What comes to mind when you hear the term “passive income”? After you get past the images of palm trees and a life of luxury, you’ll probably come back down to earth and think of all the too-good-to-be-true claims—”make $10,000 next week!”—that can tarnish the credibility of passive income.

While passive income isn’t a guaranteed win, when you work with intention (yes, work is still involved), you can break out of the time-for-money exchange. I talked to real people who made real money with less hands-on work, and these are the 12 ways to make passive income that felt the most feasible.

Automate your way to passive income

-

Rent out your car

-

Sell an online course

-

Start a blog

-

Invest in rental properties

-

Rent out storage space

-

Invest

-

Promote affiliate products

-

Sell digital assets

-

Sell stock photos

-

Buy a vending machine

-

Own a billboard

-

Dropshipping

What is passive income?

Passive income is a way to earn an income without directly trading time for money. While some work is involved, it gives you leverage to make more while working less.

Before we get into how to make passive income, there are a few things to keep in mind:

-

If possible, start with something you know. Working with a topic or industry you have experience in can make the process smoother. If your skills or interests don’t align with any of the passive income ideas below, check out our guide to low-cost business ideas. There are plenty of ways to make money and have more control over your work.

-

Automate. Automation and passive income are both about doing more in less time. For example, Manfred uses Zapier to automatically forward new supplement orders to his third-party supplier, which means automations and dropshippers handle every aspect of fulfilling online sales.

-

Don’t hold your breath. If passive income was easy—or guaranteed to work—everyone would be doing it. There’s a reason most income isn’t passive. So make sure you go into it with a realistic mindset and the understanding that there won’t always be a pot of gold at the end of the passive rainbow.

12 examples of passive income

As we explore a few ways to make passive income, let them serve as inspiration for your own creation. While you can absolutely try one of these passive income streams, the goal here is to help you understand the various types of businesses and investments—and the characteristics they share—to get the juices flowing.

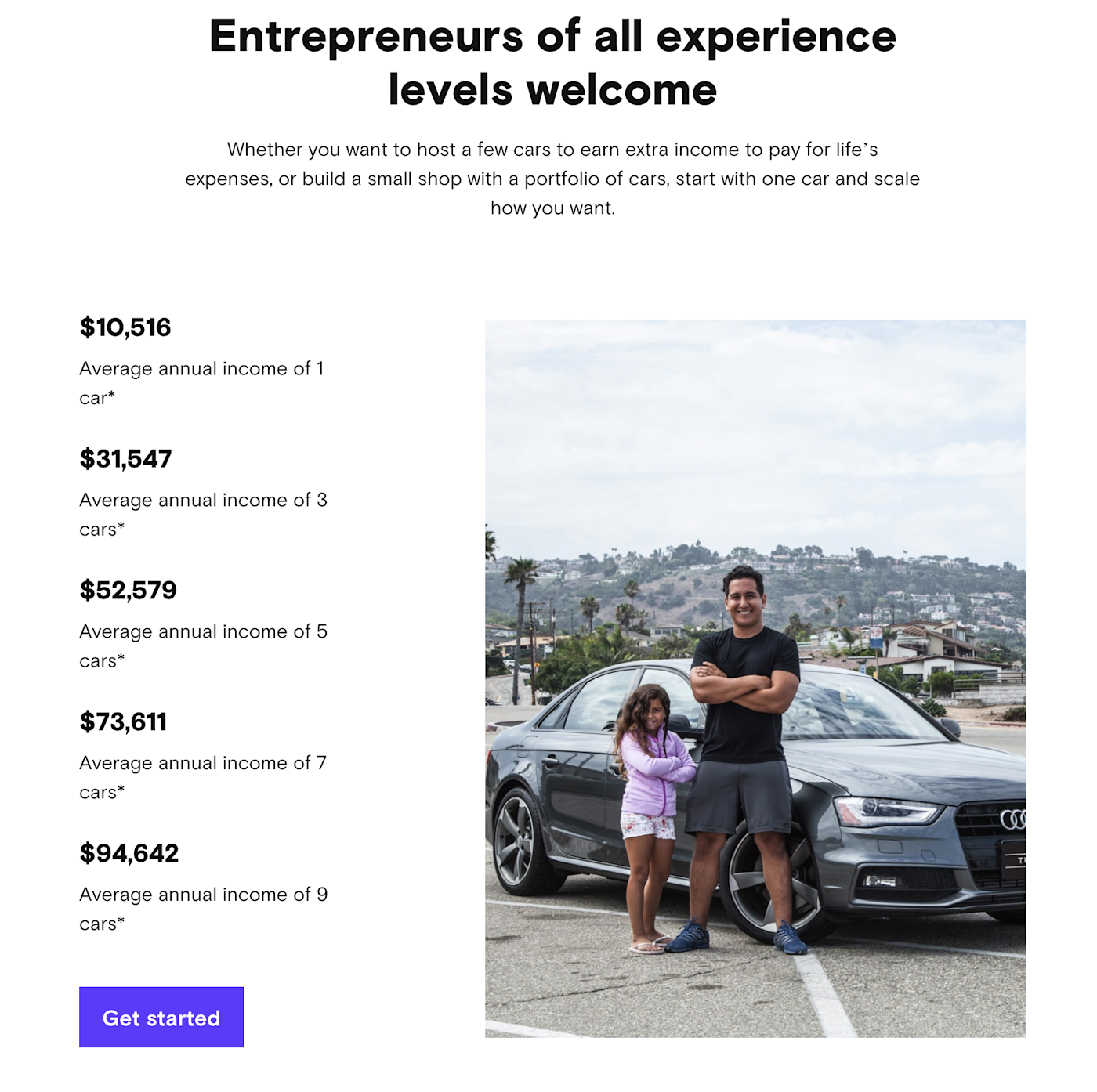

1. Rent out your car

Overhead investment: Low, assuming you already have a car.

If you don’t live in a walkable area, you need a car for all the basics. But if you’re one of the millions of people who work remotely at least some of the time, then you probably don’t use your car as much as you used to.

Enter: car-sharing. Paul Sundin, CEO of Emparion, told me: “you can list your vehicle on a car-sharing marketplace to reach a local market of car renters. Once your car has met the platform’s qualifications for listing approval, you’ll have a car renting service.”

Letting people borrow your car for short-term rentals can apparently earn you hundreds of dollars a month, so if you’re willing and able to use this passive income stream, you could cover some or all of your monthly car expenses.

2. Sell an online course

Overhead investment: Medium. You’ll need some tools, but getting started is mostly a time investment.

If you have unique skills or experiences, share the knowledge. This is exactly what Stefan Palios does to earn passive income:

“I currently have two passive income sources—both small right now, but entirely passive: My book, The 50 Laws of Freelancing (through Amazon) and my course, How to Find Freelance Clients Using Twitter (through Udemy). The marketplace element is what makes this passive income. Amazon markets and sells my book, and Udemy markets and sells my courses. Now, this isn’t a life-changing income (yet!). But I published the book in 2020, and it still pays me monthly. The course is new, but I created it relatively quickly, so the time ROI is good.”

Assuming the course you create is evergreen—meaning it will remain relevant for a while—you just need to create it once, and then folks can continue to buy it without any added effort on your part.

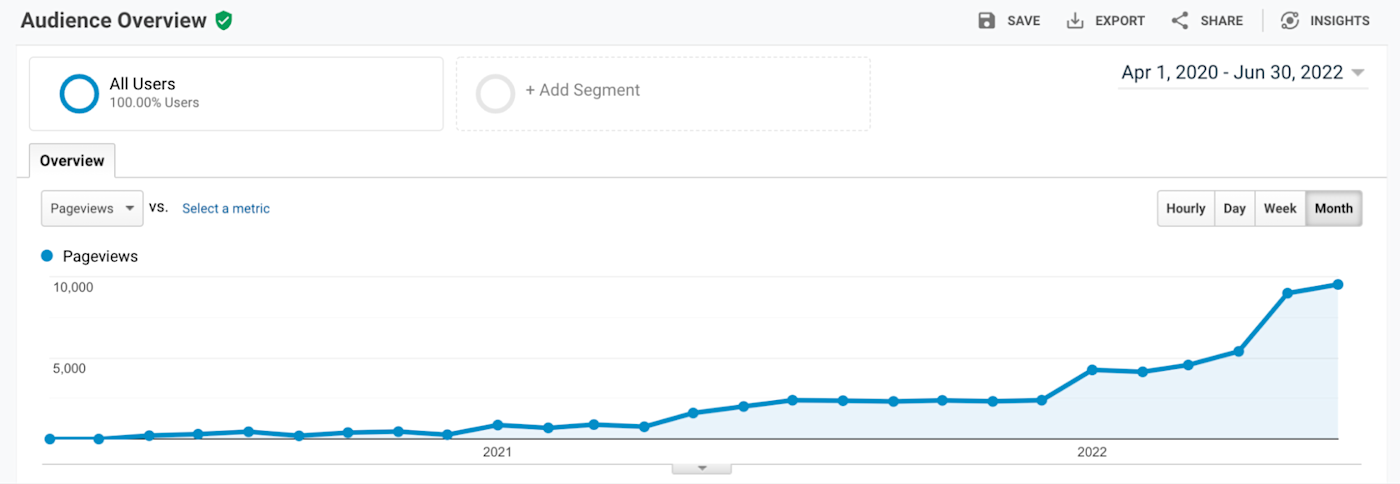

3. Start a blog

Overhead investment: Medium. You’ll need some tools, but getting started is mostly a time investment.

Two and a half years ago, Megan Jones created her travel blog, Traveller’s Elixir. “After working on it for a year and a half, I could quit my job,” she told me. “My website has grown to over 160,000 monthly visitors, and I now make income passively every single day.”

Megan’s blog generates money with display ads and affiliate marketing. “Advertisers pay me to show ads to my readers, and if a reader clicks on a link to a hotel or tour package that I’ve recommended, I get a commission if they buy it,” she added.

Megan’s hard work and consistency have paid off, and she noted that “once you’ve built up enough content on your website, you can earn money every day without even trying. The best thing about having a travel blog is that the profit margins are high, over 90%. Right now, I’m passively making around $5,000 every month.” To make running a blog even easier, you can use blogging automations to speed up your workflow.

4. Invest in rental properties

Overhead investment: High. You’ll either need cash to buy your property or arrange financing.

Investing in real estate isn’t an accessible option for most people, but if you have cash on hand, it’s a tried and true way to grow wealth and one of the best passive income investments. Michael Green, the owner of Quick Cash Homebuyers, experiences the benefits of real estate investing firsthand.

“Thanks to my real estate expertise, I have been able to find and purchase affordable rental properties in different parts of the country, which I then lease out to trustworthy tenants. By building a healthy rental portfolio, I enjoy steady passive income each month without fail. After removing repair and maintenance allocation plus taxes, I’m still left with a significant portion as profit from my investments for me to re-invest in other passive income generation activities.”

If you’re interested in rental properties but aren’t ready to add to your portfolio, you can start by renting out an extra bedroom or, if you’re planning to buy anyway, buying a duplex and renting out half while you live on the other side.

5. Rent out storage space

Overhead investment: Variable to high. The cost to buy a self-storage unit varies widely, but you’ll likely need at least $40,000 in cash or financing.

Another option for investing in real estate is buying and renting out storage space. Tomek Młodzki, the CEO at PhotoAiD told me: “If you buy some garage space in a city, you can be sure that the price will be increasing steadily, at least as much as the rest of real estate, and that you will find someone to rent it at any time. I’ve done this since early in my adult life and find it a nice way to invest without spending too much. Renting and/or selling such a space after a few years is guaranteed to be a good investment.”

YouTuber AJ Osborne of Self Storage Income shared that the price to get started and buy a storage property depends on location, property size, and potential revenue.

6. Invest in the stock market

Overhead investment: Variable. You decide how much you’re comfortable putting in.

If you’re willing to play the long game with passive income, then investing in options like mutual funds and stocks could be a good move. If you want a more hands-off approach, consider a Robo-advisor mutual fund. You can try your luck in the stock market for something a bit more hands-on.

Historically, the S&P 500 has an annual average return of about 10.5%, but be sure you don’t invest any money you might need soon (or ever, honestly). While over time, you’re almost guaranteed to make money, because of the unpredictability of the market, you can never know when you’ll have that money.

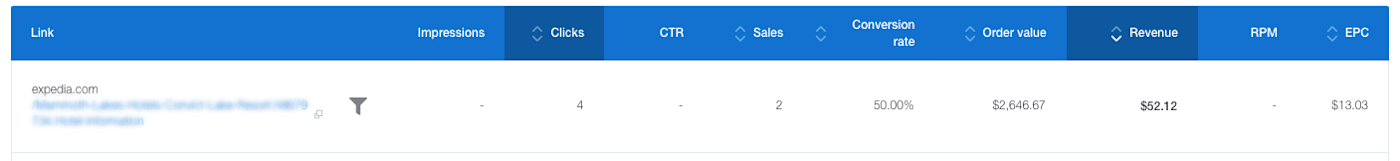

7. Promote affiliate products

Overhead investment: Medium. You’ll need some tools, but getting started is mostly a time investment.

Some bloggers use affiliate sales as part of their passive income stream, but you can also create niche sites focused solely on affiliate products. Wesley Stryker has been building Commerce Caffeine for about a year and a half. The site is a curation of eCommerce software tools and growth strategies, and Wesley targets low-competition keywords that are highly targeted.

“Commerce Caffeine makes money through referral commissions, sponsorships, and digital products. It’s completely passive—I spend about 5 hours/week on it, mostly writing content. But if I step away for a few weeks (or even months), the business will be unaffected and continue making money passively. It’s a great business model, and if I choose to spend time on it, it grows, and the more it grows, the more I outsource and the less time I spend on it.”

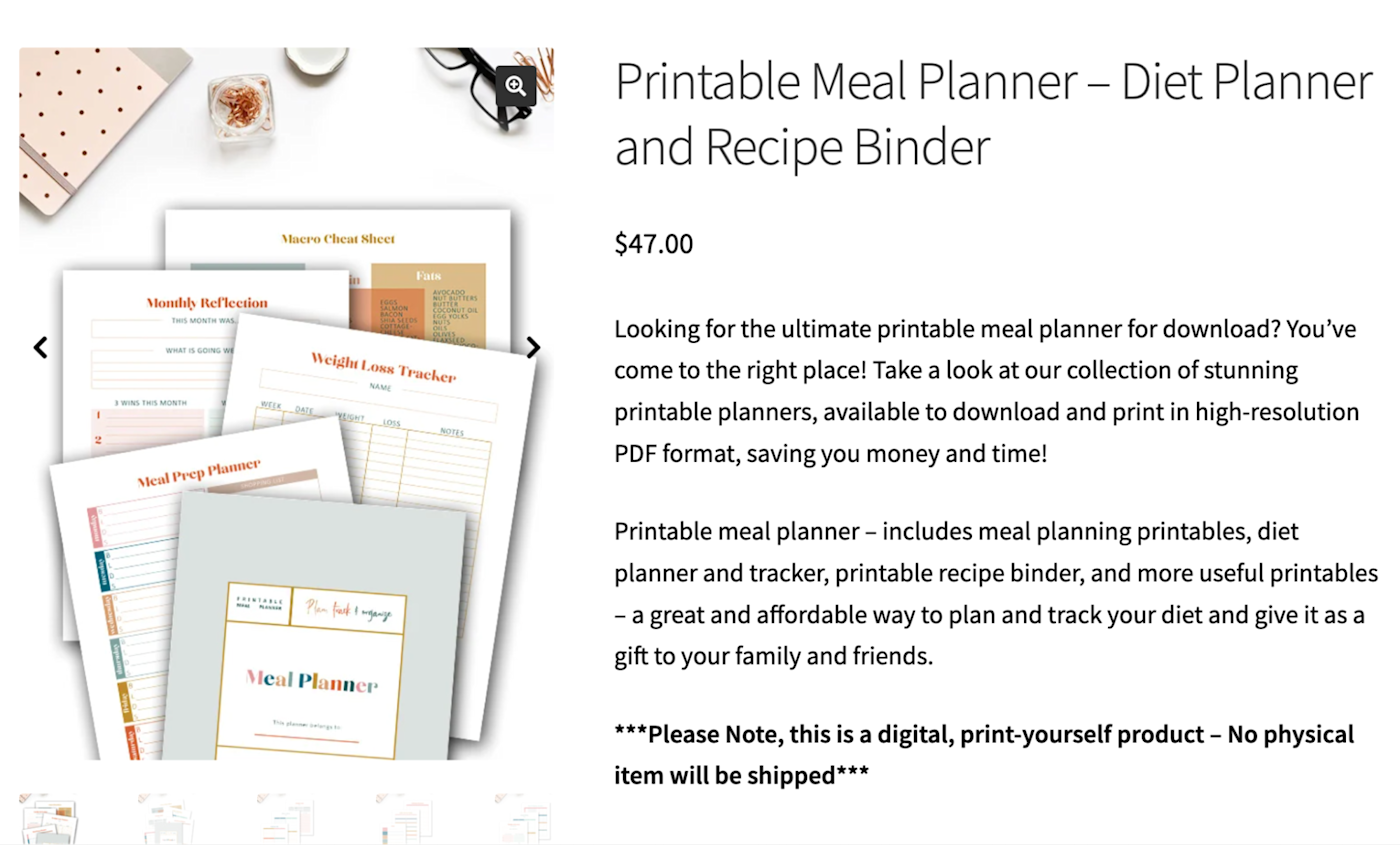

8. Sell digital assets

Overhead investment: Medium. You’ll need some tools, but getting started is mostly a time investment.

Have a knack for design? Try selling digital assets. Yanna Berman, the founder of Urban Mamaz, noted, “things like digital planners are popular because you are appealing to both regular people and business owners. The trick is to keep up with the trends and make sure you have popular products, so your sales remain high.”

The best part about digital products is that you make it one time, and it’s an unlimited resource to be distributed when the customer clicks buy. Lots of marketplaces, including Etsy, will let you sell these kinds of digital assets as well.

9. Sell stock photos

Overhead investment: Low, assuming you already have a camera.

Another artistic endeavor that can yield passive income is selling stock photos or licensing your images.

Tyler Hutchinson, the founder of Energy Powder World, sells his original photographs to artists and designers. He shared, “I’ve always been passionate about photography, and I made use of it.” As long as you don’t offer exclusive licenses, you can sell the same photos to multiple people.

10. Buy a vending machine

Overhead investment: Medium. Even used vending machines can cost a few thousand dollars.

Opportunity awaits in unexpected places—like during a snack run. Marcus Gram shared a breakdown on Twitter of what went into a vending machine location that profited $40,000.

This vending location costed $3,000 for start up. Paid $1,700 total for the machines, $600 total for card readers, $500 product and $150 for delivery. The machines made over $3,000 a month. I got my money back in 2 months and sold the location for $40,000. Great investment pic.twitter.com/Ra5nCWiNYb

— Marcus Gram | Vending Machine Expert (@brothergram) June 21, 2022

Other folks, like Jamon Garrett are taking advantage of vending machines as passive income, too.

Officially started my Vending Machine business (3rd business) with a location secured. I’m excited about this asset, passive income is the move ♻️ #VendingMachineBusiness #AssetsOverLiabilities pic.twitter.com/3HabfRgXAK

— Big Mon 👑🦁 (@_MoneyMakingMon) May 18, 2020

11. Own a billboard

Overhead investment: Variable to high. Used billboards can cost tens to hundreds of thousands of dollars.

Display ads on blogs are the digital versions of billboards, so naturally, you can take the old-school route to make passive income, too. If you happen to own land with zoning that allows billboards, you can put up one of your own. Or you can buy an existing billboard through sites like OutdoorBillboard.

Once you own a billboard, you lease it out to advertisers. You’ll need to keep up with applicable permits and ensure you always have an advertiser, but depending on your location, your billboard could earn thousands of dollars per month.

12. Dropshipping

Overhead investment: Medium. You’ll need some tools, but getting started is mostly a time investment.

Dropshipping lets you sell physical items online without holding any inventory. It’s enticing because, theoretically, you have much less risk than a traditional eCommerce store since you don’t invest in any inventory upfront. While dropshipping can be a great way to earn passive income, BeginnersPassiveIncome reiterates that it isn’t a get-rich-quick strategy. The blog shared:

“Hundreds of people are talking about how they ‘make six-figure passive income dropshipping products online.’ Some sell a few high-ticket items every month, and others sell hundreds of low-ticket items. However, how much you make depends on profit margins and expenses, often overlooked.”

Before the money starts rolling in, you’ll need to select a niche, find a supplier, and set up a website.

Use automation to help generate passive income

Generally, passive income streams require upfront work but earn disproportionate to your time commitment as the business matures. Aim to automate as much as possible if you want to spend less time on your passive income businesses without sacrificing profit.

Need Any Technology Assistance? Call Pursho @ 0731-6725516