Variety is the spice of life for certain brands these days.

Instead of ‘staying in their lane’, so to speak, many brands seem to be launching extensions to generate further revenue (based on the existing awareness and success of their company).

A brand extension is a strategy to launch a product in a tangential market or category, sometimes closely related to the core product, and other times unrelated. There are risks involved, of course, including the danger of alienating customers. However, there are big rewards, such as the opportunity to penetrate new markets and generate entirely new revenue streams. Brand extensions can also simply be great marketing, allowing brands to create awareness and capitalise on exposure.

Here’s a look at some brands embracing extensions strategies, and a bit of analysis on whether or not they work.

Panera Bread + groceries

Panera Bread is a popular US bakery-café chain, which is best known as a lunch-time spot that serves salads and sandwiches. Like all dine-in restaurants, Panera was forced to close its stores in March 2020 due to Covid, but the bakery-chain quickly identified a new customer need – groceries. This was of course a time when fresh produce was in short supply on supermarket shelves (both in the UK and the US), and consumers were beginning to pull back from in-store shopping to online delivery.

In April 2020, Panera Bread announced on its website that it would be selling grocery items. Panera’s CEO, Niren Chaudhary explained: “With this new service, we can help deliver good food and fresh ingredients from our pantry to yours, helping provide better access to essential items that are increasingly harder to come by.” Panera Grocery rolled out to US customers via curbside pickup, drive-thru, and contactless delivery.

When you want to avoid the stores, we’re making it easier to stay at home. Now you can order your Panera favorites and groceries for pick-up or Contactless Delivery. We have the essentials like milk, a variety of breads, yogurt, and fresh produce. pic.twitter.com/1frrKmZTtN

— Panera Bread (@panerabread) April 8, 2020

Following on from this, Panera also launched ‘Panera at Home’, enabling consumers to buy packaged products and meals such as dressings, soups, and pastas, from select grocery stores as well as online marketplaces like Amazon.

A year on, Panera Bread’s expansion into grocery is no longer unique. We have since seen many restaurants and eateries experiment with takeaways, grocery delivery, and meal kits in order to align with new consumer demand. Even before Covid, casual dining chains ranging from Leon to Pizza Express sold packaged items in supermarkets.

However, Panera Grocery is a particularly good example of brand extension, not only because it highlights how to capitalise on shifting consumer demand, but also how a brand can successfully pivot into a different category without deviating from what customers love about the original brand.

As Larry Light for Forbes explains, “As with really good brand extensions, Panera Grocery delivers the Panera brand promise in a different and relevant manner.” In other words, it still delivers on its commitment to ‘clean’ produce, which is food that is freshly prepared, responsibly raised and made from high quality ingredients. But by tapping into a new customer need, Panera has also established itself as a brand that now serves more than its original purpose, successfully cementing existing loyalty and finding new customers.

Levi’s + homeware

Levi’s is a brand that is synonymous with a single item of clothing, let alone multiple categories. However, the jeans maker is now looking to broaden its horizons with the launch of a new homeware range in partnership with Target.

The collection – which is still denim-inspired – is available to buy online and in-store, and includes 100 items ranging from glassware and soft furnishings to table linens and even pet accessories.

This is not the first time that the two companies have worked together – Levi’s Red Tab label has been available to buy from Target since 2019. However, the now expanded partnership will position the clothing brand in a new light (and open it up to a much wider target market).

Levi’s recently reported a 12% decline in holiday quarter sales, though this was better than the previous quarter (which saw a 20% dip). In contrast, Target reported a 17.2% rise in comparable sales, while its ecommerce sales more than doubled in November and December.

It’s perhaps doubtful that Levi’s will establish itself as a long-term player in the homeware category – particularly as the brand’s reputation is so cemented in fashion. With that said, however, this example shows that even short-term or one-off expansions can create enough of a splash (and sales) to drive a brand forward, also highlighting the benefits of strong retail partnerships.

Universal Music Group + hotels

The hospitality industry hasn’t exactly been booming of late, but that hasn’t stopped Universal Music from investing in a new chain of hotels. In October 2020, the global music corporation announced that it had partnered with entertainment investment group, Dakia U-Ventures, to launch UMusic Hotels – ‘a new global collection of music-based experiential hotel properties’. Starting with three US city locations – in Atlanta, Biloxi, and Orlando – UMusic Hotels will reportedly ‘create immersive experiences for fans, guests and artists alike, with music and entertainment at the forefront of design and guest experience all around the globe.’

So why has Universal Music Group chosen to expand into hotels, and more importantly, why has it done so now? The recent announcement that UMG is to go public in 2022 might explain why it is diversifying now. Despite more people than ever buying music subscriptions in 2020, growth for the music industry could stagnate as the pandemic subsides.

At the same time, with the appetite for live music and travel experiences likely to be bigger than ever as Covid restrictions lift, the combination of the two could turn out to be a profitable move for Universal. Similarly, with the hotel chain likely to draw in big name music artists, it could be Universal’s attempt at re-creating the type of commercial entertainment opportunities that are usually reserved for Las Vegas.

Quip + dental insurance

Expansion is often a necessity for the growth of direct-to-consumer retail brands, particularly those backed by VC investment. The typical route is into other product categories; one example is Casper expanding from mattresses to dog beds.

Another option is to expand from product to services, which is what Quip – the DTC electric toothbrush brand – has done with its venture into dental insurance.

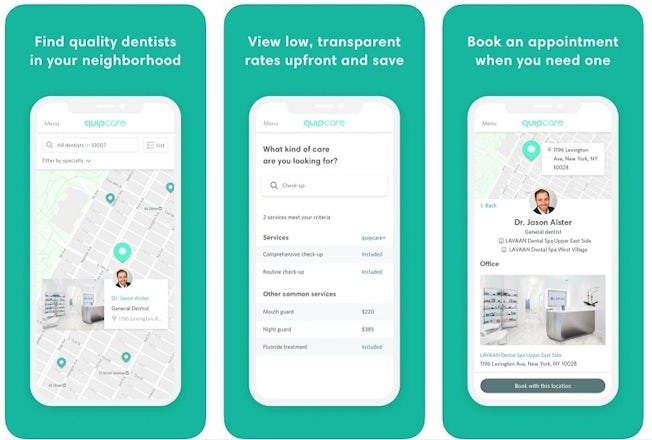

Launched in 2019, Quipcare aims to modernise US dental care for a digital audience, enabling users to find pre-negotiated rates for dental care and to book nearby appointments through its app. A subscription package, Quipcare+, also offers users preventative services such as annual check-ups and teeth cleaning.

While Quipcare is not much cheaper than other dental insurance plans in the US, its USP lies in the convenience it can offer consumers.

With online booking and same day appointments just two of its benefits – Quipcare strives to bring all the hallmarks of a direct-to-consumer brand – including transparency, a seamless CX, and flexible payment – to an outdated dental benefits system.

Brand Purpose Best Practice Guide