It has never been more important for financial services organizations to nail their customer experience (CX) than it is right now. Increased competition from fintechs, more complex security regulations and heightened customer expectations are a few of the key factors driving the emphasis on CX.

Making the connection between what customers want and what your organization provides is more difficult than you might expect. We recommend implementing the following seven tips for CX success to improve your chances of getting it right.

7 strategies for better customer experience in financial services

Let’s look at some simple ways to achieve better customer experience in the world of financial services:

- Centralize your communication system

- Leverage predictive analytics and democratize your data

- Save everyone time with artificial intelligence

- Maintain a customer-centric culture

- Focus your efforts and find the right partners

- Reinforce employee training and retention strategies

- Balance data security with customer convenience

1. Centralize your communications system

A cloud-based, all-in-one communications system is foundational to an optimized financial services customer experience. It allows your representatives to seamlessly interact with customers across all popular communications channels. Each interaction with customers is recorded, and customers can connect with your agents however they want (phone, message, video, text, web chat, email, etc.).

Innovation in the delivery methods used for products and services is top of mind for competitive financial organizations today. Research from The Financial Brand found that 53% of respondents believe that the most innovation for financial services organizations in the next five years will come in the product delivery channels organizations offer to their customers.1

For example, advanced call routing allows you to put each customer in instant contact with the most qualified person to assist. This efficient system for enhancing service protects against the frustration that comes with call transfers and long wait times – which is especially relevant when you have contact center professionals who are licensed for specific products in specific states. Here’s how advanced routing works with RingCentral:

An all-in-one communications solution also powers efficient, effective collaboration for your team members. With the new reality of hybrid work, agents can hold virtual meetings when employees are geographically dispersed. Team messaging allows for instant communication among team members. And file sharing helps every team member stay on the same page.

2. Leverage predictive analytics and democratize your data

It is difficult to optimize your CX if you don’t know what customers want or expect. Communication tools that have baked-in predictive analytics allow you to gain the most accurate visibility into customer responses to service methods, features, and effectiveness. For instance, in RingCentral Live Reports, you can see how well your team is resolving customer issues, how many calls are being left on hold, and even which team members are the most efficient, all in real time:

Financial services organizations collect large volumes of data across all digital touchpoints every day. A deep dive into the data with predictive analytics tools offers insight into customer preferences based on demographics, geography, lifestyle, communication preferences, and more. These insights improve your ability to personalize the customer experience.

The second leg of the journey with analytics is to make the insights derived from them available to all the right stakeholders, including both employees and customers. Data democratization enables all employees to gain a deeper understanding of their customers, making it that much easier to provide excellence in customer experience.

Data democratization empowers customers by providing them with hyper-personalized offers and recommendations, enabling them to make better financial decisions based on their own real-time data.

Raja Rajamannar, CMO of Mastercard, notes: “Hyper-personalization is the future. Companies that understand the value of data and use it to create personalized experiences will thrive.”2

3. Save everyone time with artificial intelligence

Artificial intelligence (AI) is a differentiator in financial services. It is a key determinant as to which organizations will grow and which ones will be left behind. Financial services organizations use AI in a number of innovative ways in customer service, including AI-powered chatbots, virtual agents, and virtual client onboarding, to name a few. Banks and insurance companies are also integrating it into their data and CX strategies.

AI-driven analytics further enhances the quality of data you collect and its usefulness. In a centralized communications system, conversation intelligence is used to evaluate service interactions over time. AI is more capable than humans of identifying the impact of various techniques and messages on customer sentiment.

Conversation intelligence: An interview with RingCentral’s head of AI

McKinsey asserts that the use of AI in customer engagement leads to a number of significant advantages.3 Though the emphasis of McKinsey’s research was on banks, the same benefits apply to all types of financial services organizations.

4. Maintain a customer-centric culture

Good CX starts with a customer-centric culture. Forbes describes customer centricity as “the ability of people in an organization to understand customers’ situations, perceptions, and expectations. The customer should be at the center of all decisions related to delivering products, services, and experiences to create customer satisfaction, loyalty and advocacy.”4

Even with all the emphasis on digitization in CX analysis, a customer-centric culture is still imperative. In a customer-centric culture, each employee recognizes how their role impacts the customer experience. All strategic decisions, capital investments, and training are designed to prioritize the customer experience.

When employees operate with a customer-first mindset, they are eager to find out how digital communication tools and other technology improve customer satisfaction. The value of a powerful digital infrastructure is magnified when your work teams have a natural desire to satisfy customers.

5. Focus your efforts and find the right partners

The old adage, “You can’t be all things to all people,” fits the current financial services climate. Stringent regulations and uncertain economic conditions put stress on organizations to deliver a great customer experience even while controlling costs. In response, some organizations have cut underperforming business units and products and concentrated efforts on their core customers.

Narrowing your strategy makes it simpler to develop successful, repeatable, customer-facing processes. Employees have a clearer sense of how their roles align with organizational objectives. Streamlined products and interactions give employees more opportunities to practice and review critical CX tasks.

At the same time they’re trimming the fat from their in-house offerings, forward-thinking financial institutions are partnering with fintechs and other service providers to enhance their desirability to an increasingly digital native customer base.

Laura Spiekerman, co-founder and President of identity-decisioning platform Alloy, notes: “Partnerships with fintech companies help banks provide new features to eager customers without spending costly resources to build their own digital products, but while still earning a share of the profits.”5

6.Reinforce training and motivation

Exceptional customer service and a great experience require consistent execution by your team members. Over time, it is easy for reps to fall into bad habits or forget how to optimize technology and resources. To maintain consistency and excellent service, you need to provide ongoing reinforcement training.

This type of training includes periodic coverage of the critical tasks, interactions, and tools reps use. The objective is to ensure that each employee understands the full capabilities of the resources available and leverages them within customer interactions. Training can include presentations on common tech tools, along with reviews of customer interaction recordings. A centralized communications system includes organized storage of customer calls.

RingCentral’s contact center solution includes powerful analytics that help supervisors understand individual agent and team performance to inform future training and coaching with a view to providing excellent customer experiences across the board.

7. Balance data safety and security with convenience

The government has increased regulations on safety and security of customer data. Firms must have more security measures in place to meet Know Your Customer (KYC) requirements, along with more routine customer verification processes.

These security measures are important for customers, but they also can lead to delays and frustration for customers trying to access accounts. The challenge for financial services organizations is to incorporate necessary safety and security features with minimal disruption to customer activities.

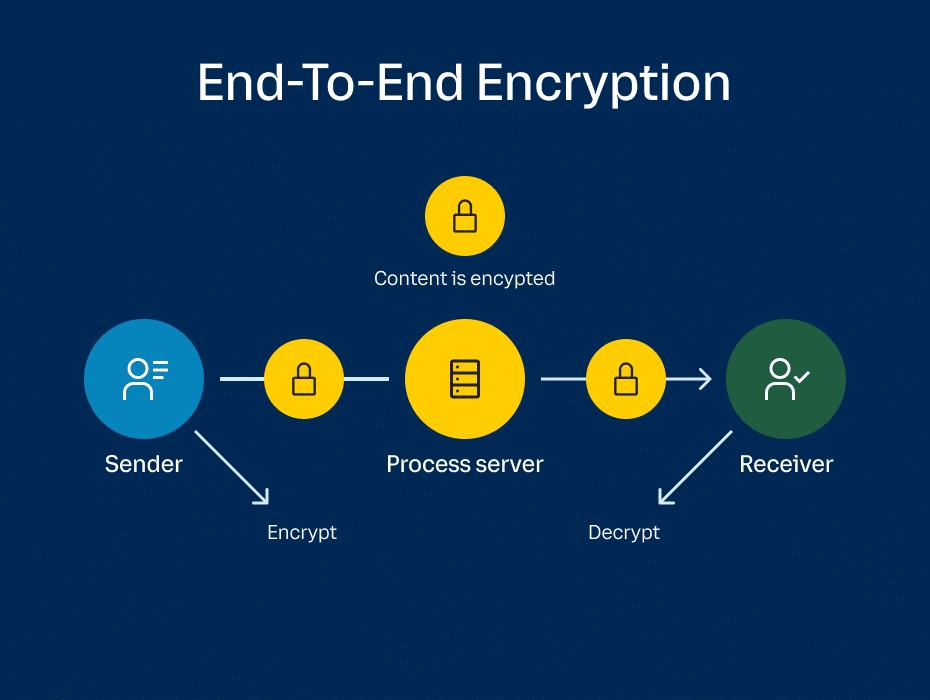

Built-in, advanced security protocols are another advantage of a robust, cloud-based communications solution. For example, multi-factor authentication and end-to-end-encryption are standard in RingCentral for Financial Services.

Improve customer experience in financial services with RingCentral

In the face of greater competition, the ability of financial services organizations to optimize the customer experience is what allows them to survive and thrive. The difficulty is trying to give customers a great experience, even while dealing with tighter budgets and stringent regulatory requirements.

To do more with less while ensuring compliance, banks and other financial institutions invest heavily in technology, particularly solutions that increase automation. The objective is to balance excellent customer experiences with fiscal responsibility and best-in-class security.

RingCentral is a market leader in communications technology for the financial services industry. Our cloud-based, all-in-one solution for financial services includes:

- Omnichannel communications capabilities

- End-to-end encryption and best-in-class security

- AI-enabled communications such as chat bots, virtual agents, smart call routing, and more

- Powerful workforce management and optimization tools

- Predictive analytics that help financial institutions anticipate customer needs in advance

- Unified communications with voice, video, messaging, SMS text, webinar, and contact center

Now is the time to improve your CX to remain competitive in an increasingly tight market. RingCentral can help you improve CX efficiently and effectively. See how it works today.

1https://thefinancialbrand.com/news/banking-innovation/5-banking-innovation-trends-to-watch-in-next-3-years-metaverse-ai-digital-banking-139577/?edigest

2https://thefinancialbrand.com/news/banking-trends-strategies/5-key-technology-trends-changing-bankings-competitive-balance-159179/

3https://www.mckinsey.com/industries/financial-services/our-insights/reimagining-customer-engagement-for-the-ai-bank-of-the-future

4https://www.forbes.com/sites/forbesagencycouncil/2022/01/20/what-is-customer-centricity/?sh=55326ec5ade9

5https://www.forbes.com/sites/forbesfinancecouncil/2023/01/13/compliance-is-the-key-to-successful-bank-and-fintech-partnerships/?sh=3d8d79d5c409

Originally published Apr 14, 2023

Looking For Startup Consultants ?

Call Pursho @ 0731-6725516

Telegram Group One Must Follow :

For Startups: https://t.me/daily_business_reads