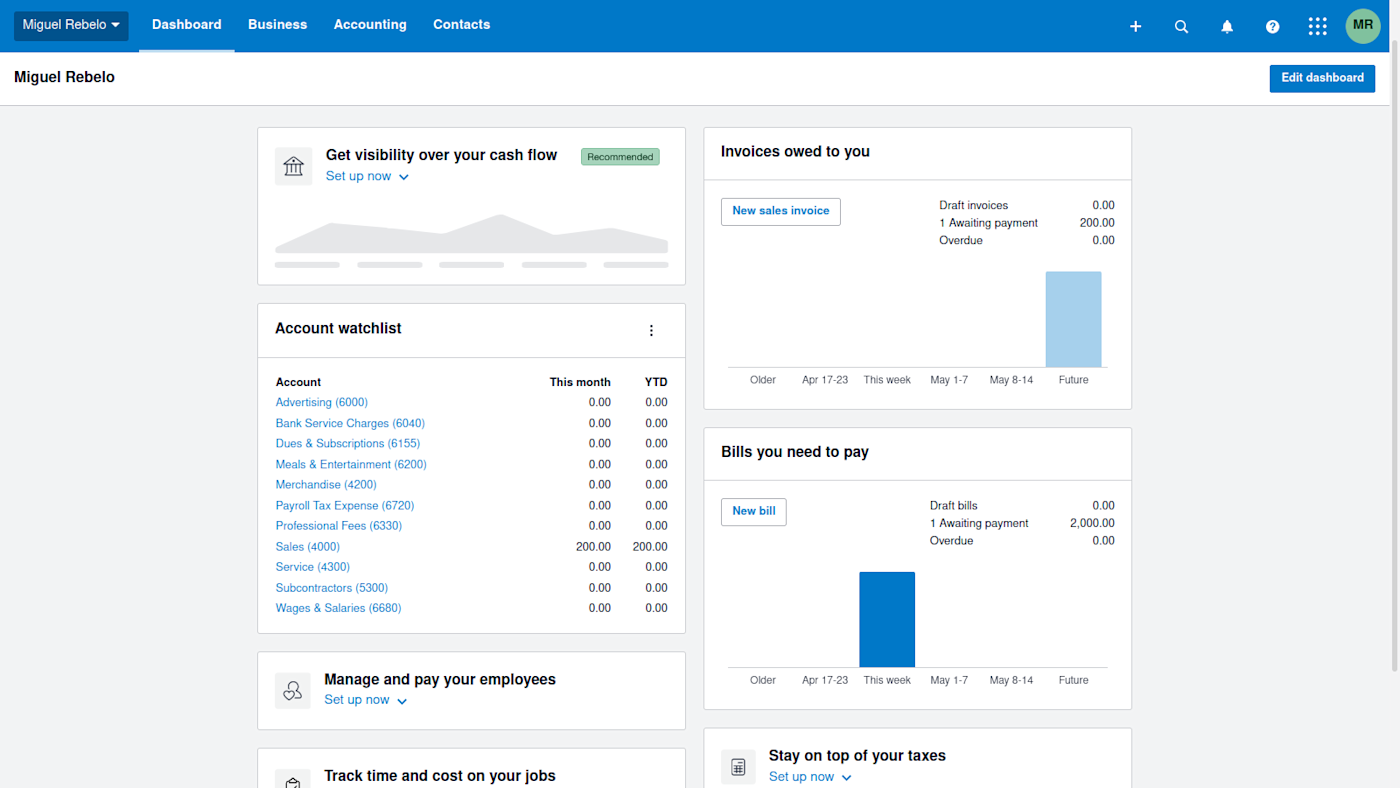

Hailing from New Zealand, Xero wants you to “do beautiful business.” And with all the features Xero offers, you can do that and much more.

The first thing I love about Wave is the dashboard. It acts as an onboarding tool, listing all the features of the app that you have to set up: configuring your invoices, creating account categories, connecting your bank account, and so on. It helps make sure you’re doing everything you need to do to take full advantage of the app. If there’s something you won’t need, you can edit the dashboard to control what you don’t want to see.

Despite this good start, the rest of the interface isn’t quite as clean as the other options on this list—for example, there’s too much going on on pages like the list of invoices. But the tradeoff is you won’t have to click a lot to see everything you need at any time.

The bookkeeping features are top-notch. In addition to the basics, you can also create purchase orders, file expense claims, and print checks. All these features are peppered with reports and local dashboards to help you see what’s going on with your business.

But the feature I was most surprised by was the detailed project tracking. You can see projects in three stages: draft, in progress, and complete. Clicking on a project will take you to the project dashboard, with the estimate, the amount invoiced, time and expenses, and the deadline. Such a thorough approach, while at the same time helping you focus on all the relevant metrics.

Xero’s accounting section is filled with lots of pre-made reports and some custom ones you can create. Your accountant will be pleased with all the features. Don’t forget to mark your 1099 contractors in the contacts section, and you’ll be able to generate reports on that as well.

Xero has its own app store, allowing you to integrate it with hundreds of apps across many categories. From the automotive industry to tourism, there’s a lot to explore and to help you connect Xero to every part of your business. And if you don’t find what you need, Zapier has you covered: connect Xero to Zapier, so you can integrate Xero with thousands of other apps. Here are some examples:

Xero pricing: Paid plans start at $12/month. To get the project tracking, you’ll need the $65/month Established plan.

If you’re looking for a Xero alternative, try FreeAgent. The interface is friendlier and it’s a lot speedier than Xero.

Best accounting software for integrating accounting and sales

OneUp (Web, Android)

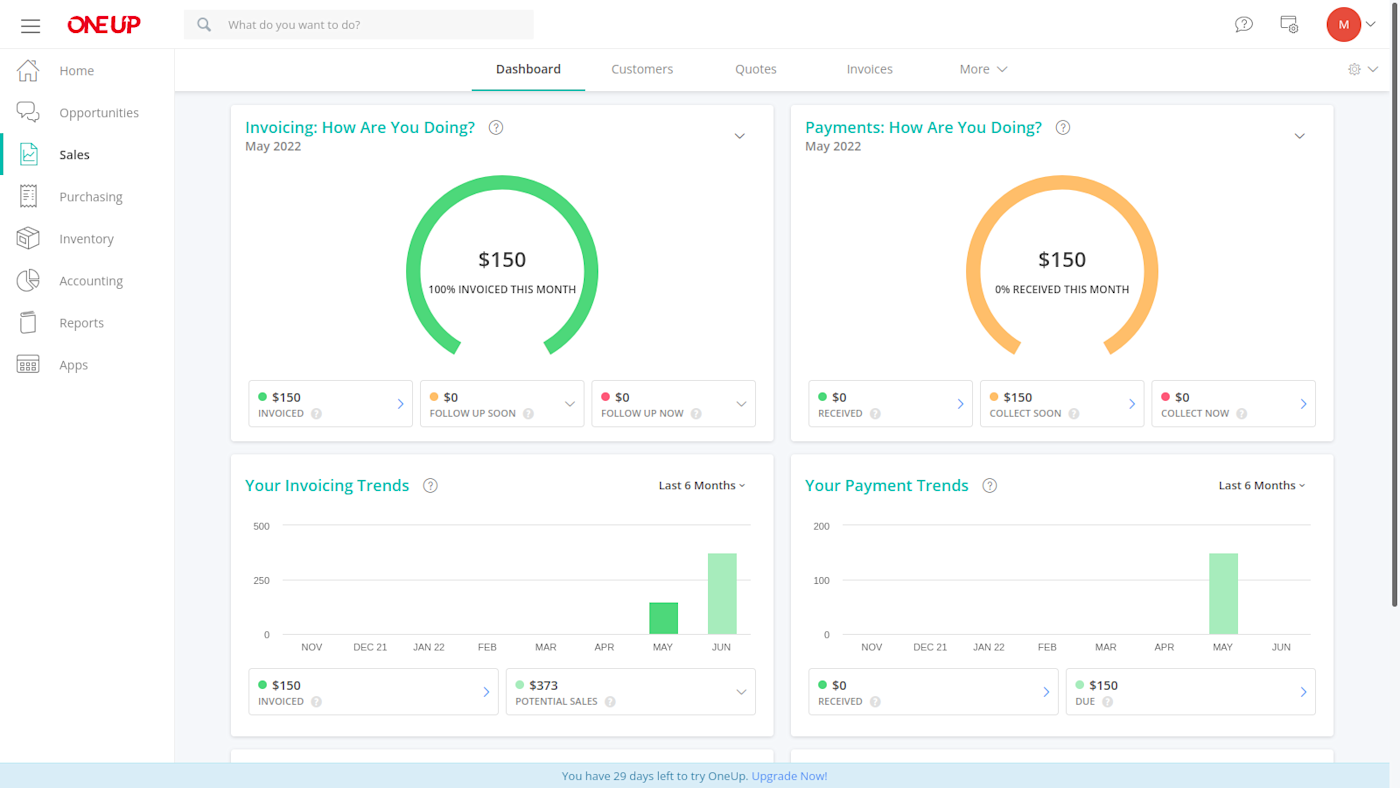

OneUp is an appealing tool, with a fresh interface and very little clutter. Its features are split into a series of “apps”: a CRM, invoicing, projects, expenses and purchasing, inventory, and accounting.

We’ll get deeper into these features, but there’s something that I really liked here: a search box where I could type what I wanted to do, and it showed a dropdown list of pages and actions I could take. This can save you a lot of time clicking through menus, especially if you like to jump directly to the action.

I activated all the apps OneUp had to offer (but you can leave out the ones you don’t need, so the platform can be as lean or as full-featured as you want). I liked how the CRM feature integrates well with all the others. Accounting tools are already a bit in the CRM territory, so it makes a lot of sense to also include a process to track leads, calls, offers, and opportunities.

And this CRM works really well with the projects feature, where you keep track of not only the billables (invoices, estimates, and so on) but also the client calls and other contact data. This is great to combine your sales team with accounting, helping you follow everything that’s happening at each stage of each deal with your clients.

The stopwatch for time tracking is nowhere to be found—billable hours have to be added manually into the app. If your timesheets land in someone’s email inbox for processing anyway, that shouldn’t be a problem. The tax preparation features are in line with the basics for this category, and if you handle inventory, OneUp has an interesting feature as well: in addition to tracking what you have and what you’re selling, you can also set up automatic inventory ordering so you’ll never run out on key products you sell frequently.

One thing to note: while the reports are easy to parse, there are only eight types, which is low when compared with other apps on this list.

OneUp Accounting pricing: Plans start at $9/month; you’ll need at least the $19/month plan to invite your business partner or accountant and have access to support. Prices increase based on the number of users.

Do you like this feature set but can’t live without the timer for time tracking? Don’t need inventory features? Give Fiskl a try as a OneUp alternative. It has a calendar and a task view, so you can plan your projects directly within the app, and it also has a mileage tracker that uses Google Maps to make journey calculations.

Best accounting software for in-depth reports

Sage Accounting (Web, iOS, Android)

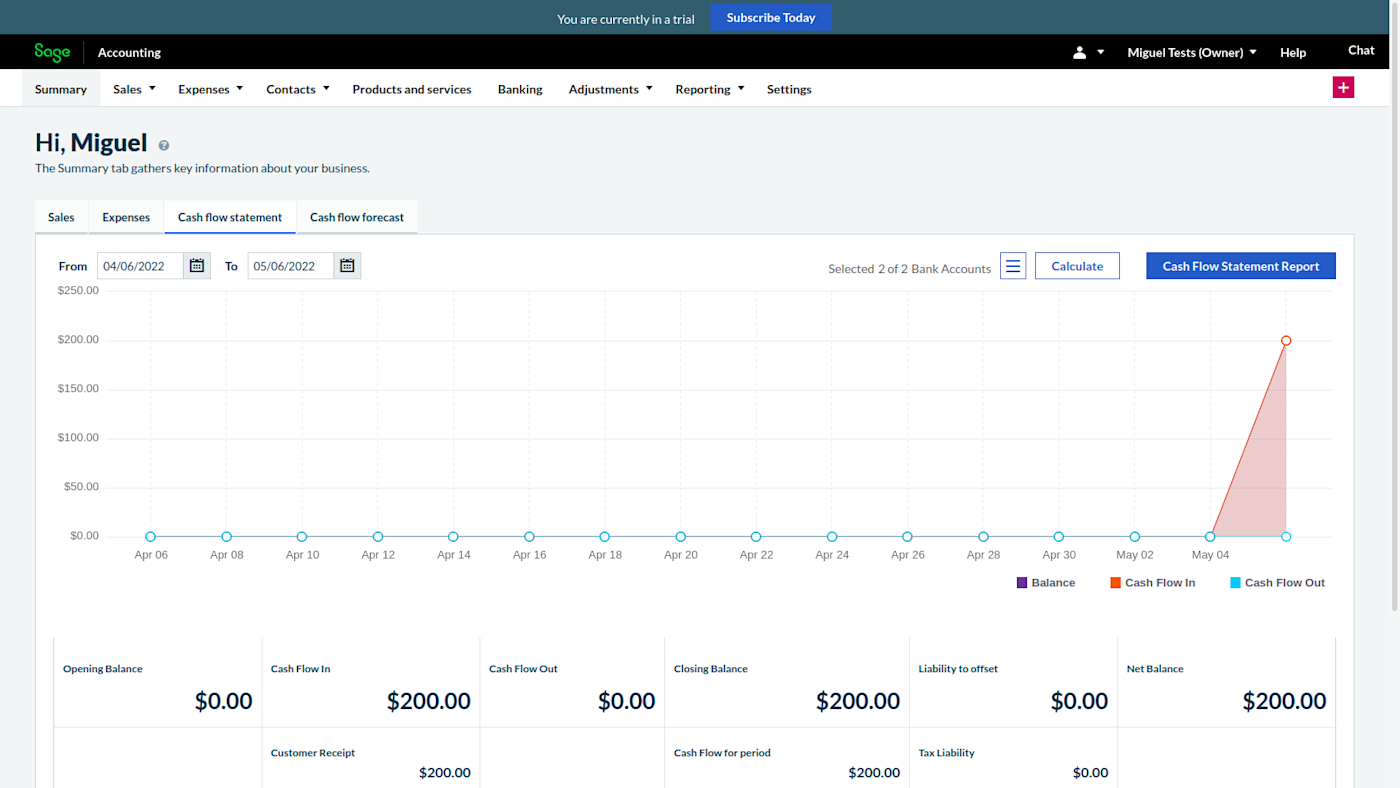

Like Intuit, Sage has been around since the ’80s, founded in cloudy Newcastle-upon-Tyne. It’s a giant company with an accounting software offer for every part of the business spectrum, from small operations to corporate behemoths. It’s no wonder that everything in the app has a distinctly professional and corporate vibe, a no-nonsense approach to your accounting needs.

The interface is modern and functional. Most pages have a spreadsheet-style kind of design to keep all the information easily accessible (even if it hurts the eyes from time to time). The bookkeeping features are in line with what’s expected and are easy to set up and use, but there’s no projects section.

The dashboard is very detailed, introducing cash flow statements and forecasting. Clicking on any of these elements takes you to an in-depth view. There’s a lot of information you can see, and if you like analyzing everything, you can use Sage Intelligence, a report-building app that correlates your business data and helps you make wiser decisions.

Integrating your bank accounts is easy, and you can set up automation to categorize transactions. You can identify transactions by source, name, or value, and then set Sage to apply the categories automatically. The tax features are also in line with the category. In addition to sales tax tracking, there are also 1099 vendor reports which can simplify your accountant’s life (you can invite them in, by the way).

Unlike other tools that have mobile apps that capture receipts for free, this is a paid feature in Sage (called AutoEntry). But it doesn’t only take care of receipts: once you set up rules to import data, you can upload any relevant documents, and Sage will take care of sorting it out, extracting data, and having it available for you when you need it. It’s definitely a step up from the classic capture receipts feature, so if you’re handling a lot of paperwork, this could cut the sweat from the blood and tears equation.

Sage integrates with 31 additional apps in the Sage marketplace, including Stripe, CRM solutions, time tracking tools, and payroll platforms. Some of these may come with extra costs, so keep an eye out for subscription expenses. To integrate Sage with even more of your tech stack, connect Sage to Zapier. Here are some suggestions to get started.

Sage Accounting pricing: Plans start at $10/month, but you’ll want the $25/month plan to have more than one user and access to robust features.

Best accounting app for software suite integration

Zoho Books (Web, Windows, Mac, iOS, Android)

I noticed something about enterprise software suites that have accounting apps: most of them were thin in terms of features or had a bad set of bugs or usability problems that made me strike them out of contention without thinking twice.

Zoho, however, is on a different plane. I’ve used Zoho Books, tested Zoho Creator in the past, and have tried Zoho Invoices as well. The quality standard is high in each of these apps, which shows that this company cares about each part of its software suite.

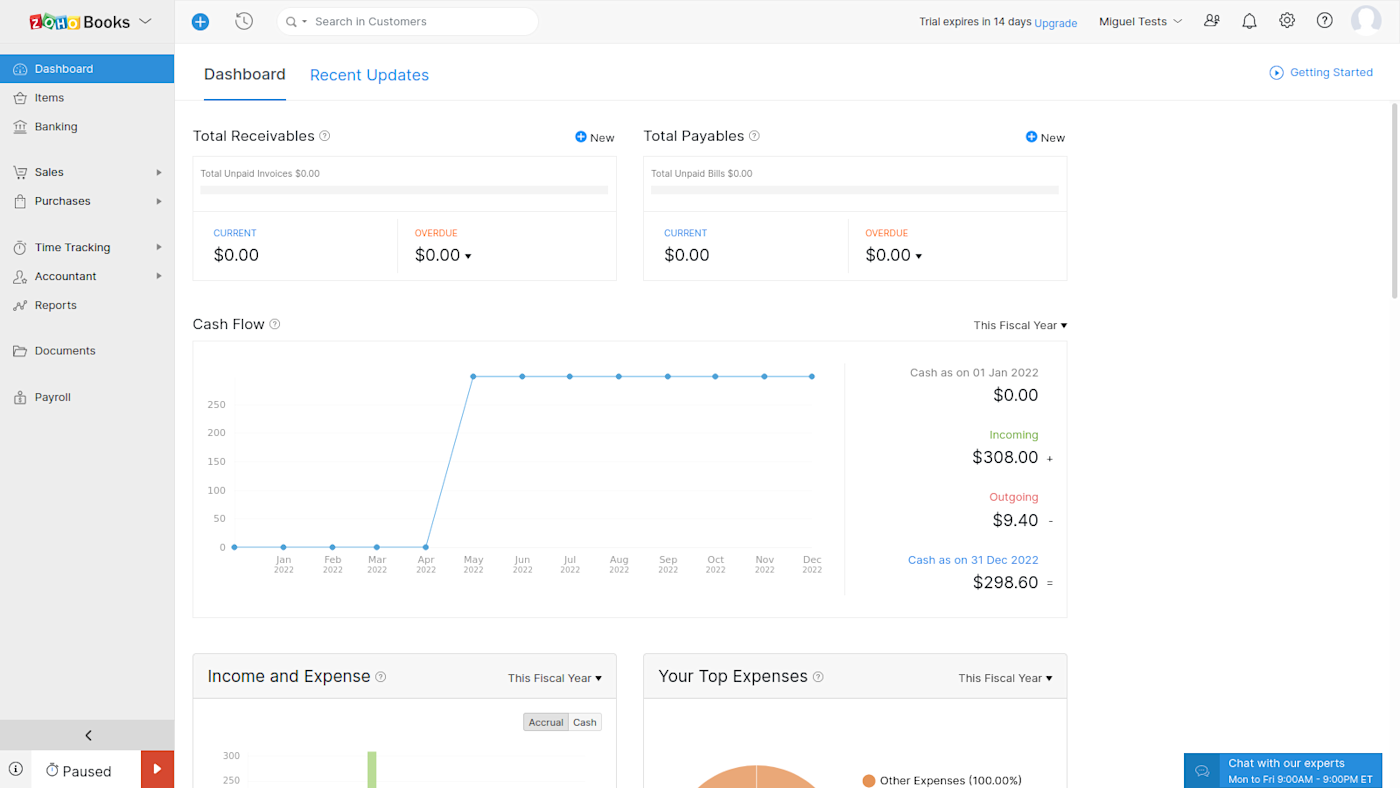

Zoho Books focuses on the professional side of things. The interface can be cluttered at times (especially the further away you move from the dashboard into creating invoices, or when you find yourself in the maze of the settings section), but there’s a lot of power here.

All the core bookkeeping features are there, including projects, time, and inventory tracking. These are easy to use once you get used to the amount of information and input fields on each page. There’s a budgeting feature where you can set limits for the accounts you choose, and even include asset, liability, and equity accounts in the mix. It’s not the intuitive personal finance approach, but it makes sense for business budgets. The reports section has a lot of variety, and you can mark your favorites and even configure report layouts.

The accounting features are great, both for your accountant (whom you can invite) and for you. There’s a whole section dedicated to tracking tax payments and tax adjustments over time, and a journal section to record all other accounting events.

Zoho integrates with nine different payment portals to let your customers pay invoices online, and it even separates the Stripe transaction costs as its own expense category, so you can see how much you’re spending on fees. Since we’re talking about a software suite, there are also integrations you can explore with other Zoho apps. Or integrate it with thousands of other apps by connecting Zoho Books to Zapier. Here are some ideas to get you started:

Zoho Books feels like the quiet kid in class who dazzles everyone whenever there’s an interesting topic to talk about. It doesn’t waste your time with glitter and sparkles—it cuts straight to the chase and doesn’t let you down.

Zoho Books pricing: Free plan available. Paid plans start at $12/organization/month. You can add additional users to any plan for $3/month.

Best accounting software for tracking vehicles and mileage

LessAccounting (Web)

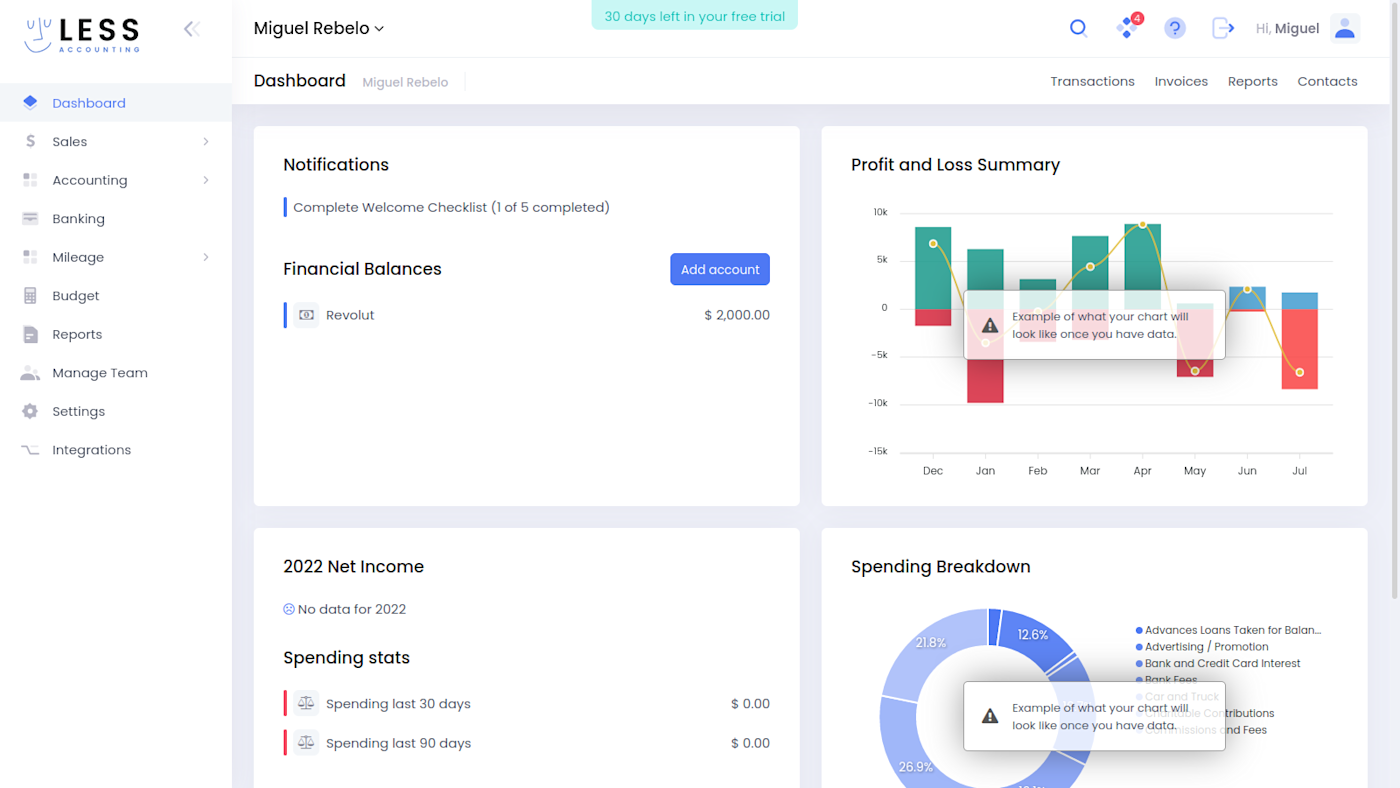

LessAccounting lands you for the first time on a cute, colorful dashboard with basic information about your business. The design seems to promise what the app’s name implies: accounting will somehow get easier, and we’ll have to do less of it.

In addition to design, LessAccounting has a lot of written help inside most of the pages on the app. This is useful if there are features that you’ll only use once in a while, or if you need a refresher on specific tax rules or accounting tricks. If you need extra help, you can chat with customer service on the bottom right and search for help topics there.

The bookkeeping features are in line with the category standards, including recurring invoices and proposals. Unlike other options, you can add the company’s vehicles to the app and then pin mileage to each one, an interesting feature if you have a whole fleet at your disposal. I added some fictional cars to test, and you can either add the total distance of the trip or the start and end values of the odometer.

You can create your own budgets for each spending category, a bit like the classic personal finance experience. This budgeting feature is the easiest to use out of all the options on this list, so you’ll have less trouble keeping track of your spending.

In line with this, LessAccounting sends you “Monday emails,” an automated email that you get every (you guessed it) Monday with some stats about your business, as well as reminders in case you’re coming dangerously close to breaking your budget.

As for payment integrations, you can choose Stripe, WePay, PayPal, and Square. And you can process payments via a LessAccounting deal at 2.7% and $0.30 per online transaction. LessAccounting has a dedicated team of accountants to help you if you don’t have your own, so that could ease your tax season. That, coupled with the great variety of reports, ensures you’ll always have multiple angles to look at your business, and have all the information at hand to please the IRS.

There are some shortcomings. There’s no support for projects, and there aren’t any inventory features. If you’re a service provider and your services don’t span a long period of time, this could be great for you, but if you sell goods or run six-month-long projects, then you’ll probably want to look elsewhere.

LessAccounting pricing: Free plan available for invoicing. Paid plans start at $24/month for accounting features.

GoDaddy Bookkeeping is a solid alternative to LessAccounting. The interface isn’t as modern, but the features are solid, with great tax support features as a bonus.

Best open source accounting software

Manager (Web, Windows, Mac, Linux)

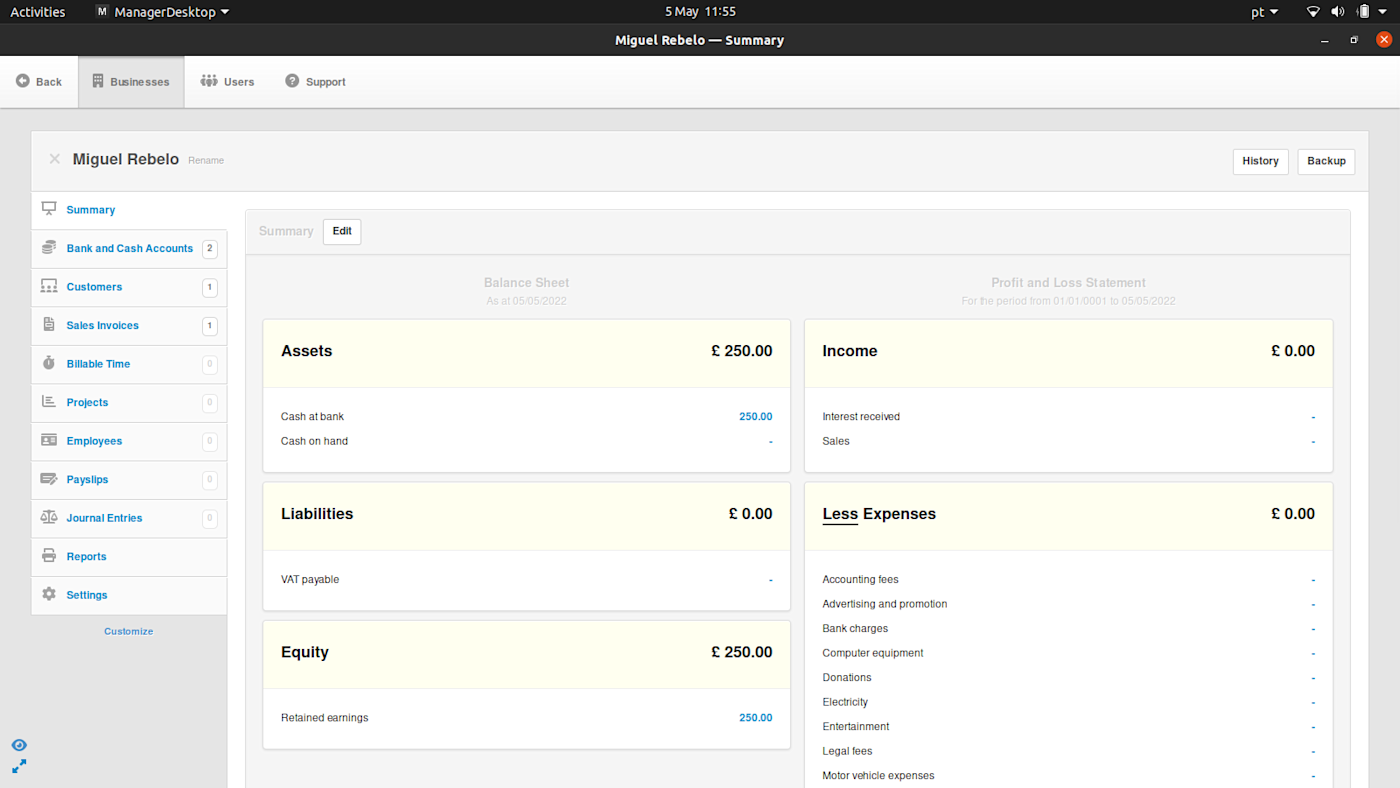

If you’re not ready to commit to a monthly subscription, you like the vibe of open source software, and you don’t need lots of advanced features, Manager is a great choice for simple accounting software. It has all the core bookkeeping features, including projects, time tracking (not timer-based), and a wide variety of useful modules.

When you hit Customize in the left menu, you can activate or deactivate all these modules depending on what you need. This ability to control the number of buttons on the menu is something I really like. Need purchase quotes? Add it in. Don’t need investments? Uncheck the box. You control the clutter.

There’s no onboarding sequence or detailed help within the app. You’ll have to refer to the (very complete) documentation section to get up to speed on how everything works. If you already have experience with accounting apps, it shouldn’t be too hard to get used to Manager.

Everything is local, so the app’s speed is great. Your data is always inside your computer. But that also means there’s no bank account integration, no automation, and no integration with other apps. If your accounting is straightforward and you can’t automate a lot of it anyway, then Manager is a great option to keep your software expenses under control.

The dashboard is simple, just a list of the key information about your business. The reports section is surprisingly good, including a wide variety of options to see more into your finances.

Collaborating with an accountant isn’t as easy as other options, but it’s possible. If you’re using the desktop app, you have two options: either back up all your information and send it to your accountant (remember to set up a secure way of doing this), or invite them over for a cup of coffee and an afternoon at your computer. If you go with option 2, take some time to chat and figure out how to streamline the tax season—it needs some configuration to get right.

When you visit the site, you’ll notice there’s an option to purchase hosting at $49 per month, which runs the very same Manager but on a cloud server you can access remotely. You can upgrade and downgrade at will, but let’s be honest: if you’re willing to pay, why would you do it with so many other attractive options on the market for a lower price?

Manager made this list because it’s a free, open-source alternative to other paid apps on offer, with a set of strong core features and a simple user experience. It feels like a sleeper car: stock car on the outside, souped-up engine under the hood. Take it for a spin, and see how it handles.

Manager pricing: Complete desktop version is free. Paid cloud hosting option at $49/month.

Which accounting app should you use?

Honestly, the most important thing is that you toss your Excel sheet out the window and use a real accounting app. All the accounting software programs in this roundup have a free trial or a free tier that you can use to get a feel of the features on offer. Take some time to figure out what you value in an accounting app, and then try out the ones that offer the best package for your business.

This article was originally published in January 2019 by David Harrington.

Need Any Technology Assistance? Call Pursho @ 0731-6725516