Coming from someone who’s not a numbers person, anyone who does accounting is a brave and admirable soul, and I’m glad that there are excellent tools out there to make your job easier.

FreshBooks and Xero are two of those tools: they combine several solutions to organize and manage a company’s financial assets. I created accounts with both platforms and spent a bunch of time testing all their features to better understand each one’s strengths and weaknesses—and how they stack up. Read on for my breakdown of FreshBooks vs. Xero.

FreshBooks vs. Xero at a glance

FreshBooks and Xero are both powerful accounting tools that can help businesses keep their financial information and assets organized and accessible. But the two apps are geared toward different audiences, which explains their functional differences.

-

FreshBooks is mostly built for freelancers and other self-employed people. It combines accounting and project management features, such as time tracking, that would make a freelancer’s job easier.

-

Xero, on the other hand, is accounting software through and through, and is built for more established businesses with large accounting teams and inventory to manage.

There’s a reason FreshBooks made it on Zapier’s list of the best self-employed accounting software, while Xero made it on the list of the best accounting software for bigger businesses.

|

FreshBooks |

Xero |

|

|---|---|---|

|

Price |

⭐⭐⭐⭐ Plan pricing starts higher than Xero but offers a more extensive upgrade at a lower cost Lite: $15/month Plus: $30/month Premium: $55/month |

⭐⭐⭐⭐ Plan pricing starts lower than FreshBooks, but established businesses pay more Early: $12/month Growing: $34/month Established: $65/month |

|

Accountant access |

⭐⭐⭐ Can invite 10 accountants with Plus and Premium plans |

⭐⭐⭐⭐⭐ Unlimited user access with the Early plan |

|

Interface |

⭐⭐⭐⭐⭐ Very straightforward, clean, and easy to navigate; clear labels point the user toward every feature |

⭐⭐⭐⭐ A bit of a learning curve due to extensive options, but clean, practical, and customizable |

|

User-friendliness |

⭐⭐⭐⭐⭐ Tips explain how to use every feature; features are simple and intuitive |

⭐⭐⭐⭐ Slightly less intuitive, but video walkthroughs explain how to use features |

|

Reporting |

⭐⭐⭐⭐ Easy-to-generate, visually appealing reports; fewer reporting options than Xero |

⭐⭐⭐⭐⭐ Detailed and customizable accounting and inventory reports |

|

Invoicing |

⭐⭐⭐⭐⭐ Unlimited invoices available with Lite plan |

⭐⭐⭐⭐ 20 invoices per month with Early plan; unlimited with Growing and Established plans |

|

Bank reconciliation |

⭐⭐⭐ Available with Plus plan and up |

⭐⭐⭐⭐⭐ Available with Early plan and up |

|

Time tracking |

⭐⭐⭐⭐⭐ Both live and retroactive time tracking; billing based on time tracked; available on the mobile app |

N/A |

|

A/P management |

⭐⭐⭐ Offers basic accounts payable features with Plus and Premium plans |

⭐⭐⭐⭐⭐ Offers advanced accounts payable features with Early plan |

|

Integrations |

⭐⭐⭐⭐⭐ Over 100 third-party integrations available to streamline processes; integrates with Zapier |

⭐⭐⭐⭐⭐ Over 1,000 third-party integrations available to streamline processes; integrates with Zapier |

FreshBooks is more intuitive, but Xero makes up for it with video tutorials and a demo feature

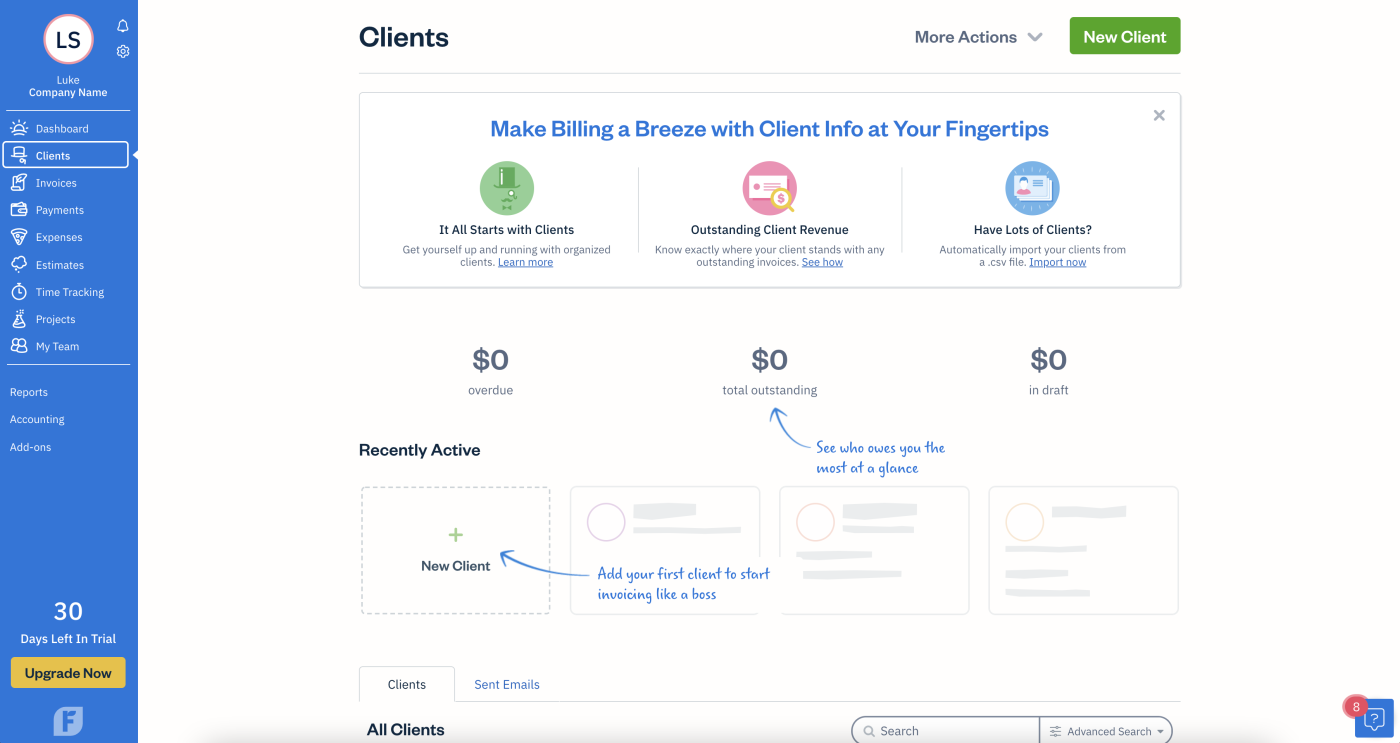

When it comes to usability and design, FreshBooks does something I thought impossible: it makes accounting feel fun. Not only was the setup process easy and straightforward, just asking for a few basic details about my company, but the interface and beginner prompts also felt approachable and simple.

It creates this feel through bright colors, creative design, a straightforward layout, clear navigation, fun fonts, and a super casual tone. I never thought I’d hear the phrase “invoicing like a boss,” yet here we are.

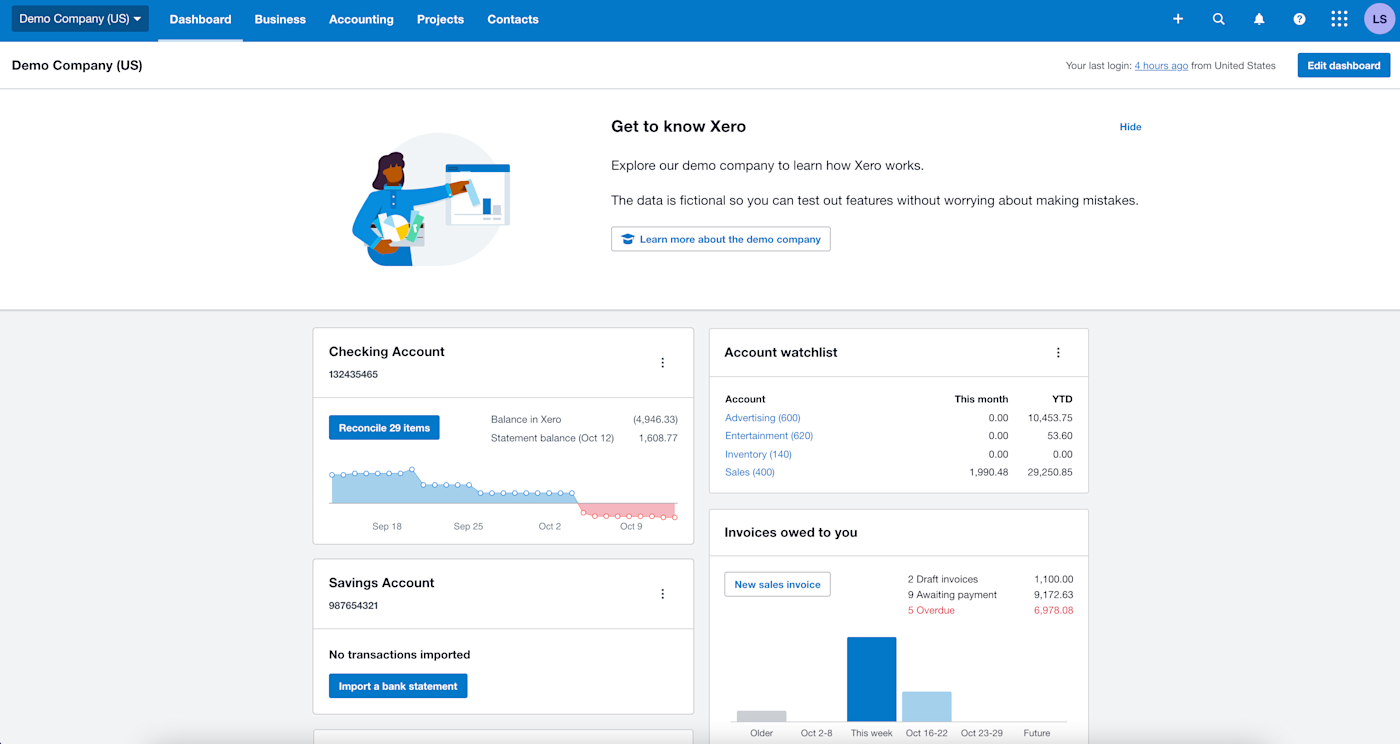

Xero’s interface feels a bit more clean-cut and professional, which is more what I’d expect from accounting software. No colorful scribbles or fun fonts—straight to business. While I did appreciate the dashboard’s clear and customizable widget feature, the interface felt a bit intimidating initially. There weren’t tips guiding me through the process of adding clients and invoices or creating reports.

That said, Xero makes up for its user-friendliness shortcomings through tutorial videos and a demo company feature. In FreshBooks, no data appears until you add it yourself. In Xero, you can view the platform as a demo company with pre-recorded data, which makes it far easier to see how the platform will look and operate when you input your own business’s data.

One final thing that just gives FreshBooks the upper hand: I felt like there were too many ways to access the same feature on Xero. For example, I found three sections I could use to create an invoice: the Business dropdown on the top navigation bar, the plus icon on the same bar, or the Invoices owed to you widget. While some people may appreciate the ability to access frequently used features in many ways, from where I sit, it makes the interface unnecessarily cluttered and complex.

FreshBooks is ideal for less experienced freelancers, whereas Xero is better for established businesses

FreshBooks is best equipped to serve freelancers without much accounting experience. The larger your business is, the better equipped Xero becomes to meet your needs. Here’s why.

Apart from FreshBooks’ user-friendliness for those who aren’t accounting experts, it also appeals to freelancers through its time tracking and client management tools. All plans offer unlimited time tracking and allow you to bill clients for the time you track.

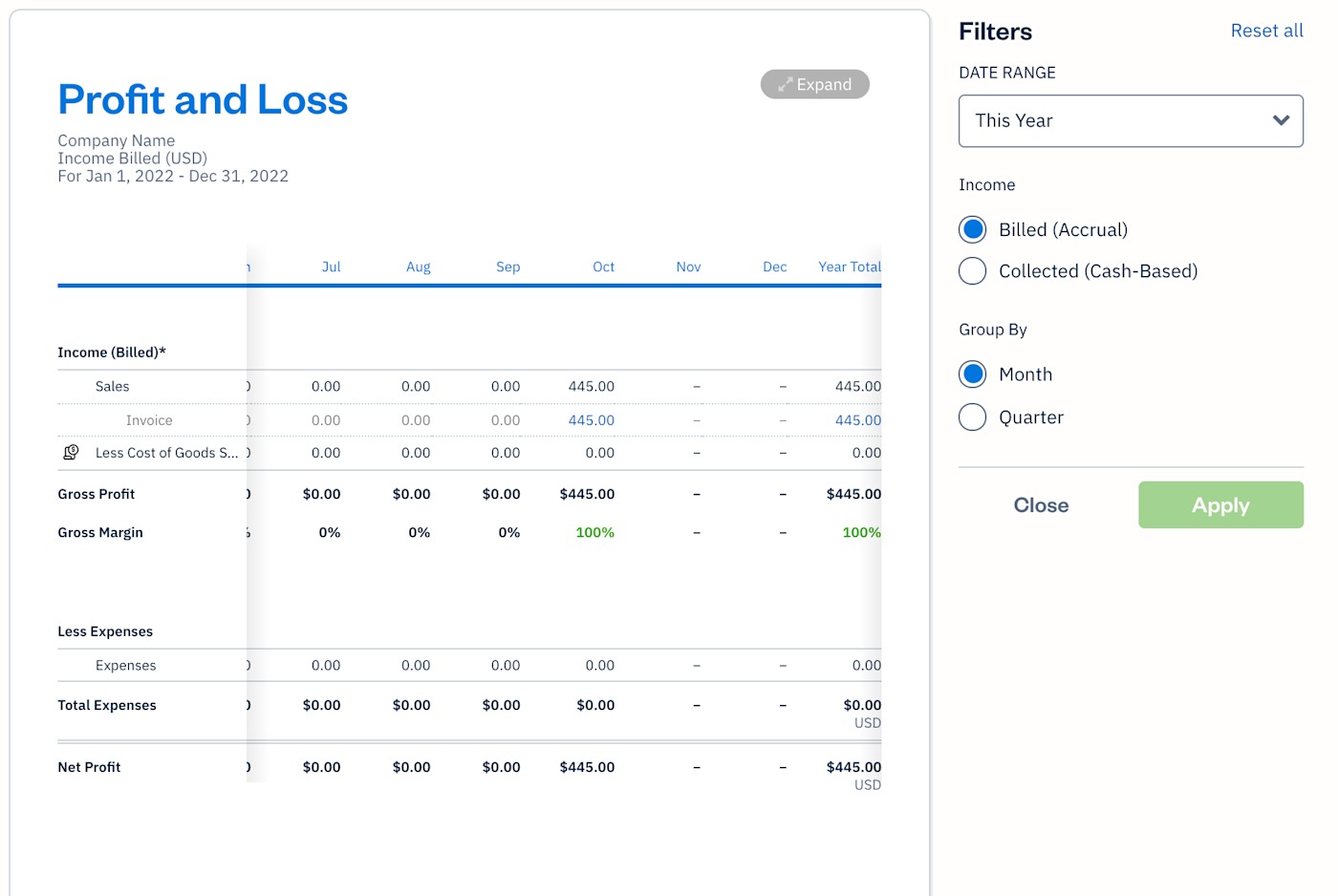

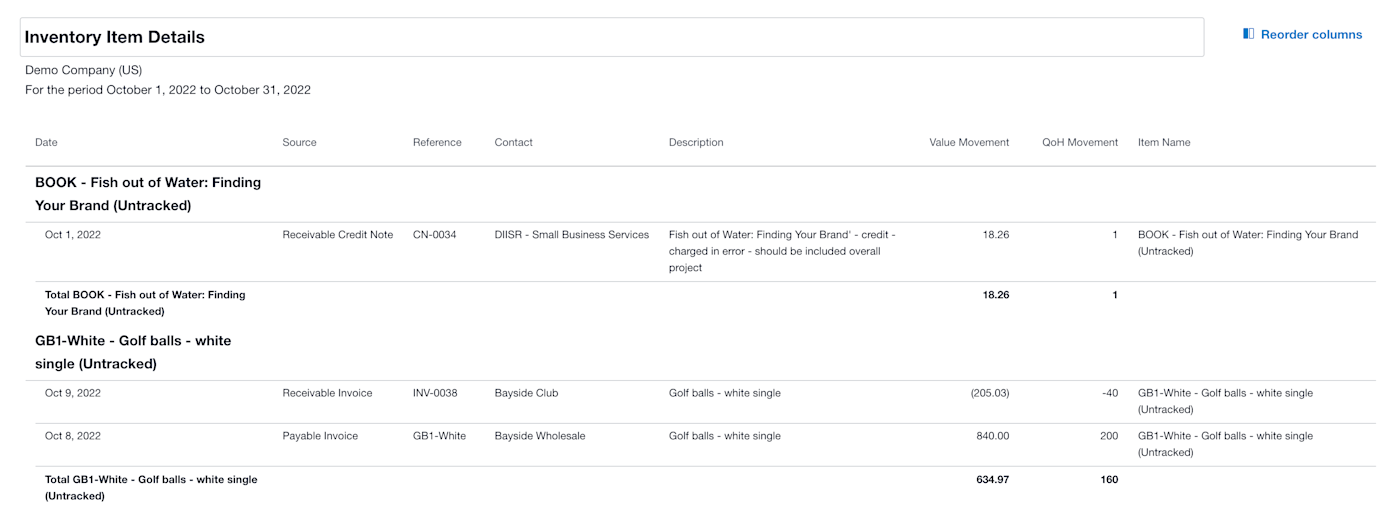

Reports

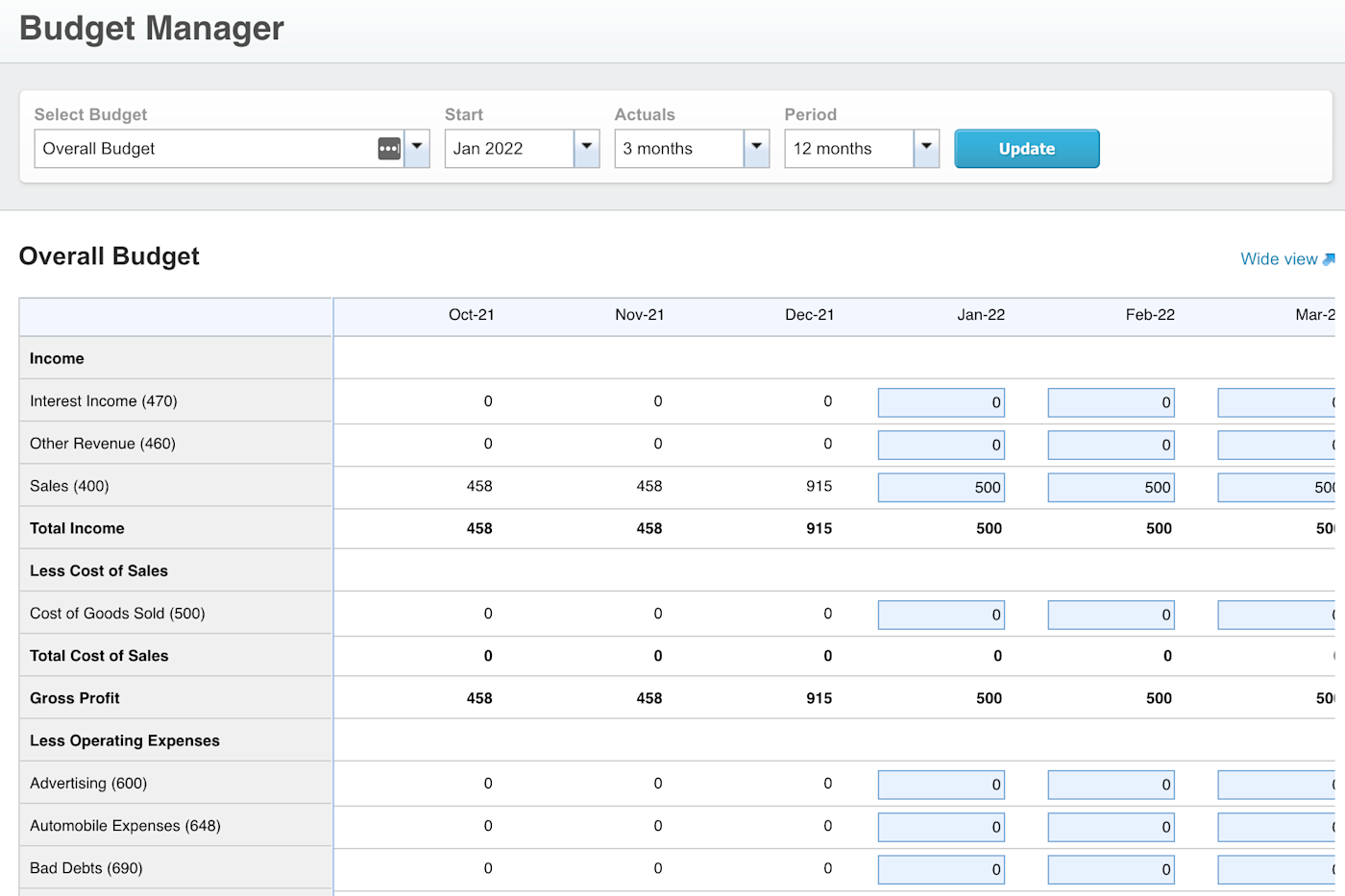

FreshBooks’ tools are also pretty minimalistic, not providing the same depth that a larger organization would need. When comparing the reports generated by FreshBooks vs. Xero, I found Xero’s to consistently provide more detail and offer more flexibility with data presentation than FreshBooks’.

For example, Xero allows you to view accounting reports and specific budgets for any time period. You can even monitor your company’s performance by customizing and measuring specific KPIs.

Due to its limited accounting features when compared to Xero, FreshBooks doesn’t offer as many report options, and within its reports, customization is pretty sparse.

Bank reconciliation

In addition to its more robust reports, Xero proves itself to be the better fit for established and growing organizations with its bank reconciliation feature. Even the most basic Xero plan allows bank reconciliation, whereas FreshBooks requires you to upgrade to its Plus plan to access this feature.

Inventory management

When it comes to inventory management, Xero is also the name to beat for larger companies with lots of products and customers. FreshBooks offers some helpful (but basic) features, like automatically reducing your stock based on invoicing, but Xero goes a step further with advanced features, like identifying which of your items are the most profitable via comprehensive inventory reports.

FreshBooks’ reports may be more aesthetically pleasing and easier to navigate, but Xero’s include the level of detail needed to stay organized as your company grows.

Ultimately, Xero is an accounting powerhouse. With its most basic plan options, it comes equipped with bank reconciliation, unlimited user access (for entire accounting teams to access company financials), and comprehensive accounts payable management. These features are either not as robust with FreshBooks or are only accessible by upgrading to a more expensive plan.

|

FreshBooks Lite Plan |

Xero Early Plan |

|

|---|---|---|

|

Bank reconciliation |

X |

|

|

Unlimited user access |

X |

|

|

A/P management |

X |

|

|

Unlimited invoices |

X |

|

|

Time tracking |

X |

Despite Xero’s accounting wins, FreshBooks reigns supreme in invoicing and mobile usability

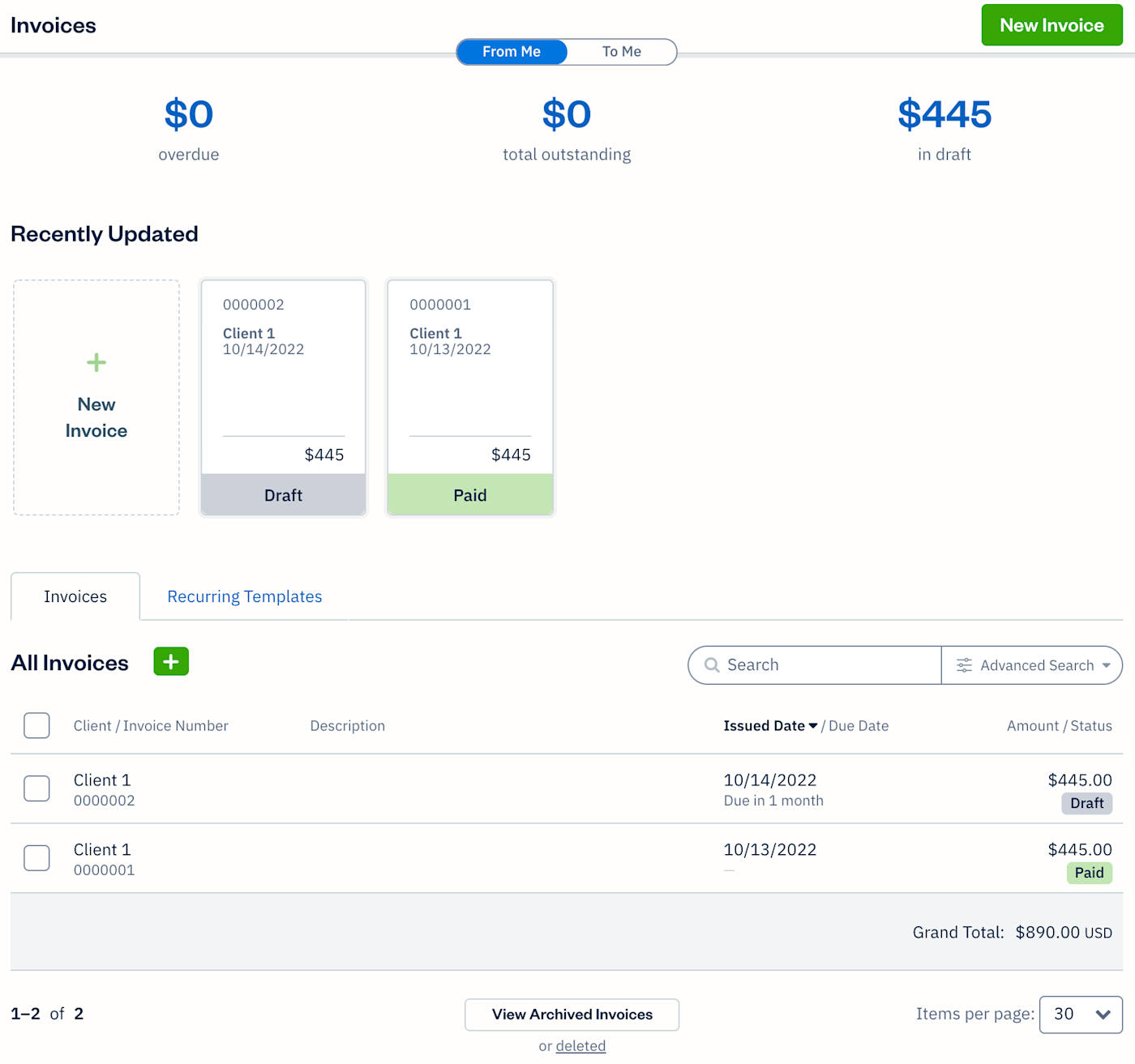

Invoicing

FreshBooks may not be as comprehensive an accounting platform as Xero, but it’s hard to deny that its invoicing features are top-tier. Even with FreshBooks Lite, I was able to create and send unlimited customized invoices, whereas Xero restricted me to 20 per month.

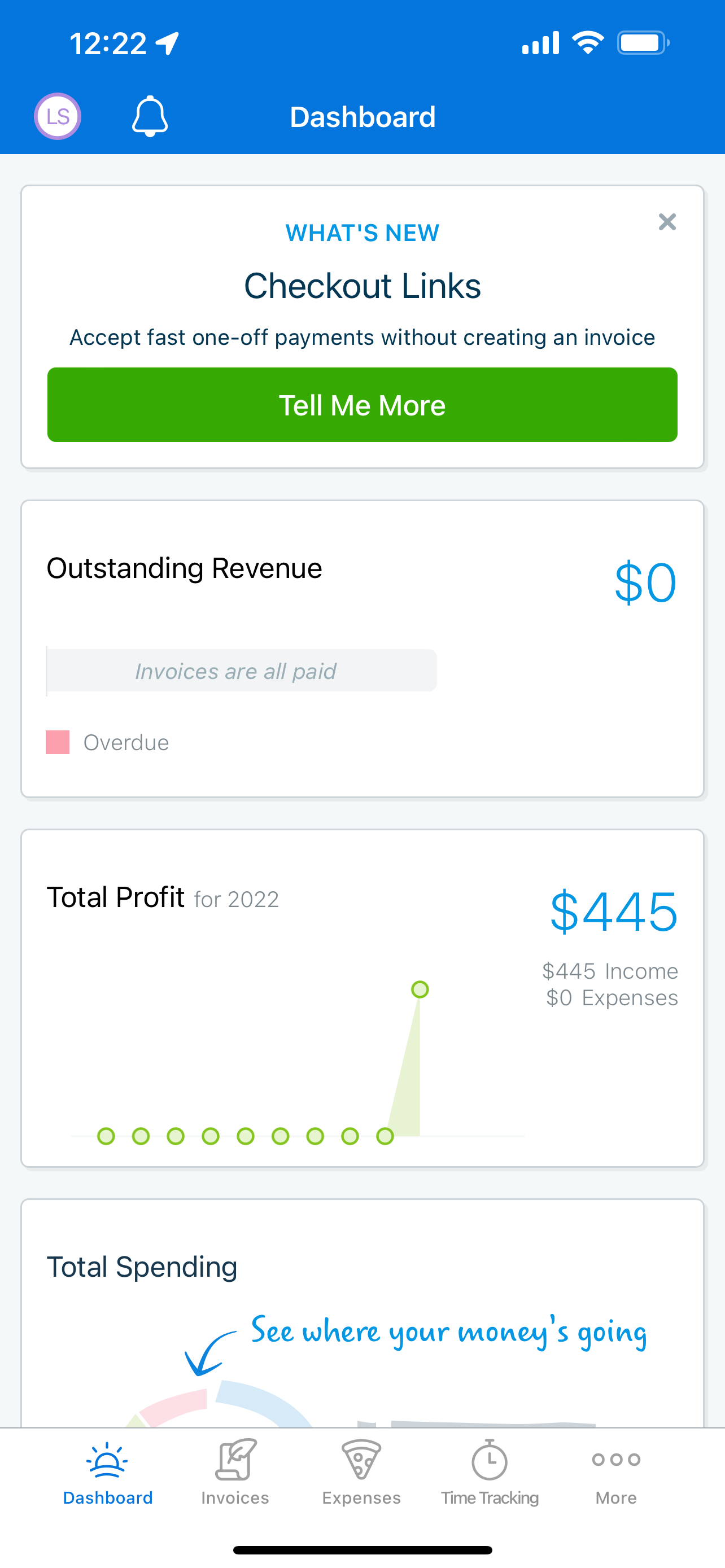

Mobile usability

Another area where FreshBooks shines is its mobile experience. Compared to Xero’s app, it’s more user-friendly and offers a wider selection of features, including entering bills, live time tracking, and billing clients for time worked. In short, it’s a freelancer’s best friend.

Xero’s app includes the basics, like sending invoices and assigning expenses, but its capabilities are a bit limited. Plus, Xero doesn’t seem to care to consolidate its mobile experience into one app—there are different Xero apps for managing expenses, projects, and more. In fact, when signing up for an account, I had to download an entirely separate app just for two-factor authentication—a very unpopular requirement made clear by the app’s below-1.5 star rating.

FreshBooks vs. Xero: Which should you choose?

There isn’t a clear winner in the FreshBooks vs. Xero debate—they’re designed for different audiences, and deciding between them should feel natural depending on your needs.

If you’re a freelancer or a very small business that doesn’t plan to expand rapidly, FreshBooks’ time tracking, invoicing, and mobile features were made for you. If you run a growing or established business, sell inventory, and/or have a relatively large accounting team, Xero is better equipped to meet your needs.

As you connect your business to whichever accounting platform you choose, explore the following guides to help you make the most of it:

[adsanity_group align=’alignnone’ num_ads=1 num_columns=1 group_ids=’15192′]

Need Any Technology Assistance? Call Pursho @ 0731-6725516