Direct-to-consumer brands were stars from 2018 through mid-2019. The storyline was that they were flawlessly executing while brick-and-mortar retailers were flailing. Now weaknesses in the DTC arena are emerging.

Brandless Shuts Down

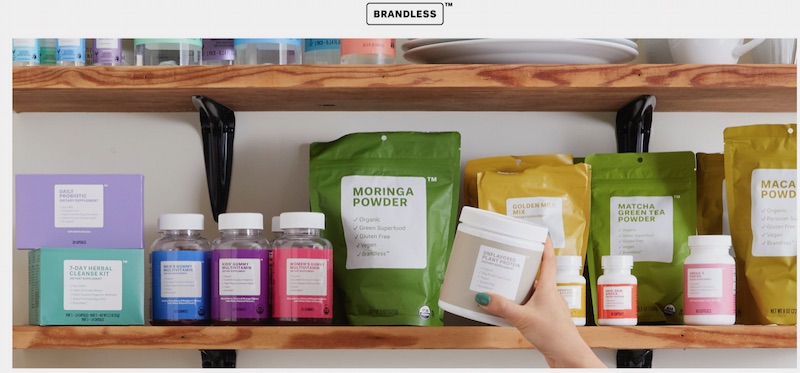

Earlier this month, just two and a half years after it launched, Brandless — which offered “cruelty-free” household, personal care, and baby goods — shut down. The company could not see a path to profitability in a very competitive market.

Brandless was an alternative to Amazon’s private-label goods, but competing with Amazon on price proved to be a losing proposition. Brandless’s intended audience was younger people who preferred to shop online, were price-sensitive, and didn’t care about brand names. The company received most of its funding from the Japanese conglomerate Softbank’s Vision Fund. SoftBank was pushing Brandless to quickly turn a profit and meet rigorous financial targets, which proved to be unrealistic.

The company’s website states, “After more than two amazing years of bringing customers across the country better for you and better for the planet products, Brandless is halting operations.”

Brandless offered “cruelty-free” household, personal care, and baby goods. The company recently announced that it would shut down.

Casper’s IPO

On February 6, Casper Sleep Inc., which described itself as the “pioneer of the Sleep Economy,” started trading on the New York Stock Exchange. The company priced its shares at $12, lower than the $17 to $19 it had initially targeted.

On its first day of trading, Casper gained 12.5 percent. The next day it fell 18 percent. The poor showing was partially due to the revelation in the company’s IPO filing that it lost $67 million on $312 million in revenue during the first three quarters of 2019 and spent $114 million on sales and marketing.

Casper’s shares closed at $10.10 on February 24, resulting in a market cap of $400.7 million, a substantial drop from its $1.1 billion valuation in a March 2019 private funding round. Casper sold 8.35 million shares in the IPO, raising $100.2 million in gross proceeds.

The outlook for Casper is not good. Online sales of foam mattresses in a box have become a crowded market, with 175 competitors, according to GoodBed, a mattress comparison website. Casper provides free shipping and returns and allows purchasers to keep the mattresses for a 100-day trial. The company cannot resell returned mattresses as new. It usually gives them to homeless shelters. The cost of free shipping and free returns is substantial and calls into question whether Casper can turn a profit with its business model. The company also has 60 physical stores.

It is difficult for Caspar to control its manufacturing costs because it outsources the process to a firm called Elite. Last year Elite was purchased for $1.25 billion by Leggett & Platt, a Missouri-based bed-parts giant with $4.65 billion in revenue. Leggett also makes mattresses for several of Casper’s competitors, including Leesa and Tuft & Needle.

Away’s CEO

In December Steph Korey, CEO and co-founder of the luggage and lifestyle brand Away, resigned after an exposé in The Verge, which described a demanding boss and a toxic work environment. Then in January, Korey changed her mind and said that she would keep her position.

In the interim, Away had hired a new chief executive, Stuart Haselden, who worked at Lululemon, the athletic apparel retailer. Now it appears that they will share the CEO role. Korey stated that the story misrepresented her behavior but she recognized that she had made mistakes. Away is expected to file an IPO eventually. The allegations, if they persist, could impact the filing.

Wayfair Halts Expansion

Earlier this month online furniture and accessory seller Wayfair announced that it would eliminate 550 jobs or about 3 percent of its workforce. In an email to Wayfair employees obtained by the Boston Globe, CEO Niraj Shah stated, “We find ourselves at a place where we are, from an execution standpoint, investing in too many disparate areas, with uneven quality and speed of execution. Through two years of aggressive expansion, we no doubt built some excess, inefficiency, and even waste at times, in almost every area.”

Wayfair, which operates in Canada, Germany, the U.K., and the U.S., has never turned a profit.

Thredup Succeeds

All is not doom and gloom in the DTC space. Thredup, which identifies itself as the largest online consignment and thrift store, continues to expand its partnerships with brick-and-mortar retailers.

Thredup states that it has processed over 100 million items since it started in 2009. Earlier this month, Gap Inc. entered into a partnership with the company. Starting in April, customers can turn in used clothing in exchange for credit at the company’s Gap, Banana Republic, Janie and Jack, or Athleta brands. Thredup will provide consignment kits that consumers can take home, fill with used clothes, and ship to Thredup.

Gap Inc. is Thredup’s largest retail partner. In the last six months, Thredup has entered into partnerships with Macy’s, J.C. Penney, J. Crew’s Maxwell, and Stage. Macy’s already decided, reportedly, that the relationship is a success.