Payment gateways and payment processors do more than just process transactions. They let you embed a payment form or button on your website, securely take in credit card details, and trigger all the necessary notifications to help you deliver your products or services on time. And then, every few days, the platform will pay out everything you’ve received.

I spent time researching and testing the best payment gateways, looking into nearly 100, spanning all sorts of sub-categories and use cases. After narrowing it down to a couple dozen to test in depth, I spent time with each app—and these are the five best.

The 5 best payment gateway services

-

PayPal for first-time users

-

Stripe for accessible analytics

-

Square for selling both online and offline

-

Gumroad for selling individual items

-

Amazon Pay for leveraging Amazon’s brand and payments infrastructure

What makes the best eCommerce payment gateway?

Payment gateways and credit card processors are critical components of an eCommerce shop. They enable secure online payments, exempting you from investing in costly security and compliance software. The most basic credit card processor will do exactly that: stay compliant to PCI-DSS standards and provide simple integration options with your sales channels. But more advanced platforms offer features like recurring billing and subscription support, advanced analytics, or seamless integration with your website or eCommerce platform.

As I was researching and testing eCommerce payment processors, here’s what I was looking for:

-

Accepted payment methods. At minimum, these credit card processing companies needed to accept all major credit card brands.

-

Transaction fees. I kept my eye out for platforms with reasonable fees for the features they offer.

-

Security. Every payment processor listed here is PCI-DSS-compliant, so you don’t need to implement any additional security measures on your shop.

-

Customer experience. It should be easy for customers to buy products and services at your eCommerce shop, so I looked out for the platforms that offer the best customer checkout experience.

-

Extra features. Having a toolkit at your disposal—including subscription support, invoicing, payment links, or card readers—can be useful, so I kept tabs on all those extras as well.

I signed up for each eCommerce credit card processor, adding my business information and completing the onboarding process. (Providing details about your business is mandatory for compliance reasons, so make sure to enter yours correctly to enable all the features.) I then went on to set up payment buttons or forms on a page on my website. Some platforms offer a developer mode that lets you test transactions: in that case, I tested the payment flow. Other platforms didn’t offer this option, so I relied on live checkout demos provided by the platform to get all the way to the end. After a couple hours of testing each app, I was able to narrow it down to the five best credit card processors for eCommerce.

Before I jump in: if you’ve set up your shop with Shopify, BigCommerce, or WooCommerce, check out their payment processing options as well. The rates may be more competitive than the ones listed here, and the integration with your shop can also make things a bit easier.

Best credit card processing for first-time users

PayPal (Web, Android, iOS)

PayPal has been in the payments industry for a long, long while. In that time, it’s built an experience that’s really easy for first-time users, taking most of the complexity out of the equation. This means little to no coding and zero developer lingo.

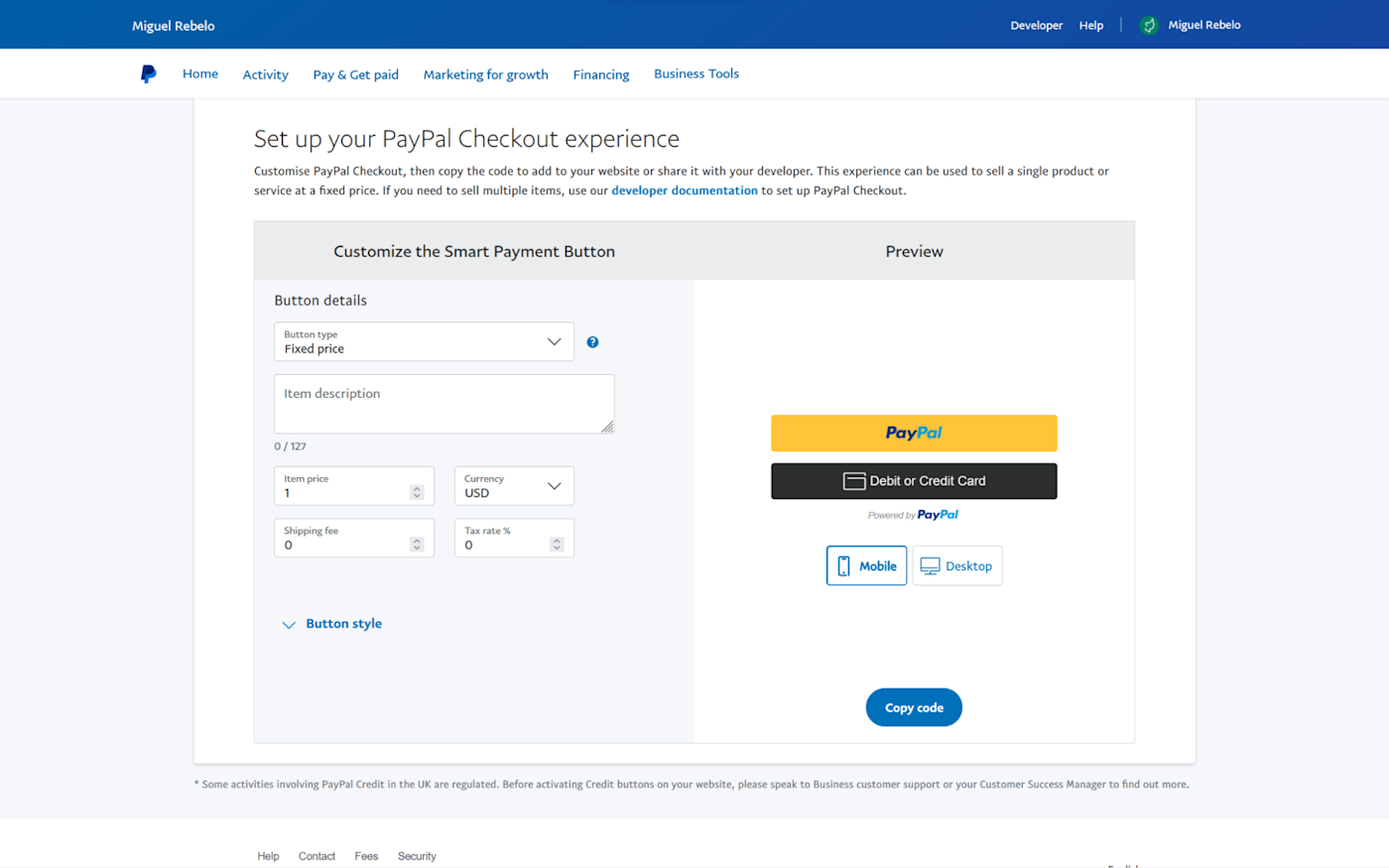

After you complete the registration process, you’ll land on the dashboard. In addition to key information about your business, you have access to all of PayPal’s features right there. You can start by setting up your PayPal Checkout experience, which is what enables the payment processing features for your store.

Once you add your products, you can customize the Smart Payment Button, as you can see in the screenshot above. The only thing you can’t customize are the colors: you can change the shape, what logo appears on the PayPal button, and show/hide the Debit or Credit Card button. When you’re done, simply click Copy code and paste it on your product page.

What happens on the customer side? When they visit your website, they’ll see the button you’ve configured. They can then choose to pay with their PayPal balance or any saved payment method on their PayPal account. If they don’t have PayPal, they can check out by entering their credit card details (all data is handled securely by PayPal in both cases). Added security measures include fraud protection, which keeps your store safe from credit card fraud, and also customer protection, which lets shoppers file claims if there’s a mismatch between the products advertised and what they actually got.

One thing you’ll hear from anyone using PayPal: the transaction fees are flat-out confusing. In general, PayPal charges a base fixed price for each transaction and then a percentage over the total amount. So the basic credit card fee is 3.5% + $0.49 for U.S. transactions, but this percentage/cents combo varies a lot depending on transaction type and currency, so be sure to read the fine print.

PayPal has some interesting extras to offer. You can create your PayPal.me profile page, which gives you a searchable profile, and generate individual payment links that you can share via email or in a text message. And if you’re running a subscription-based business, there’s also a lot of customization there, including setting up trial periods, one-time setup fees, and billing cycle length.

When you’re set up and ready to sell, connect PayPal to Zapier to automatically add new customers to your email marketing tool, a spreadsheet, or anywhere else you store your data.

PayPal pricing: Fees vary by transaction type and currency; 3.5% + $0.49 per transaction for U.S. credit cards. Full pricing information here.

Is your sales volume growing? PayPal has another payment solution for you: Braintree. It has advanced analytics, better control in creating and implementing your checkout experience, and slightly lower payment processing fees. It also accepts a wider range of payment methods, including Venmo. If you stick with PayPal, learn more about how to automate PayPal.

Best payment processing system for accessible analytics

Stripe (Web, Android, iOS)

Stripe has become a kind of household name for online businesses, mostly because of how flexible it is and for the range of tools it offers. It brands itself as the financial infrastructure for the internet, and it’s not wrong.

As soon as you land on the dashboard, you’ll realize that Stripe has depth. That may make things a bit unintuitive at the start. Developers will feel right at home, but what about those of us that don’t know how to make an API call? Stripe has an implementation wizard, where you can choose how you want to implement it in your shop by answering a few simple questions. The results come with a full guide to help you copy and paste code to the right place on your website.

If you’re running Shopify or WooCommerce, for instance, a lot of this work is done for you. Since Stripe is so popular, a lot of apps have created plugins and customized flows to help you integrate payments on your website without code.

When your shop is good to go, Stripe lets you look deep into what’s happening with your payments. You can see sales volume, a report on fraud and disputes, spend-per-customer, and high-risk payments on the home dashboard. Want to take a deep dive? Head to the Reports section, and explore all the options available, including billing analytics that help you look into your MRR or revenue forecasts.

Stripe accepts payments from major card providers, the digital wallets Google Pay and Apple Pay, as well as BACS/SEPA direct debit. Extra setup is required to get all of these going, but offering more payment options during checkout may increase your conversion rates, so it’s worth it to implement more over time.

Another win: the fee structure is simple. It’s 2.9% + $0.30 per transaction for credit cards, and while other payment methods have different costs, the pricing page is straightforward and clear about them.

There are three main ways you can embed Stripe on your shop:

-

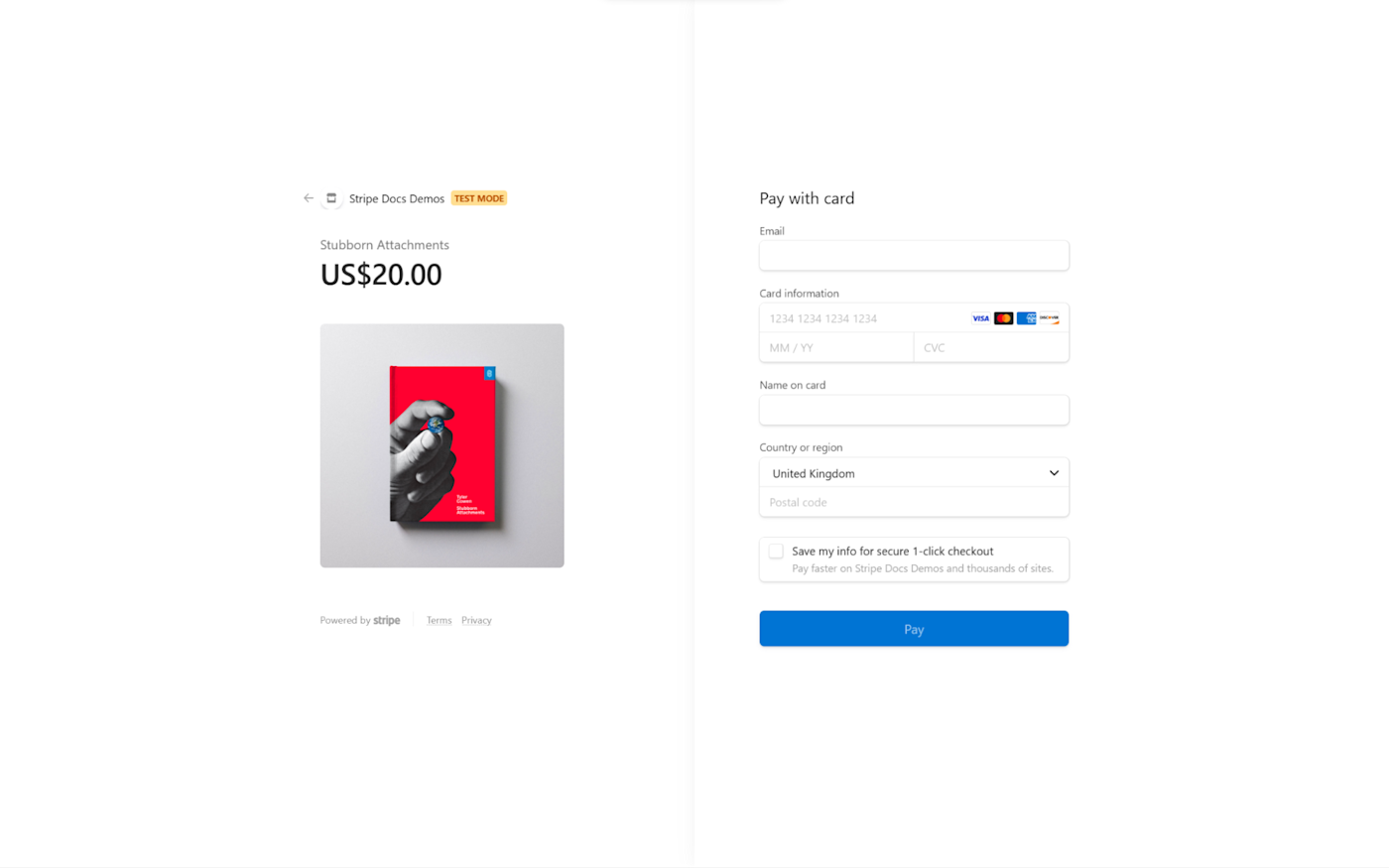

You can set up an embedded payment form (this requires some coding to customize everything about it).

-

You can add a button that’ll bring up a pop-up hosted by Stripe, where the customer can input their credit card details securely. Then, the payment button is unlocked on your shop, and the transaction can be processed from there (also involves some coding to implement).

-

You can redirect your customer to a beautiful checkout page (pictured above), where the customer can input all their details. When they’re done, they get redirected back to any part of your website.

Stripe has a bottomless pit of extras—there are so many things to explore, and for all levels of expertise too. I’ll tease you the main ones: subscription features that support cross-selling, tax automation, incorporation of your own startup via Atlas, and native integrations with a range of website builders and eCommerce platforms.

It’s a lot, and you can go even further by connecting Stripe to Zapier. Automatically get Slack notifications for new Stripe sales, create QuickBooks customers for new Stripe payments, and connect Stripe to your entire tech stack.

Stripe pricing: Fees vary by transaction type; 2.9% + $0.30 per online credit card transaction. Full pricing information here.

Best payment gateway for selling online and offline

Square (Web, Android, iOS)

Do you run a brick-and-mortar shop? Not accepting card payments at all? Square is here to help. Besides offering full support for physical card reader machines, it also lets you build your own online store with seamless payment processing. That means faster sales in person and online sales support too.

The interface is sleek and easy to use. The main dashboard gives you a snapshot of your business at a glance, and you can then use the left-side menu to access the wide range of features on offer. These include accepting payments online for all major card brands, as well as Google Pay, Apple Pay, and Samsung Pay.

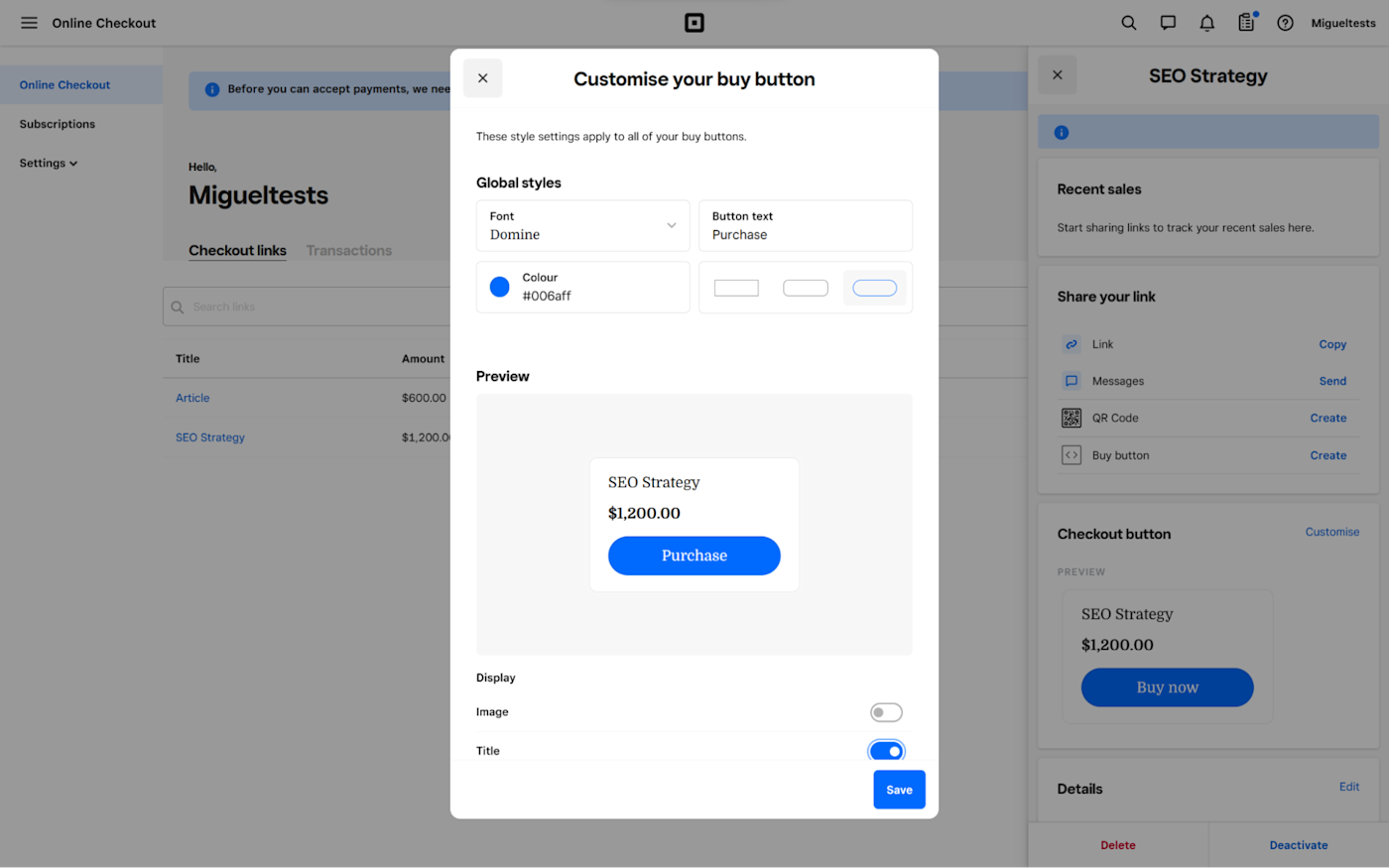

After you set up your account and add your products, you can embed customizable buy buttons on your sales channels. The level of customization is great, but there are no payment method badges or a “processed securely by Square” note. Be sure to add those to your website to give your customers a sense that it’s safe to shop with you.

Don’t have a website? No problem. Square offers a website builder with beautiful themes, easy to set up and publish. It also offers basic email marketing features, so you can keep in touch with your customers, run campaigns to raise awareness about new products or services, or get some feedback on customers’ experiences.

Most of Square’s features are free to use, but if you want to unlock more for your store and checkout experience, there are two subscription plans available. The highest one, Premium ($79/month), even lowers the transaction fee to 2.6% + $0.30 (from 2.9% + $0.30), so if you end up setting up shop with Square and start selling a lot, it may make sense to upgrade.

As for extras, Square has quite a bit to offer. You can open a checking account, letting you receive payments faster and make payments directly from there too. You can also keep your invoices organized, send estimates and contracts, and see filterable reports on everything from sales to disputes.

You can connect Square to all the other apps you use with Square’s Zapier integrations. For example, you can create new contacts in any other app whenever you have a new customer in Square. Here are a couple of examples:

Square pricing: Fees vary by transaction type; 2.9% + $0.30 for online credit card transactions. Square also offers subscription plans to unlock more features, starting at $29/month. Full pricing details here.

Best eCommerce payment processing for selling individual items

Gumroad (Web, Android, iOS)

Gumroad is cute. Click the link, and you’ll see what I mean. There’s a whole creator economy vibe around it, with great design to top it off. But cuteness isn’t the main feature we’re looking for in a payment processing platform, right? Right. Moving on.

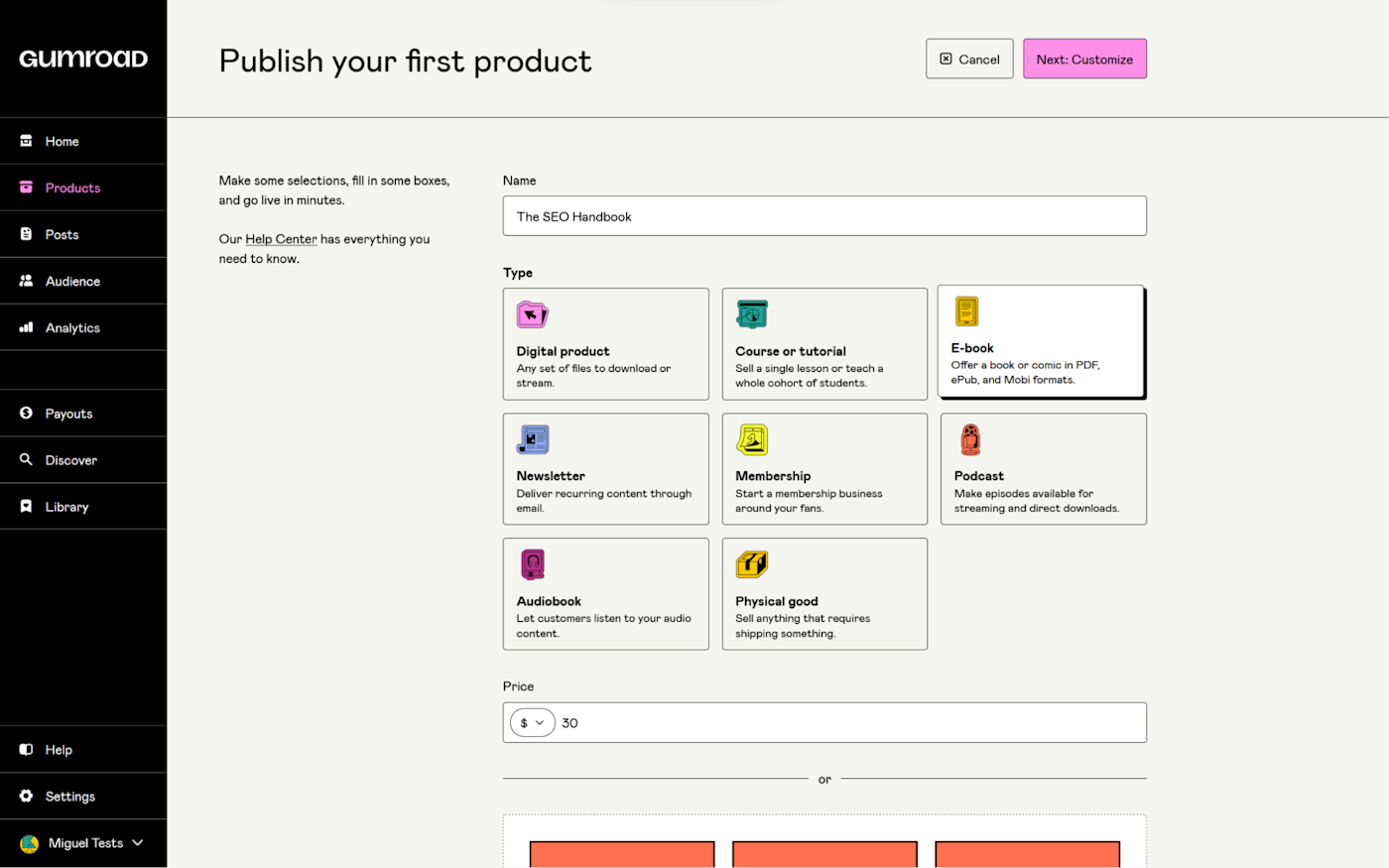

Gumroad helps you sell a wide range of products, digital or physical. You can:

It works especially well for more unique, individual items. You can set up a page on Gumroad with the details, your customers can read more about what you’re selling, and then they can checkout from there. If you want to embed it on your website or on a blog post, you can. Simply customize the button you want to embed, and when your visitors click on it, they’ll be taken through Gumroad’s checkout experience. For a full guide on how to do this, here’s the help page.

When sales start happening, you can keep track of everything in a dashboard that’ll show you sales, page views, traffic sources, and geolocation. When you click on the Audience tab, you’ll see a list of emails of people that purchased your products, so you can later follow up with them to get some feedback or just chat.

Gumroad accepts all major debit and credit card brands, as well as Apple and Google’s digital wallets. The pricing is unique when compared with other options on this list: you pay $0.30 per transaction as a base, and then a percentage over your total earnings. At $0, that’s a hefty 9% fee, but it gets progressively smaller as you move towards 1 million, where it sits at 2.9%. But if you want to offer free products from time to time, you can leverage all these features at absolutely no cost.

While you’re selling, connect Gumroad to Zapier to automatically send new Gumroad customers to your email marketing tool (or any other app you can think of). Here are some examples:

Gumroad pricing: $0.30 + anywhere from 2.9% to 9% per transaction, based on total sales volume processed on Gumroad. Full fee breakdown here.

Best online payment processing for leveraging Amazon’s brand and security

Amazon Pay (Web)

Amazon’s an eCommerce giant. With Amazon Pay, you can stand on the shoulders of this giant and take advantage of Amazon’s familiar payment flow and security features.

The signup process has a few hoops to jump through when compared with others on this list. You’ll have to fill out a form; then you get an email; after that, you have to fill out your business details and await confirmation. This kind of verification is required by all the platforms on this list, but Amazon decided to front-load it to the signup process—so it’s not extra work; it’s getting it done earlier. While you wait for the sales team to onboard you, you can read a tailored guide on how to integrate Amazon Pay with your platform. There are dozens of detailed articles with step-by-step video instructions to help you set everything up the way you need to.

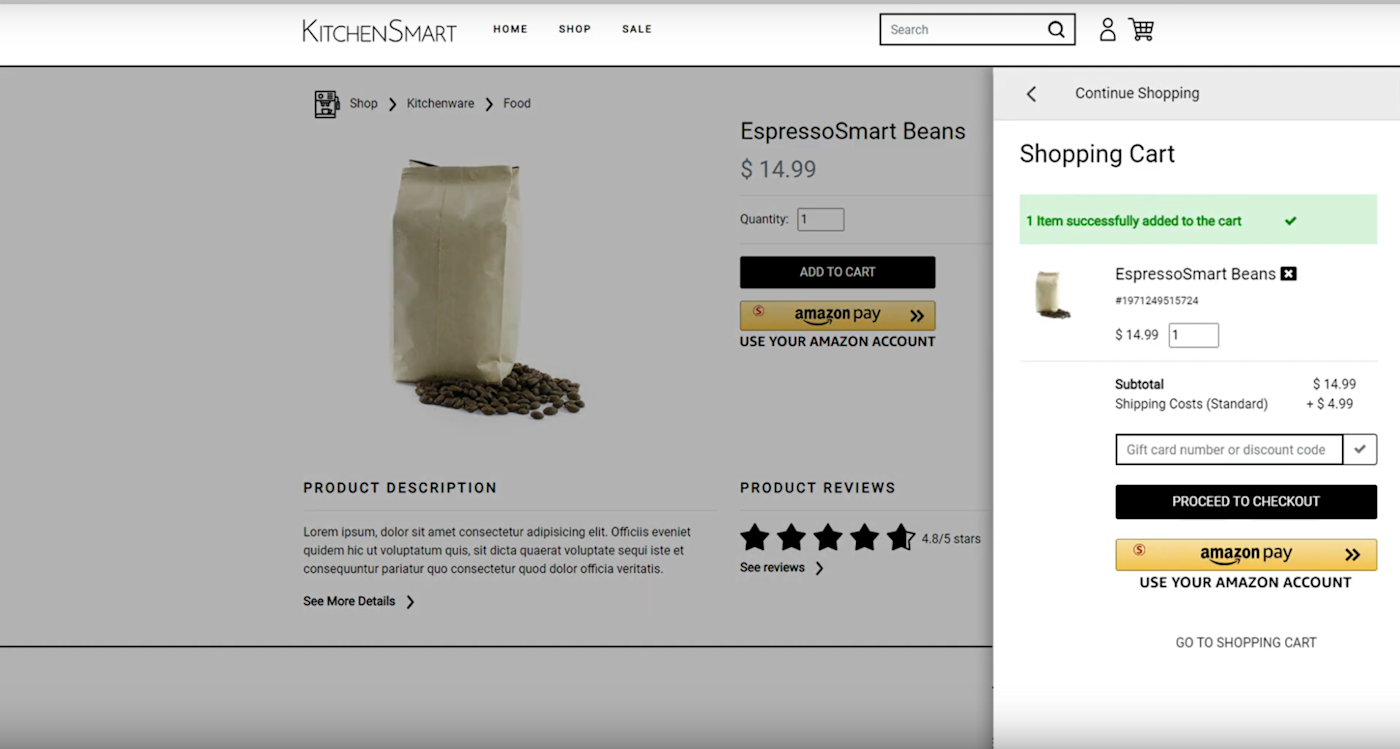

Once you log in to your seller account, the user interface has the same vibe as the Amazon website. You can see simple payments as well as transaction and performance reports. Start adding your products and services and generate buttons you can then embed on your own website. When your customers click to pay, they get redirected to the Amazon page for the checkout flow. If your customer has an Amazon account (which, let’s be honest, they probably do), they can pay for their order with a couple of clicks, just by logging in and using their payment method on file. If not, they can enter their payment details there and finish the transaction.

By using Amazon’s payment flow on your store, existing Amazon users will have an easier time checking out, leading to reduced friction and increased conversion. It also positions your store as a trustworthy source, especially because of its “Amazon A-to-Z guarantee” customer protection features. Customers can make claims to Amazon if there’s a mismatch between the product or service advertised and what was actually delivered. These claims (and their success or failure) affect your performance rating, so it’s something to keep in mind.

As for fees, Amazon separates between domestic and global transactions. In the U.S., you’ll pay 2.9% + $0.30; for the rest of the world, that’s 3.9% + $0.30. And if your customers order via Alexa, you’ll have to pay her a surcharge, bumping the percentage to 4% for domestic and 5% for global. AI needs to eat too, you know?

Amazon Pay pricing: 2.9% + $0.30 per U.S. transaction. Fees vary by location and whether Alexa was involved in the transaction. Full breakdown here.

What’s the best online payment gateway for eCommerce?

All these payment processing companies are solid choices to let your customers pay you securely. Take your time to explore their entire feature sets, as not all of them offer the same possibilities or have the same pricing model. It’s also wise to try out the support team and ask some questions—I mostly interacted via chat and phone, but your experience may vary depending on your needs.

Once you’re locked in on your favorite online credit card processing system, register for an account and familiarize yourself with the way payments are processed, the fees applicable to your business, and how chargebacks are handled. Happy selling!

This article was originally published in September 2016 by Matthew Guay, and has also had contributions from Hannah Herman. The most recent update was in December 2022.

Need Any Technology Assistance? Call Pursho @ 0731-6725516