If driving is part of your job, you qualify to get federal income tax reductions. However, the qualification to get the federal income tax reductions is largely pegged on a crucial document called the mileage log.

A mileage log is a record showing how different cars operating for business have been driven. This record shows accurate business-related expenses incurred using your fleet of cars. An IRS auditor checks the mileage log before it is approved for consideration in the federal income tax reductions. Many companies think that keeping a record of the mileage covered every week and month is enough to suffice an IRS audit.

However, the mileage itself is not enough for IRS requires a clear view of all the operating costs that include the mileage. To get it right, you need to record all the trips made. This task may sound tedious, and true it is. However, some right tools with mileage log templates can make it a little easier for companies to keep records of driving-related expenses.

Why Should You Keep a Mileage Log?

The importance of a mileage log should not be downplayed, for it is an essential factor in the final books of accounts of a business.

1.Claim tax reductions

The obvious reason why you need to keep a mileage log is that it will help you claim federal income tax reductions. These deductions can help improve your net profit annually. Since your business’s primary concern is to increase income, then keeping a mileage log helps you make this a reality.

2.Protect you against a lawsuit

Another reason why keeping a mileage log is important is that it can help a company protect itself from a damaging lawsuit by the IRS. If the IRS conducts a business audit and finds that you don’t have a mileage log yet you claimed the reductions, then you can lose a lot of money.

Therefore, it is important to keep accurate mileage logs.

Mileage Log Templates

How to Log Mileage for Taxes?

A major concern for businesses is logging mileage correctly to get tax benefits. Remember, a mileage log is a crucial document that if not correctly inputted, then IRS might reject a company’s request for tax reductions.

Here are simple steps that you should follow:

Step 1: Ensure you qualify

A business qualifies for mileage deduction if the fleet of vehicles logged travel from the office to a work site or engages in business-related errands.

Step 2: Choose your calculation method

There are two methods of calculation that you can choose i.e. standard mileage deduction and actual expense method.

- Standard mileage deduction: this requires a business to record a log of qualifying mileage driven.

- Actual expense method: record all logs of mileage and the receipts of costs incurred related to the driving expenses while driving for business.

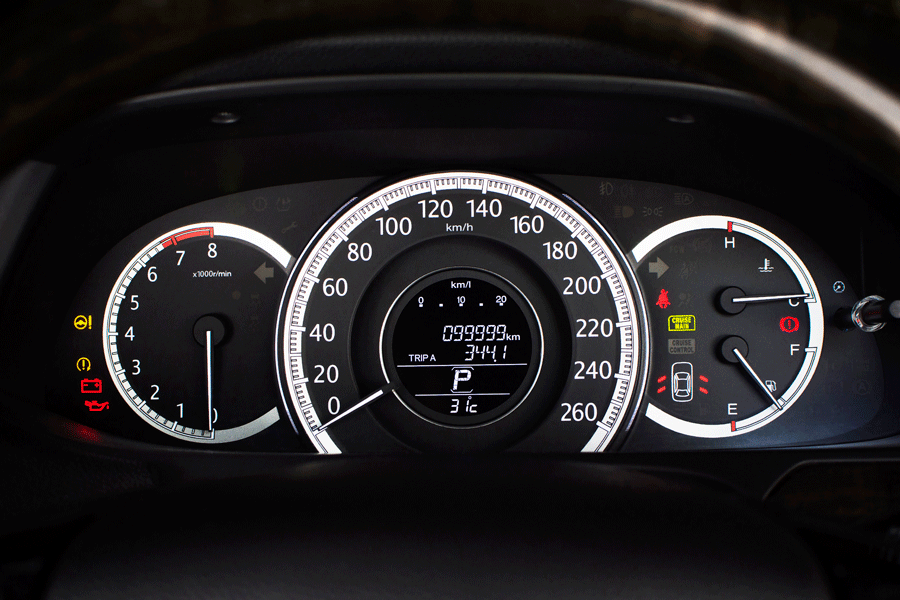

Step 3: Record each car’s odometer at the beginning of the tax year

IRS needs to know the mileage covered by a car during the entire tax year. Therefore, you need to record the odometer at the start of the year.

Step 4: Maintain driving logs

The standard mileage deduction requires you to keep a clear record of driving logs. IRS is very strict with these logs. So, you should do the following:

- Record vital details of any business trip i.e. date, the purpose of business, starting location, ending location, and odometer reading at the beginning and end of the trip.

- Calculate the mileage covered per trip and record it separately.

Step 5: Maintain a record of receipts

Actual expense deduction requires companies to keep clear documentation of all the expenses related to the business travels. Each recorded document should show the date, the amount used, the service or product purchased, and its description.

Step 6: record odometer at the end of the tax year

When the tax year ends, you need to record the odometer of the business cars used during the year. The figure will be used in conjunction with the one recorded at the beginning of the year to calculate the mileage covered during the tax year.

Step 7: Record mileage on tax return

When filing the annual income tax returns, you will need to record the mileage on the tax return. Indicate the mileage covered. It should correspond to the records you have maintained during the year.

Step 8: Retain the documentation

You need to keep the documentation associated with the mileage logs safely. IRS might request it before granting the tax reductions. Keep the records straight and start a new log for the upcoming tax year.

Common Mistakes for Mileage Log

Many businesses make simple mistakes when filing mileage logs. Here are some common mistakes that you should avoid:

1.Illegible mileage log

You need to use a readable format when recording the mileage log. If you are using a handwritten log, ensure it is readable lest it will be rejected by IRS.

2.Supporting document mismatch

Some companies file documents that do not match the mileage log presented to IRS. Every supporting detail needs to correlate with the mileage log to avoid rejection.

3.Late logging

You need an exact log for your driving history. To ensure this, there needs to be a stamp showing the date and time for your trips. Logs generate afterward may call on IRS to audit the mileage log.

4.Not considering holidays and vacations

Most taxpayers don’t work during federal holidays. Similarly, there are vacation days that taxpayers don’t work. Therefore, your mileage log needs to reflect this information. Some companies forget to switch off mileage logs during holidays and vacations.

5.Claiming round numbers

Round numbers such as 15,000 miles attract IRS attention for auditing the company. Therefore, you need to record the actual mileage and avoid rounding it off.

6.Filing identical distance

Simply because you use a certain route every day doesn’t mean that you should estimate the mileage on your log; you should be precise because the calculation varies based on traffic and other factors.

Mistakes to Avoid

These are the most common errors you should avoid. Others include:

- Having many unexplained gaps

- Claiming commuter mileage

- Overstating expenses

- Poor record-keeping

- Claiming that a car has served all the miles for business

- Mixing personal commuting and business miles

A mileage log can help you save a lot of money. However, you must do it right to ensure that IRS doesn’t come in auditing your company records. Strictly follow the steps highlighted and avoid the common mistakes that some companies make when filing mileage logs.

Looking For Document Management System?

Call Pursho @ 0731-6725516

Check PURSHO WRYTES Automatic Content Generator

https://wrytes.purshology.com/home

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads