Choosing the right accounting software isn’t as easy as a shopping spree in Downtown Disney—it takes a lot of care to ensure your business is set up for financial success; you can’t just put things in your cart without thinking twice about it. I took FreshBooks for a spin when comparing FreshBooks and Xero, but there’s another popular software that should be on your radar as you hunt for the best accounting solution: QuickBooks Online.

FreshBooks and QuickBooks both offer a lot of tools to help you manage your business’s finances. I created a fake company for both and experimented with their features to determine which platform is the best fit for various types of businesses. Read on for my analysis of FreshBooks vs. QuickBooks.

FreshBooks vs. QuickBooks at a glance

FreshBooks and QuickBooks, while both powerful and user-friendly, each have unique strengths that make them a good fit for different audiences.

-

FreshBooks is best for freelancers, solopreneurs, and small businesses that offer services and don’t intend to grow much. It offers time tracking, unlimited invoicing, basic project management, and basic reporting at a low price.

-

QuickBooks is best for medium to large businesses and businesses that have plans to grow. It offers more comprehensive accounting and reporting features than FreshBooks, while also providing unique inventory management for those with physical products—as well as lots of automation opportunities.

This should shed some light on why FreshBooks topped our list of the best accounting software for self-employed individuals, while QuickBooks topped our list of the best accounting software for bigger businesses.

|

FreshBooks |

QuickBooks |

|

|---|---|---|

|

Price |

⭐⭐⭐⭐⭐ Plan pricing is significantly lower than QuickBooks Lite: $15/month Plus: $30/month Premium: $55/month |

⭐⭐⭐ Plan pricing is significantly higher than FreshBooks due to its more extensive capabilities Simple start: $30/month Essentials: $55/month Plus: $80/month Advanced: $200/month |

|

Accountant access |

⭐⭐⭐ Can only invite one accountant after upgrading to Plus plan |

⭐⭐⭐⭐⭐ Can invite two accountants with any plan |

|

User-friendliness |

⭐⭐⭐⭐⭐ Simple and intuitive interface with callout tips describing features |

⭐⭐⭐⭐ Large number of options poses a slight learning curve to those less familiar with accounting, but videos and walkthroughs assist the user |

|

Time tracking |

⭐⭐⭐⭐⭐ Available with all plans |

⭐⭐⭐⭐ Requires a separate account with QuickBooks Time ($20/month) |

|

Automation |

⭐⭐⭐⭐ Integrates with Zapier; can send automatic invoice reminders but no other in-app automation functionality |

⭐⭐⭐⭐⭐ Integrates with Zapier; enables automation through its workflow feature (with Advanced plan) |

|

Reporting |

⭐⭐⭐ Templates provided; one report style with minimal customization options |

⭐⭐⭐⭐⭐ Templates provided; the user can customize and save their own reports |

|

Inventory management |

⭐⭐⭐⭐ Basic features like automatic stock updates based on invoicing |

⭐⭐⭐⭐⭐ More advanced features like low stock alerts, pricing rule setting, and reports of best-selling products |

|

Mileage tracking |

N/A |

⭐⭐⭐⭐⭐ Available with Simple Start plan |

|

Bank reconciliation |

⭐⭐⭐⭐ Available with Plus plan and up |

⭐⭐⭐⭐⭐ Available with Simple Start plan |

FreshBooks is friendly to freelancers, whereas QuickBooks caters to scaling organizations

FreshBooks is a solopreneur’s dream, providing inexpensive access to some great freelancer and small business tools. QuickBooks is more equipped to meet the accounting needs of larger businesses.

Time tracking

With FreshBooks Lite (priced at $15 per month), you can track time both live and retroactively and bill clients for accrued time. The FreshBooks app is also really convenient for on-the-move freelancers by offering mobile time tracking, invoicing, and expense management.

Meanwhile, QuickBooks only offers time tracking with an upgrade to QuickBooks Time Premium (priced at $20 per month, with an extra $8 for every additional user). That said, the bonus features that come with QuickBooks Time, such as employee GPS tracking and simple switching between projects, are more advanced.

Client and accountant access

QuickBooks one-ups FreshBooks in a lot of features that matter to large and growing businesses. While FreshBooks places limitations on how many billable clients you can include in its first two plans (five clients with Lite and 50 with Plus), QuickBooks offers unlimited clients with all of its plans.

It’s a similar story for user and accountant access. QuickBooks offers multi-user access in its higher-level plans, while FreshBooks charges an additional $10 per month for every additional user, regardless of your plan. QuickBooks also allows you to invite two accountants, whereas FreshBooks only allows you to invite one.

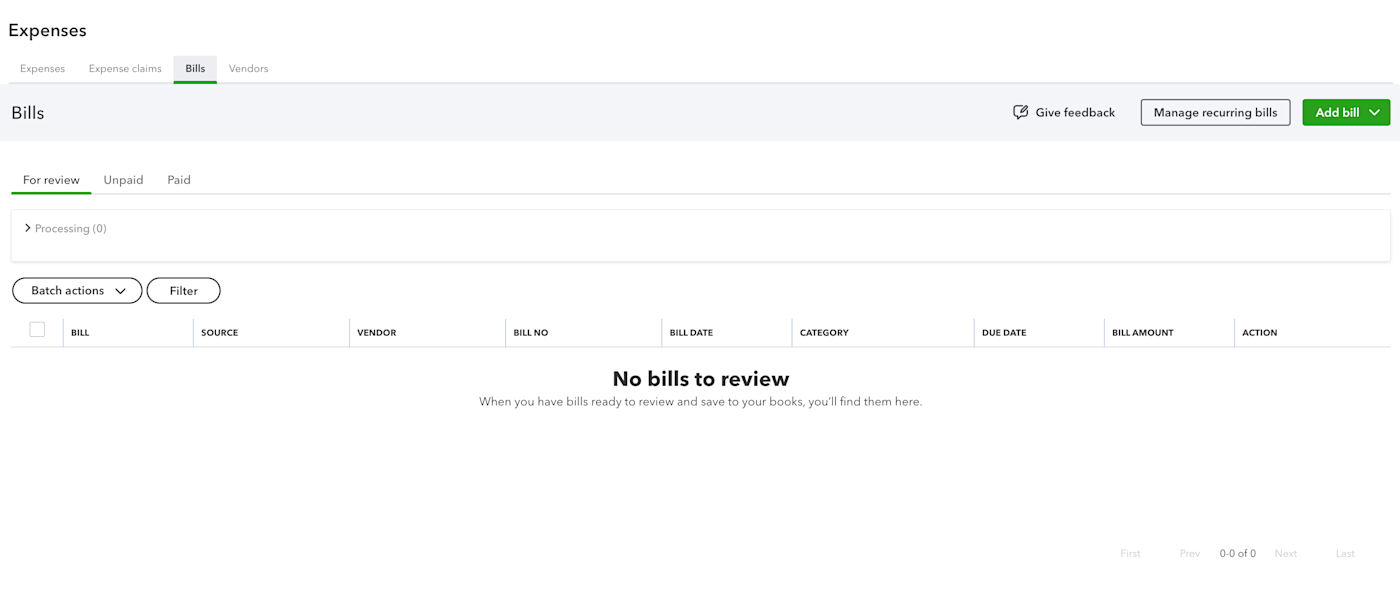

Accounting features

QuickBooks is also more geared toward helping big businesses with accounting, offering bank reconciliation with all of its plans, while FreshBooks requires that you upgrade to its Plus plan to access this feature. It also helps you keep your expenses organized, offering additional tabs for expense claims, bills, and vendors—a great feature for larger companies that sell a lot of products and work with third parties.

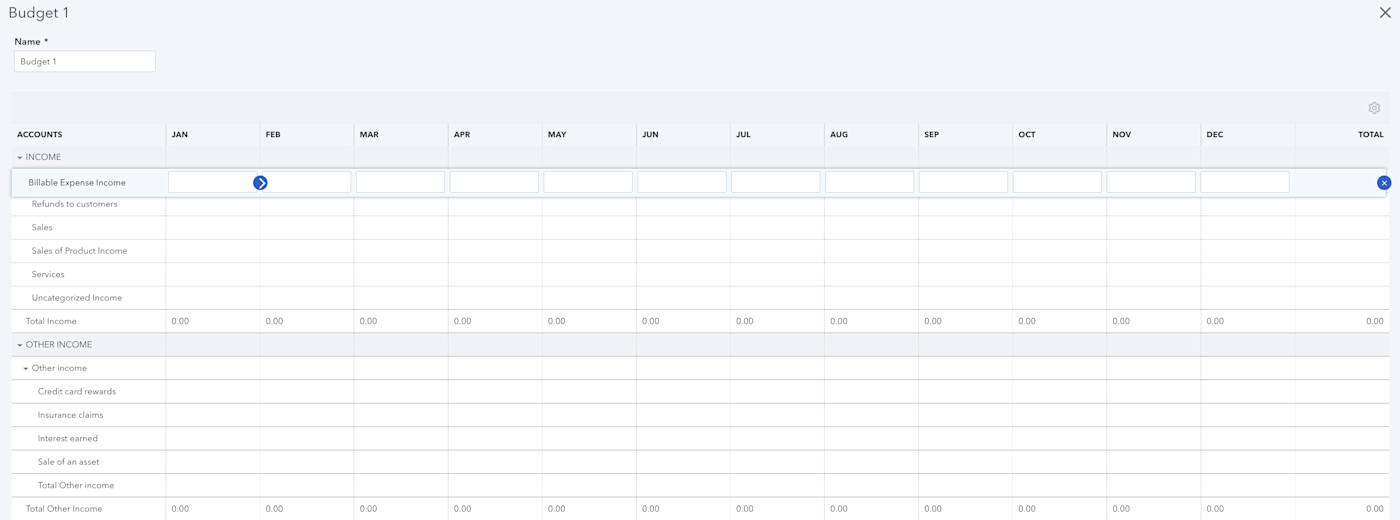

Budgeting

Unlike FreshBooks, QuickBooks also offers a budgeting tool—a particularly helpful feature for businesses that have to keep track of several expenses and sources of income.

Pricing

If nothing else indicates that QuickBooks’ main audience is larger companies, its price certainly does. The most basic plan costs double that of FreshBooks, and its most advanced plan costs nearly quadruple that of FreshBooks. Who’s most likely to spend big bucks on an accounting software with highly scalable features? Established businesses.

FreshBooks is best for businesses offering services, whereas QuickBooks is best for those offering products

Your choice of accounting solution might just come down to what your business offers.

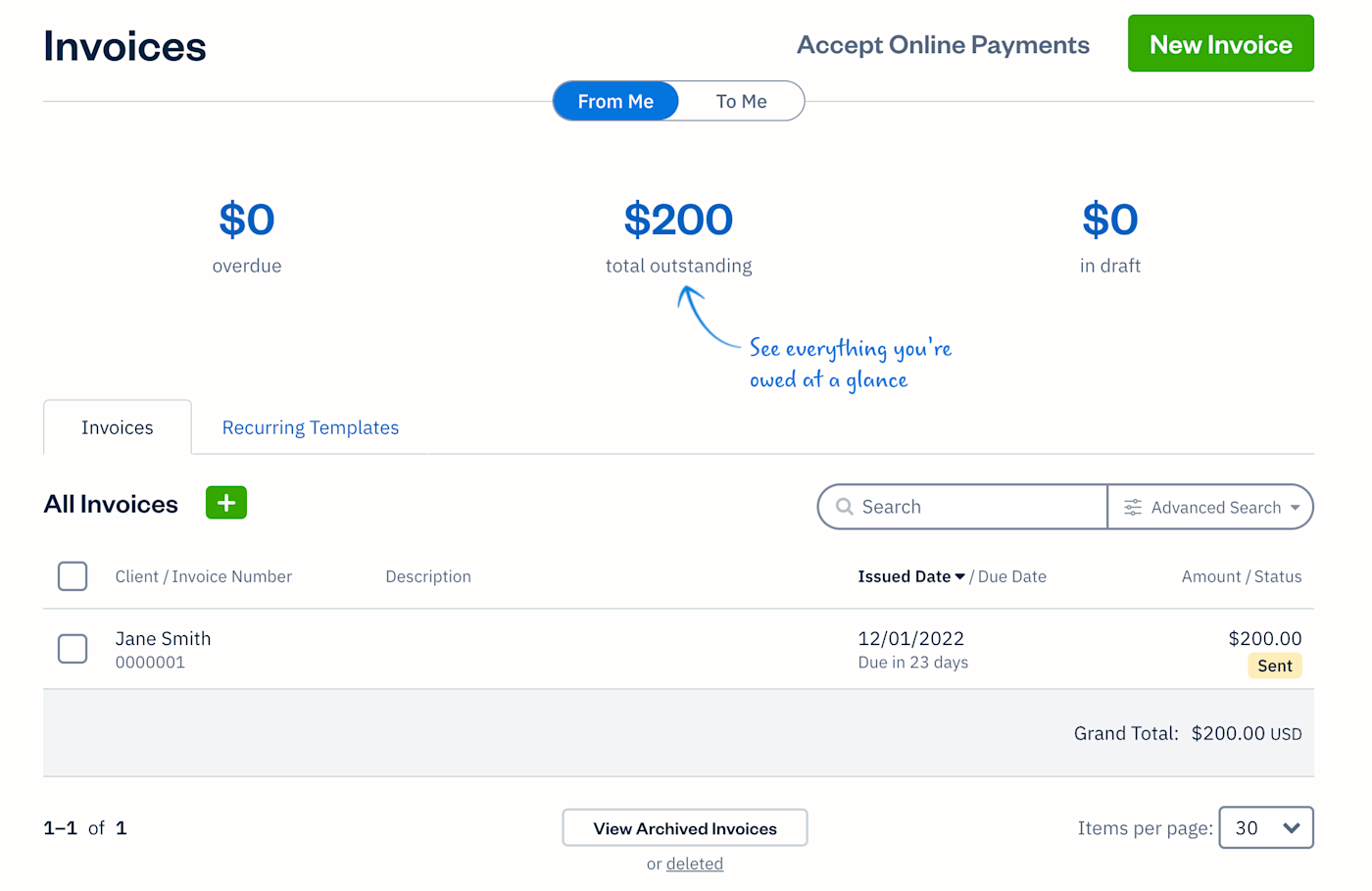

Invoicing

If your business provides services, there’s a good chance you’ll be regularly invoicing your clients. Both QuickBooks and FreshBooks allow you to send unlimited customized invoices, but FreshBooks does so for much cheaper—$15 per month compared to QuickBooks’ $30 per month. Simply put, FreshBooks is the way to go if invoicing clients for services is the main reason you need an accounting solution.

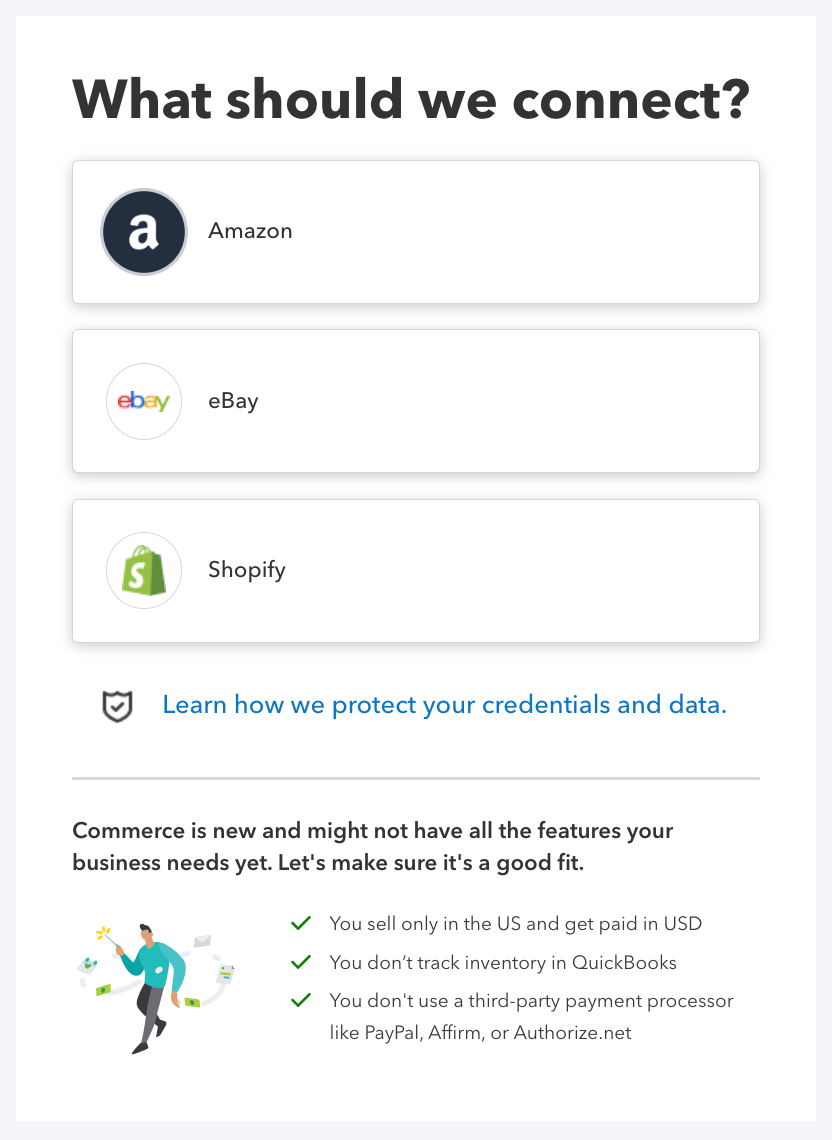

Sales channel syncing and POS

If you offer a lot of products, QuickBooks can make your life easier. The platform allows you to record daily sales from your channels (imported from Amazon, eBay, or Shopify) and sync data from your sales systems (Square, PayPal, etc). QuickBooks even offers its own POS system—QuickBooks Point of Sale—doubling down on its product focus.

Inventory

QuickBooks also caters to big businesses that sell a lot of products with its inventory features. It sends restock notifications when stock is low, enables you to set pricing rules, and even provides reports presenting your best-selling items. FreshBooks’ inventory features are more limited, though it does automatically update your stock using data from invoices.

FreshBooks is straightforward and limited, whereas QuickBooks is complex and flexible

If simplicity is your cup of tea, you may not need to pay big bucks for a platform that includes every accounting feature under the sun.

Interface and menu items

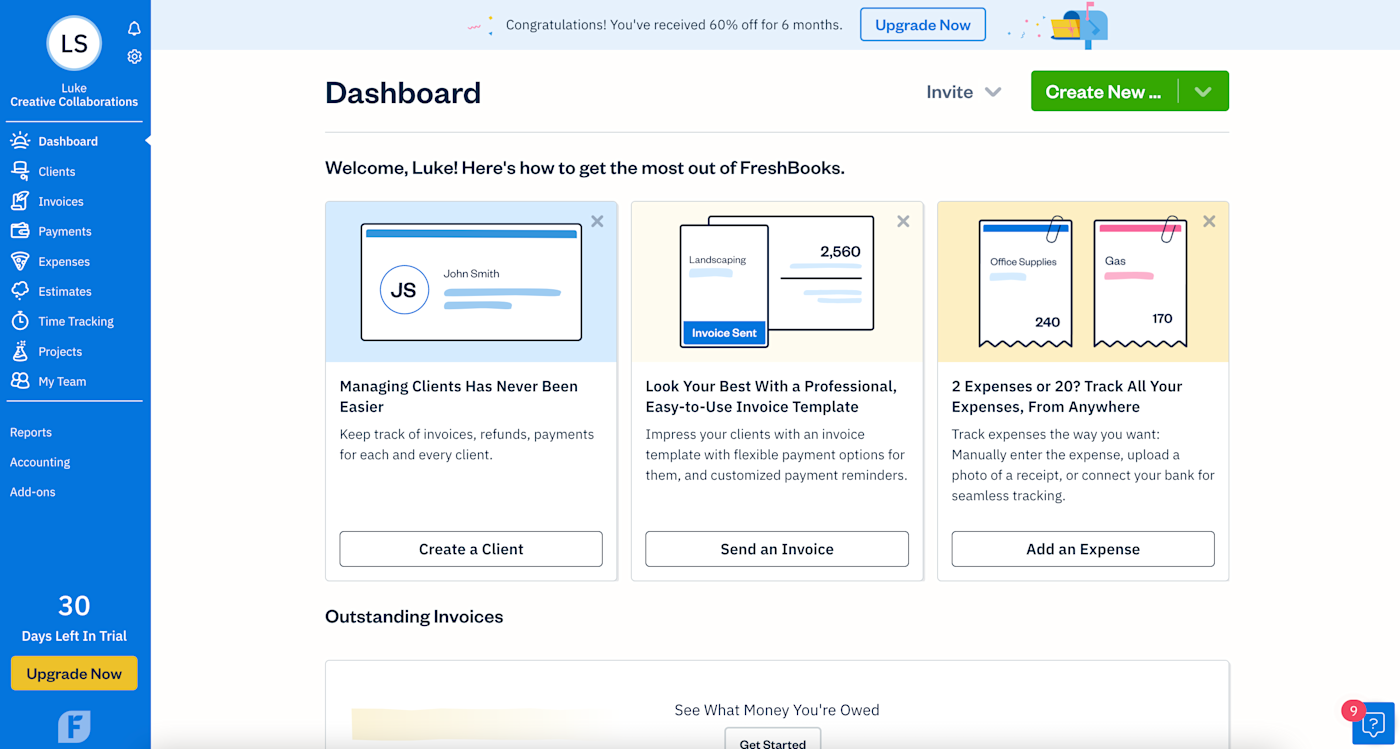

FreshBooks’ simplicity is evident as soon as you enter the platform. When I logged in, I was greeted by an interface that a toddler would enjoy playing around with (no offense): bright colors, clear breakdowns of tools, and relatively few navigational options.

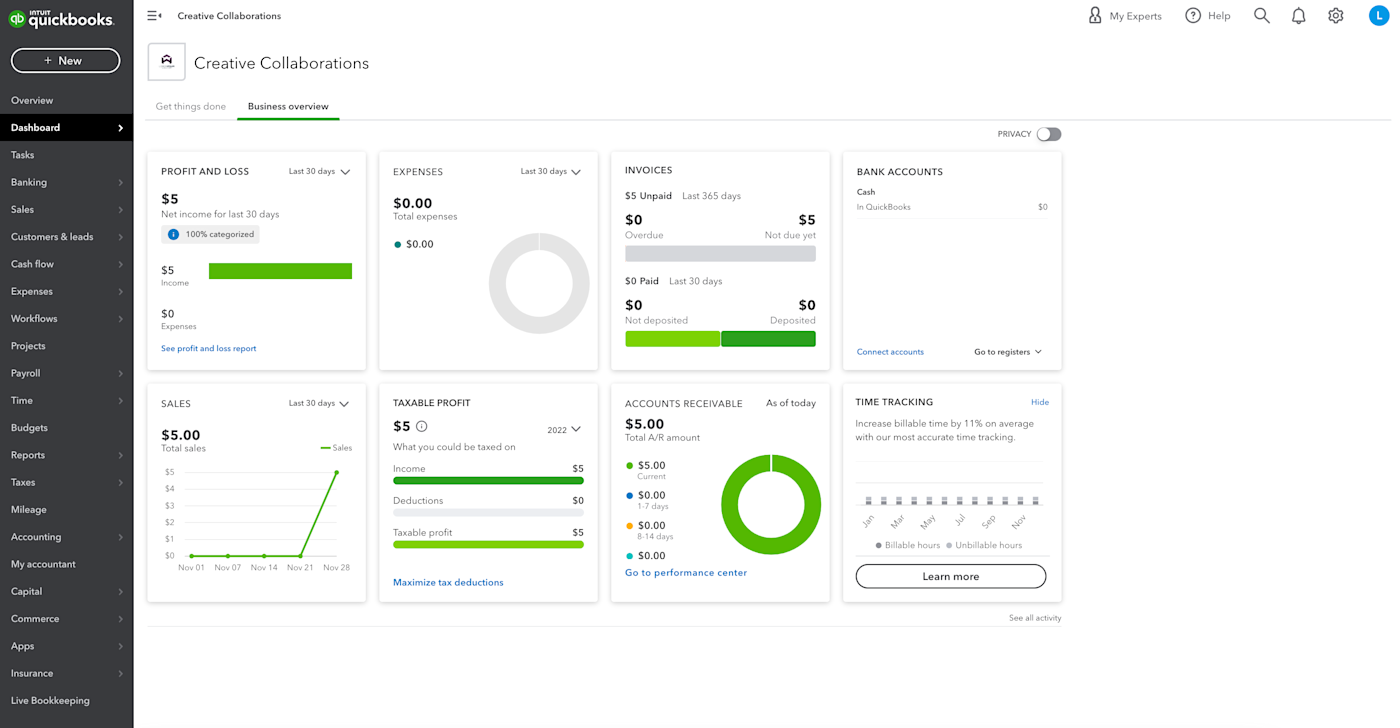

Opening QuickBooks was another story: I encountered over 20 menu items, several widgets with charts and graphs summarizing business metrics, and an overall “business professional” interface.

Reporting

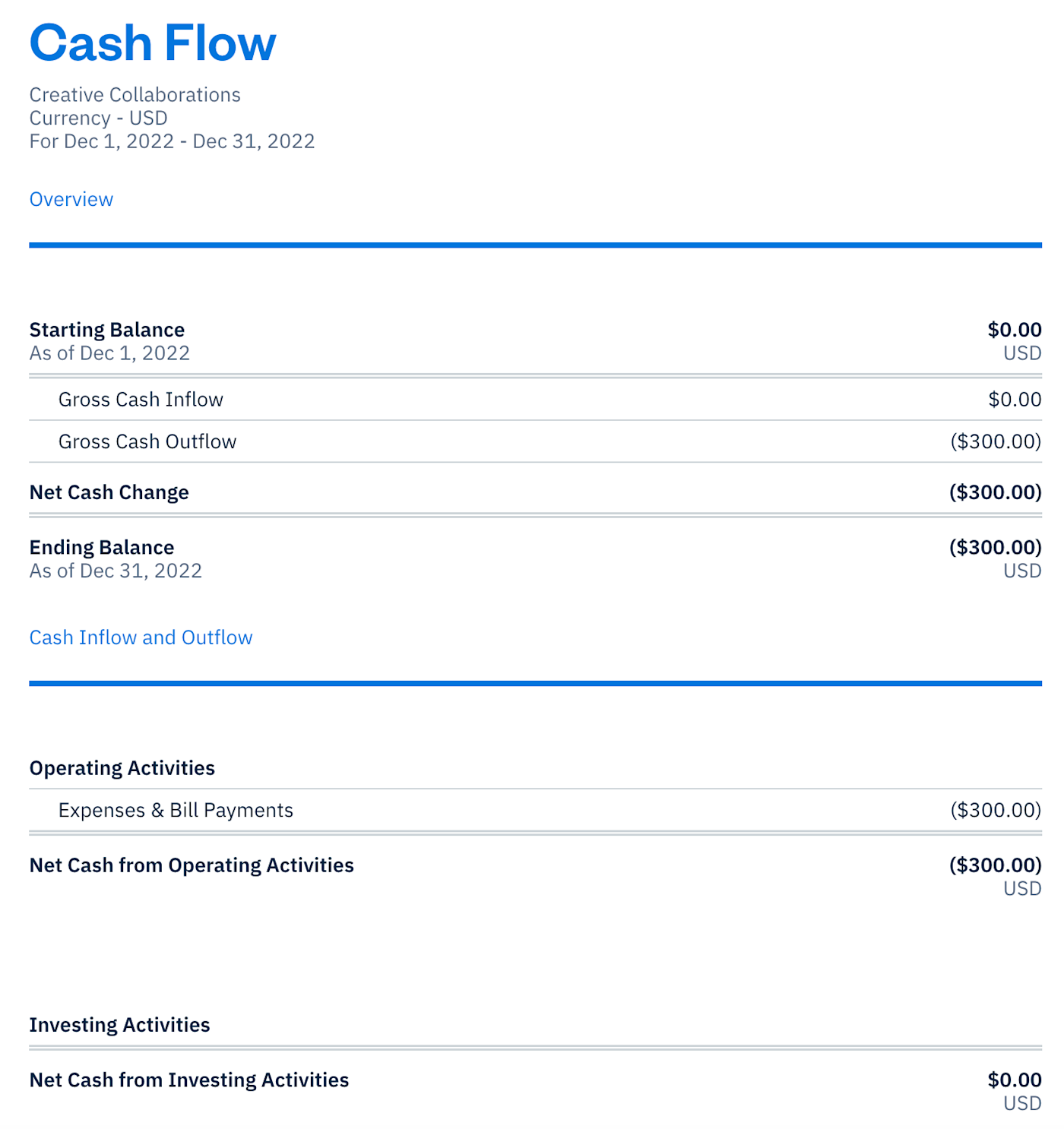

Don’t get me wrong—FreshBooks offers a lot of the same features as QuickBooks. But after exploring these features, I found FreshBooks to be far more limited. For example, both platforms allow you to generate reports, but the FreshBooks reports all have the same simple and non-customizable format.

Meanwhile, QuickBooks offers a long list of customization options for its pre-saved reports and even allows you to build your own custom reports from scratch.

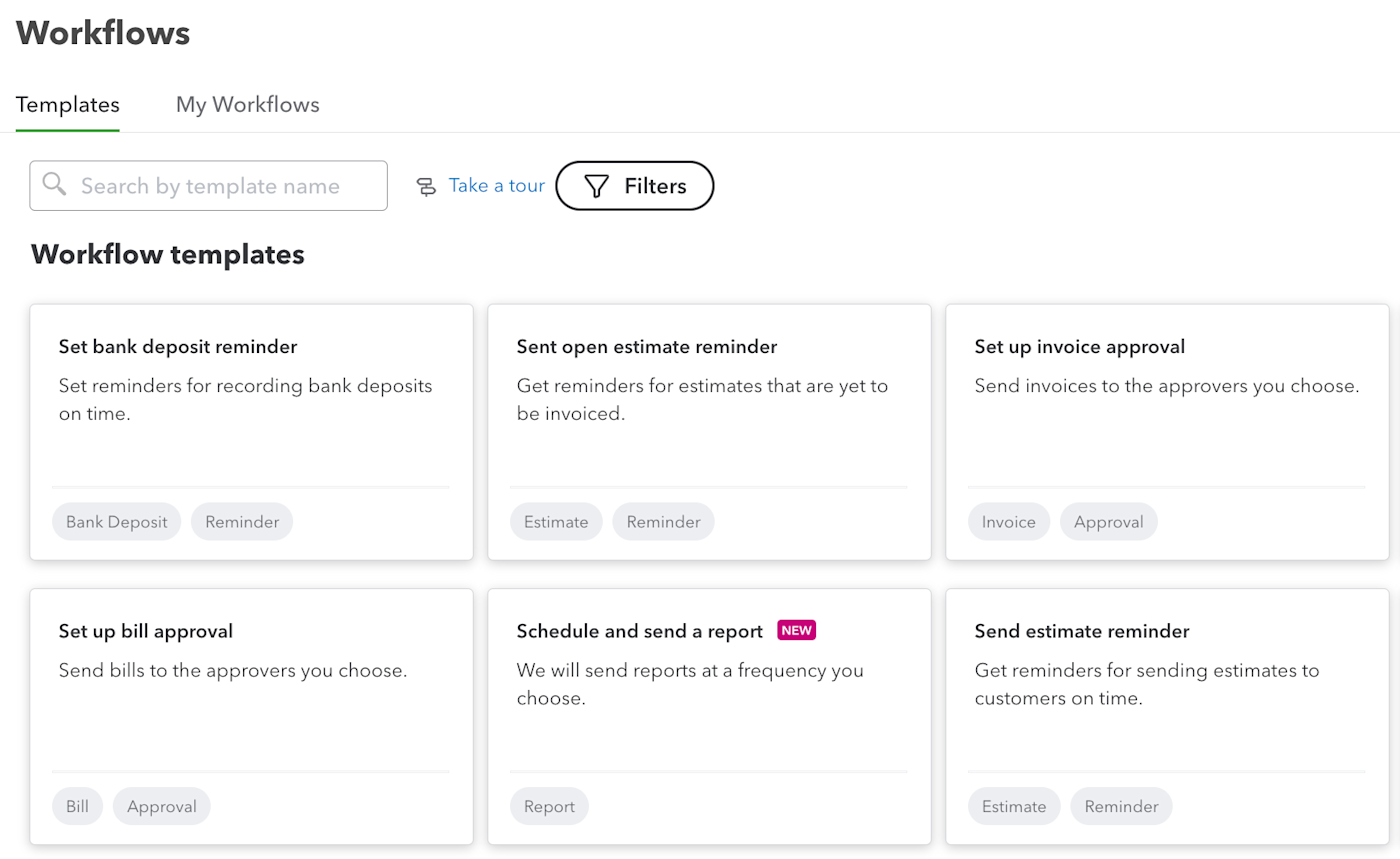

Automation

Another area QuickBooks shines is its workflows feature, enabling you to schedule reminders and automate tasks. For example, you can tell QuickBooks to automatically generate and send reports to people via email on a specific schedule. You can either choose from several templated workflows or create your own from scratch. Granted, this feature is only included with the Advanced plan, so you have to spend quite a bit to access it.

Despite all of QuickBooks’ advanced features, the platform does a good job with user-friendliness. On most of the platform’s pages, I had the option to “take a tour” through the interface and its options. Some pages even included walkthrough videos explaining how to use its features. Overall, it’s a platform that any office manager should be able to learn relatively quickly.

FreshBooks vs. QuickBooks: Which is right for you?

Like most things in life, there isn’t a one-size-fits-all answer to the FreshBooks vs. QuickBooks debate. Each solution has different features offered at different price points, so you should ultimately choose the option that meets all of your business’s needs.

If you’re a freelancer, solopreneur, or very small business that primarily offers services and needs an easy tool for invoicing clients, FreshBooks likely offers everything you need at a relatively low price point. If you run or work in accounting at a medium, large, or growing business that sells inventory and needs a comprehensive and customizable accounting solution, QuickBooks has you covered.

Whichever platform you choose, rest assured that both integrate with Zapier, so you can keep all of your business’s tools communicating seamlessly.

Related reading:

Need Any Technology Assistance? Call Pursho @ 0731-6725516